Buy workers’ comp insurance online is now a convenient and efficient way to secure essential coverage for your business. This guide provides a comprehensive overview of the process, from understanding the various types of coverage to navigating online platforms and ensuring compliance with state regulations. We’ll also explore the benefits and drawbacks of this approach compared to traditional methods, empowering you to make informed decisions.

Purchasing workers’ compensation insurance online offers streamlined access to quotes, comparisons, and policy details. This direct approach can save time and potentially money, while also providing a transparent overview of different coverage options.

Overview of Online Workers’ Compensation Insurance

Source: fitsmallbusiness.com

Workers’ compensation insurance is a crucial element of a comprehensive risk management strategy for businesses. It provides financial protection for employees injured on the job, covering medical expenses, lost wages, and rehabilitation costs. This protection is mandated by state laws and is designed to ensure that injured workers receive necessary support while employers are shielded from potential lawsuits and financial burdens.The fundamental purpose of workers’ compensation insurance is to facilitate a swift and efficient recovery process for injured employees while simultaneously protecting businesses from significant financial liabilities.

This insurance is vital for maintaining a safe and productive work environment.

Types of Workers’ Compensation Insurance Coverage, Buy workers’ comp insurance online

Various types of coverage are often included within a workers’ compensation policy. These coverages vary depending on the specific state regulations and the employer’s needs. Common coverages include medical expenses, lost wages, and rehabilitation costs. In some cases, additional benefits, such as vocational retraining or death benefits, may be included.

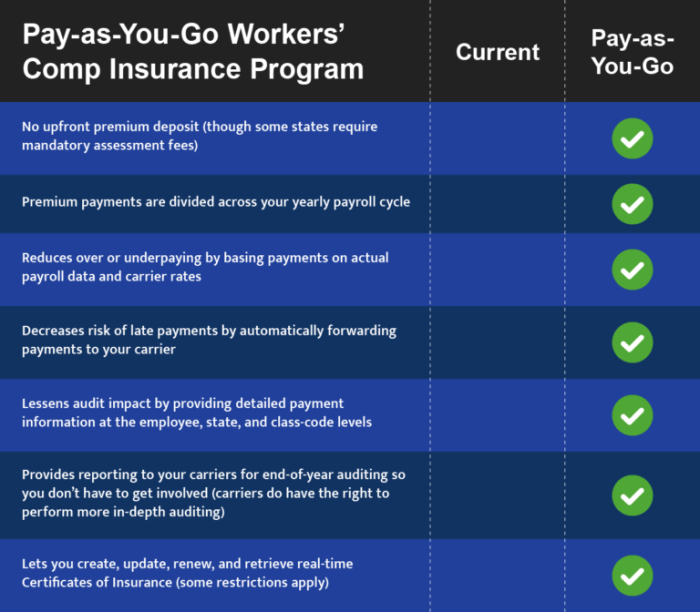

Benefits of Purchasing Workers’ Compensation Insurance Online

Purchasing workers’ compensation insurance online offers several advantages. Often, online platforms provide competitive pricing and streamlined application processes. Businesses can frequently compare quotes from multiple insurers quickly and easily, enabling them to select the most suitable policy. This ease of access is a substantial benefit for smaller businesses and startups.

Drawbacks of Purchasing Workers’ Compensation Insurance Online

While online purchasing offers convenience, there are potential drawbacks. It’s crucial to thoroughly review policy details, including exclusions and limitations. Some policies might not align perfectly with specific business needs or state regulations. Direct interaction with an insurance agent can be valuable for personalized guidance and clarification on complex aspects of the policy. Businesses should prioritize thorough research and comparison to ensure they select the right coverage.

Importance of Compliance with State Regulations

Strict adherence to state workers’ compensation regulations is paramount. State laws dictate coverage requirements, premium rates, and reporting procedures. Non-compliance can lead to significant penalties, including fines and potential legal repercussions. Employers should carefully review state-specific regulations to ensure their chosen policy complies with all applicable laws.

Comparison of Traditional vs. Online Workers’ Compensation Insurance Purchase Methods

| Feature | Traditional Purchase Method | Online Purchase Method |

|---|---|---|

| Process | Involves contacting an insurance agent, often requiring multiple phone calls, emails, and potentially in-person meetings. | Generally involves a self-service platform with online applications, quotes, and policy documents. Usually faster and more convenient. |

| Cost | Potential for higher transaction costs due to agent commissions and administrative overhead. Might also involve higher premiums in some cases. | Can offer competitive pricing through direct comparison of multiple insurer quotes. Often involves lower administrative costs. |

| Flexibility | Offers personalized advice and assistance from an insurance agent, but can be less flexible in terms of immediacy and access. | Offers more flexibility in terms of scheduling and time. Provides immediate access to information and policy documents. |

| Support | Agents provide direct support and guidance. | Online support resources, such as FAQs or online chat, are often available. |

Online Insurance Platforms and Features

Online platforms have revolutionized the way businesses and individuals acquire workers’ compensation insurance. These digital marketplaces offer convenience, transparency, and often competitive pricing. Navigating these platforms effectively can save time and potentially reduce costs.Online platforms for workers’ compensation insurance provide a wide array of features designed to streamline the purchasing process. These features include intuitive user interfaces, robust search capabilities, and readily available policy information.

Common Features on Online Platforms

Online platforms often feature user-friendly dashboards, allowing users to manage their policies and track claims. Key features typically include:

- Policy Management Tools: Users can access policy details, view premium history, and make payments through secure online portals. This facilitates easy tracking of policy information and simplifies administrative tasks.

- Quote Generators and Calculators: These tools enable users to quickly estimate premiums based on their business specifics, including payroll data, industry, and location. This allows for preliminary cost comparisons before purchasing.

- Comprehensive Policy Information: Detailed descriptions of policies, coverage options, and exclusions are typically available online, allowing potential buyers to understand the specifics before making a decision. This transparency enhances the decision-making process.

- Secure Payment Options: A variety of secure payment methods are usually available, ensuring a seamless and protected transaction process.

- Customer Support: Online platforms often offer various channels of customer support, such as FAQs, live chat, or email, to address any queries or concerns.

Steps in Purchasing Workers’ Compensation Insurance Online

Purchasing workers’ compensation insurance online is typically a straightforward process:

- Gather Information: Compile relevant data about your business, including payroll information, industry type, and location.

- Use a Quote Generator: Input the required information into the quote generator on the platform to obtain an initial price estimate.

- Compare Quotes: Evaluate the quotes provided by different insurers to ensure the best value for your business needs.

- Review Policy Details: Carefully examine the policy documents, including coverage, exclusions, and any additional endorsements.

- Complete the Application: Submit the necessary information and complete the online application.

- Payment and Confirmation: Proceed with the secure payment and obtain confirmation of the purchased policy.

Comparing User Interfaces of Different Platforms

User interfaces on different online insurance platforms vary in design and functionality. Some platforms might offer more intuitive navigation than others, influencing the overall user experience. Differences in design can affect the ease of finding specific policy information or completing transactions. Some platforms may prioritize speed and efficiency, while others may offer a more detailed and comprehensive user experience.

The Role of Online Quote Generators and Calculators

Online quote generators and calculators play a crucial role in the purchasing process. They provide immediate estimates of premiums based on user input, allowing potential buyers to compare different options quickly. This facilitates a more efficient and data-driven approach to policy selection.

“A well-designed online quote generator can significantly reduce the time and effort required to compare workers’ compensation insurance options.”

Example of a Simple Online Insurance Quote Form

This example Artikels the basic structure of a simple online quote form:

- Business Name: (e.g., Acme Construction)

- Business Address: (e.g., 123 Main Street)

- Payroll Information: (e.g., $50,000 per month)

- Industry Type: (e.g., Construction)

- Location: (e.g., State of California)

- Number of Employees: (e.g., 10)

- Coverage Preferences: (e.g., specific types of coverage needed)

This form, after inputting the requested information, generates a quote for the selected policy options.

Benefits of Online Platforms

The following table Artikels the benefits of using online platforms for purchasing workers’ compensation insurance:

| Feature | Ease of Use | Cost Comparison | Customer Support |

|---|---|---|---|

| Online Platforms | Intuitive interfaces, 24/7 access | Quick quote comparisons, potential savings | Accessibility of FAQs, online chat |

Factors Influencing Online Purchase Decisions: Buy Workers’ Comp Insurance Online

Source: allenthomasgroup.com

Online platforms have revolutionized the way individuals and businesses acquire workers’ compensation insurance. This shift has brought numerous benefits, including greater accessibility and convenience. However, several key factors significantly impact consumers’ decisions when choosing an online provider. Understanding these factors is crucial for both businesses and insurance providers to optimize their online offerings and build trust with potential customers.Online platforms play a vital role in simplifying the workers’ compensation insurance process.

Consumers can readily compare various options and find policies that meet their specific needs. This efficiency often results in cost savings and time savings for customers.

Price Transparency and Comparison Tools

Price transparency is paramount in online insurance marketplaces. Customers need to readily compare quotes from multiple providers. Effective comparison tools enable users to identify the most competitive rates based on their unique circumstances. Without clear and readily available pricing information, consumers may feel hesitant to engage in the online purchasing process.

Customer Reviews and Ratings

Customer reviews and ratings serve as valuable indicators of an online insurance platform’s reliability and service quality. Positive reviews often highlight ease of use, prompt responses to inquiries, and overall satisfaction. Conversely, negative reviews can shed light on potential issues with the platform, such as poor customer service or inadequate security measures. Potential customers rely on these testimonials to make informed decisions.

Ease of Use and Navigation

The user-friendliness of an online insurance platform directly affects the purchasing experience. A well-designed platform with intuitive navigation helps customers quickly find the information they need and complete the purchase process smoothly. A confusing or cumbersome platform can deter potential customers and lead to a higher rate of abandoned shopping carts.

User-Friendly Features

Various user-friendly features can significantly enhance the online purchasing experience. Features like secure payment gateways, personalized policy recommendations, and interactive tools that illustrate potential savings are valuable additions. These features demonstrate a commitment to user convenience and increase customer trust. For example, a platform that offers a chat function for instant customer support can be a major asset.

Security Measures

The security of online transactions is paramount. Customers need assurance that their personal and financial information is protected. Online insurance platforms must employ robust security measures, such as encryption protocols, secure payment gateways, and multi-factor authentication. Different platforms may adopt different security measures, which can influence a customer’s decision.

| Security Measures | Platform Reputation | Customer Service Contact Methods |

|---|---|---|

| Utilizes advanced encryption, secure payment gateways, and multi-factor authentication. Regular security audits and updates. | High reputation, consistent positive customer feedback, and trusted industry partnerships. | Dedicated customer support phone lines, email support, and online chat options. |

| Adopts industry-standard security protocols, but customer reviews suggest room for improvement regarding response time to security breaches. | Moderate reputation, mixed customer reviews, and some reported instances of slow responses to security concerns. | Customer service available via phone, email, and online portal with limited real-time chat options. |

| Basic security measures in place but lacking robust encryption and multi-factor authentication. Limited customer feedback regarding security concerns. | Low reputation, few positive reviews, and potential security vulnerabilities. | Customer support primarily through email with long wait times and limited support options. |

Navigating the Online Purchasing Process

Getting workers’ compensation insurance online can be a streamlined process. However, a thorough understanding of the steps involved is crucial for a smooth and efficient purchase. This section details the methods for obtaining quotes, necessary information, comparing quotes, and important considerations for policy terms.

Obtaining Quotes from Online Platforms

Online platforms typically offer various methods for obtaining workers’ compensation quotes. These methods may include using interactive tools that collect key details about your business, or directly contacting a representative for a personalized quote. The best method often depends on the complexity of your needs and the level of customization required. For example, small businesses with straightforward needs might find the interactive tools sufficient, while larger businesses with unique risk factors might prefer a direct conversation with an agent.

Necessary Information for a Workers’ Compensation Quote

Several key pieces of information are essential for obtaining an accurate workers’ compensation quote. This information generally includes details about the business’s operations, employee demographics, and the types of risks involved. Specific details might include the number of employees, the industry the business operates in, the nature of the work performed, and any prior claims or accidents. This comprehensive data allows the insurance provider to assess the risk profile accurately and tailor a suitable policy.

Comparing Quotes from Different Providers

Comparing quotes from various providers is a crucial step in the purchasing process. A systematic approach is vital for evaluating the different options. This involves analyzing the premiums, coverage limits, and additional benefits offered by each provider. It is also important to look at any deductibles, policy exclusions, and the financial stability of the insurance company. This thorough comparison allows you to make an informed decision that aligns with your business’s needs and budget.

Questions to Ask Insurance Agents During the Online Purchasing Process

To ensure you are making an informed decision, having a list of questions for the insurance agent is essential. These questions can cover various aspects of the policy, such as coverage specifics, exclusions, and the claims process. For example, you could ask about the policy’s response time in the event of a claim or the specific types of injuries covered under the policy.

Another important question is whether the insurance provider has a dedicated claims department.

Understanding Policy Terms and Conditions

Before finalizing the purchase, carefully reviewing the policy terms and conditions is crucial. This document Artikels the specifics of the coverage, responsibilities, and limitations of the policy. Understanding these aspects helps avoid future misunderstandings and ensures that the policy aligns with your expectations. The terms and conditions usually cover areas like the definition of covered accidents, the claims process, and the policy’s duration.

Steps in the Online Purchasing Process

| Quote Request | Comparison | Policy Terms |

|---|---|---|

| Provide necessary information, such as employee details and business specifics, to online platforms or agents. | Evaluate quotes from multiple providers, considering premiums, coverage, and additional benefits. Analyze policy exclusions and deductibles. | Thoroughly review policy terms and conditions, focusing on covered accidents, claims procedures, and policy duration. |

Compliance and Legal Considerations

Source: pbcdn.in

Purchasing workers’ compensation insurance online requires careful attention to legal regulations. Understanding the specific requirements of your state is crucial to avoid potential penalties and ensure your business’s compliance. Navigating these regulations can be complex, but a thorough understanding of your responsibilities will help you avoid costly errors.Compliance with state workers’ compensation laws is essential for businesses. Failure to adhere to these regulations can result in significant financial penalties and legal repercussions.

This section Artikels the legal requirements for online purchases, potential risks of non-compliance, the role of state insurance departments, common compliance issues, and methods for verifying licensing information. A clear understanding of these factors is vital for a smooth and compliant online purchasing process.

Legal Requirements for Purchasing Workers’ Compensation Insurance

State laws dictate the requirements for obtaining workers’ compensation insurance. These requirements vary by state, but generally include the need for a valid policy covering eligible employees. Businesses must ensure their chosen policy aligns with the specific needs and regulations of their state.

Potential Risks of Non-Compliance with State Regulations

Non-compliance with state workers’ compensation laws can lead to substantial penalties. These penalties can include fines, assessments, and even the suspension or revocation of business licenses. Moreover, failing to comply may expose businesses to lawsuits from injured workers. Examples include the inability to make claims for medical expenses or lost wages, resulting in significant financial burdens.

Role of State Insurance Departments in Regulating Online Insurance Platforms

State insurance departments play a vital role in regulating online insurance platforms. They oversee the licensing and operations of insurance providers, ensuring that they adhere to state regulations and consumer protection laws. Their role includes conducting examinations, implementing rules, and enforcing compliance to protect the interests of policyholders. They are responsible for establishing the criteria for companies to operate in their jurisdictions.

Common Compliance Issues Related to Online Workers’ Compensation Insurance

Common compliance issues related to online workers’ compensation insurance include ensuring the online provider is licensed in the state and that the policy accurately reflects the state’s requirements. Businesses should verify the policy details to ensure coverage meets the legal requirements of their specific state. Another issue involves correctly classifying employees and accurately reporting the coverage details. Incorrect employee classification can lead to legal issues and financial penalties.

How to Find and Verify Licensing Information for Online Insurance Providers

Verifying the licensing information of online insurance providers is crucial. Contact the relevant state insurance department to confirm the provider’s license and ensure its validity. You can usually find this information on the state insurance department’s website. Businesses must meticulously check the licensing status of the online provider to ensure their legitimacy and adherence to state regulations.

Comparison of State Regulations for Workers’ Compensation Insurance

| State | Key Regulatory Differences (Regarding Online Providers) | Example |

|---|---|---|

| State A | Requires online providers to maintain a physical presence in the state for licensing. | State A mandates a local office for processing claims. |

| State B | Allows online providers to operate with a virtual presence, but with strict reporting requirements for policy information. | State B necessitates regular reports on policy details to the state insurance department. |

| State C | Requires providers to use a specific, state-approved online platform for policy transactions. | State C mandates a unique online platform for all insurance transactions. |

Note: This table provides a simplified comparison. Specific regulations can vary and should be reviewed with the relevant state insurance department for the most accurate information.

Customer Support and Resources

Source: californiacontractorbonds.com

Accessing reliable support is crucial when purchasing workers’ compensation insurance online. Understanding how to contact support and the resources available for policy clarification ensures a smooth experience and minimizes potential issues. This section details various avenues for customer assistance, from readily available FAQs to dedicated support channels.

Contacting Customer Support

Online insurance platforms offer multiple channels for customer support. These channels often include email, phone, and live chat options, allowing customers to choose the method that best suits their needs. Prompt and efficient responses are essential to resolve inquiries and address concerns promptly. The platform’s website typically Artikels the contact information and operating hours for each channel.

Frequently Asked Questions (FAQs)

A comprehensive FAQ section on the online insurance platform is a valuable resource. It proactively addresses common questions regarding policy details, coverage specifics, and online purchasing processes. These FAQs typically cover aspects like premiums, claim procedures, and policy adjustments. Customers can find answers to many questions quickly and independently without needing to contact support directly.

Policy Resource Examples

Online platforms often provide various resources to help customers understand their policies. These may include policy summaries, downloadable guides, and online calculators. Detailed policy documents, frequently updated, help customers understand their specific coverage and entitlements. Furthermore, access to educational materials like sample claim forms and policy amendments can further assist in navigating the insurance process.

Importance of Clear Communication Channels

Clear communication channels on online platforms are paramount. Customers should be able to easily access and use these channels to seek assistance and obtain information about their insurance policies. This includes providing clear contact information, detailed FAQs, and readily available resources. A user-friendly design and intuitive navigation of the support section can contribute significantly to a positive customer experience.

Support Channels Comparison

| Insurance Platform | Phone | Chat | FAQs | |

|---|---|---|---|---|

| Platform A | Yes, 24/7 | Yes, 9 am – 5 pm EST | Yes, limited hours | Extensive, searchable |

| Platform B | Yes, 24/7 | Yes, 8 am – 8 pm EST | Yes, 24/7 | Good, but not as extensive as Platform A |

| Platform C | Yes, limited hours | Yes, 9 am – 5 pm EST | Yes, 24/7 | Basic, limited search |

This table provides a comparative overview of different online insurance platforms’ support channels. Each platform may prioritize specific support options based on its service model. The availability of each channel should be confirmed on the respective platform’s website.

Closing Summary

Source: bassineinsurance.com

In conclusion, buying workers’ comp insurance online presents a modern and efficient solution. By understanding the process, comparing options, and prioritizing compliance, businesses can secure essential coverage with ease. Remember to thoroughly research platforms, compare quotes, and verify licensing information before making a final decision. This will help you navigate the online purchasing process effectively and ensure your business is adequately protected.

Frequently Asked Questions

How do I find the licensing information for an online insurance provider?

Look for a license or certification number displayed prominently on the provider’s website. Verify this number with your state’s insurance department’s website to ensure its legitimacy.

What are the common compliance issues related to online workers’ compensation insurance?

Ensuring the online platform adheres to state-specific regulations is crucial. Misrepresenting coverage or failing to disclose all relevant information can lead to significant issues. Also, policies might not comply with all state-mandated provisions.

What are the key differences between traditional and online workers’ compensation insurance purchase methods?

Traditional methods often involve direct interaction with an agent, potentially offering personalized service. Online platforms provide broader access to quotes and comparisons but might lack the personal touch.

What security measures should I look for when choosing an online insurance platform?

Look for platforms with strong encryption, secure payment gateways, and verifiable privacy policies. These measures safeguard your sensitive information during the purchasing process.