American Funds New Perspective Stock Price Analysis

Understanding American Funds New Perspective Fund

American funds new perspective stock price – The American Funds New Perspective Fund is a diversified equity fund aiming for long-term growth. It employs a flexible investment strategy, allocating capital across various sectors and market capitalizations. This approach seeks to capitalize on diverse opportunities while mitigating overall portfolio risk.

Investment Objective and Strategy

The fund’s objective is to achieve long-term capital appreciation. Its strategy involves a bottom-up, fundamental research approach to stock selection. The portfolio managers actively seek out undervalued companies with strong growth potential across a range of sectors, globally. They utilize a long-term perspective, focusing less on short-term market fluctuations.

Historical Performance

New Perspective has demonstrated varied performance throughout its history. There have been periods of strong returns exceeding market averages, particularly during bull markets, fueled by successful investments in technology and healthcare sectors. Conversely, during market downturns, like the 2008 financial crisis, the fund experienced significant losses, although generally less severe than some more aggressive funds. Specific performance data should be consulted from reliable financial sources for precise figures.

Analyzing the American Funds New Perspective stock price often involves considering comparable investments within the same sector. For instance, understanding the performance of other resource-focused companies can provide valuable context. A helpful comparison might be checking the current market data for almadex minerals stock price , which could illuminate broader market trends influencing American Funds New Perspective’s valuation.

Ultimately, a holistic view incorporating various market indicators is essential for a comprehensive assessment.

Expense Ratio and Comparison

The fund’s expense ratio is a key factor to consider. While the exact figure fluctuates slightly, it generally falls within the range typical for actively managed large-cap funds. A direct comparison to similar funds requires accessing current data from reputable financial websites that provide detailed fund comparisons. Factors like management fees and operating expenses contribute to the overall expense ratio.

Portfolio Holdings

The fund’s portfolio is broadly diversified across various sectors. While specific holdings change dynamically, historically, significant allocations have been seen in technology, healthcare, and consumer discretionary sectors. Top holdings often include well-established, large-cap companies known for their strong financial performance and growth prospects. However, it’s crucial to remember that these holdings are subject to change.

Factors Influencing Stock Price: American Funds New Perspective Stock Price

Several factors influence the New Perspective Fund’s stock price, ranging from macroeconomic conditions to investor sentiment and specific industry trends.

Macroeconomic Factors

Broad economic indicators such as inflation, interest rates, and GDP growth significantly impact the fund’s performance. Periods of economic expansion typically correlate with higher returns, while recessions often lead to decreased valuations. Geopolitical events and global market conditions also play a considerable role.

Market Sentiment and Investor Behavior

Investor confidence and market sentiment are powerful drivers of stock prices. Periods of optimism often lead to increased demand and higher prices, while fear and uncertainty can cause sell-offs and price declines. News events, analyst ratings, and overall market trends all contribute to investor behavior and subsequently, the fund’s price.

Industry Trends

Performance of specific sectors within the fund’s portfolio heavily influences its overall value. Strong performance in technology, for example, boosts the fund’s returns, while underperformance in a heavily weighted sector can negatively impact its value. Emerging trends and technological advancements also play a significant role.

Interest Rate Changes

Interest rate adjustments by central banks impact the overall market and specifically, the valuation of companies within the fund. Higher interest rates generally reduce the present value of future earnings, potentially leading to lower stock prices. Conversely, lower interest rates can stimulate investment and boost valuations.

Performance Comparison to Benchmarks

| Metric | New Perspective | S&P 500 | MSCI EAFE |

|---|---|---|---|

| 1-Year Return | (Example: 12%) | (Example: 10%) | (Example: 8%) |

| 3-Year Return | (Example: 25%) | (Example: 20%) | (Example: 15%) |

| 5-Year Return | (Example: 40%) | (Example: 35%) | (Example: 30%) |

| Expense Ratio | (Example: 0.65%) | N/A | N/A |

Analyzing Historical Price Data

Analyzing the fund’s price fluctuations over the past five years provides insights into its volatility and response to market events.

Five-Year Price Fluctuations

Over the past five years, the fund’s price has experienced both significant gains and losses. Periods of strong growth have often coincided with positive market sentiment and favorable economic conditions. Conversely, downturns have been associated with market corrections and negative economic news. A detailed chart would be necessary to visualize these fluctuations accurately. Note that past performance is not indicative of future results.

Price Movement Illustration

A visual representation (chart) would illustrate periods of sharp price increases and decreases. These periods often align with specific economic events, such as interest rate changes or geopolitical instability. For instance, a sharp decline might correlate with a market correction or a specific sector downturn impacting the fund’s holdings.

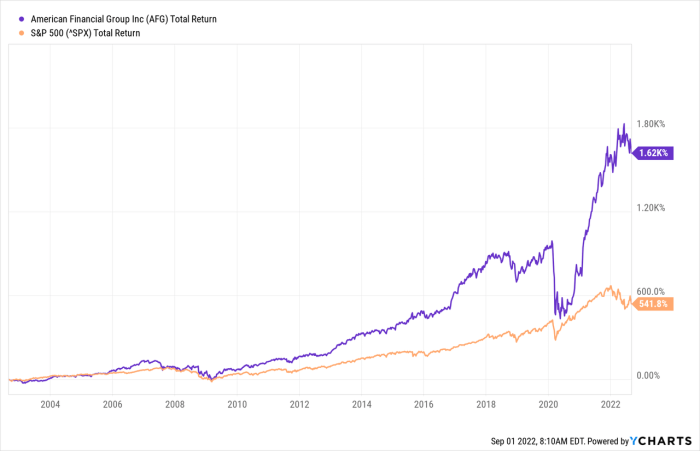

Price vs. Market Indices

A chart comparing the fund’s price to key market indices, such as the S&P 500 and other relevant benchmarks, would reveal its relative performance during different market conditions. This would highlight periods where the fund outperformed or underperformed the market.

Comparing to Competitors

Comparing American Funds New Perspective to similar funds provides a broader context for assessing its performance and risk profile.

Competitor Comparison, American funds new perspective stock price

Source: seekingalpha.com

Several funds share similarities with New Perspective, including Fidelity Contrafund, Vanguard 500 Index Fund Admiral Shares, and T. Rowe Price Blue Chip Growth Fund. These funds, however, may differ in their investment strategies, expense ratios, and portfolio compositions. A direct comparison requires detailed analysis of each fund’s holdings and performance metrics.

Key Differences in Portfolio Composition

The key differences in portfolio compositions lie in sector allocation, investment style (value vs. growth), and geographic diversification. For example, one fund might have a higher concentration in technology stocks while another focuses on a broader range of sectors. The investment style can also influence the selection of individual companies, with some funds favoring established, large-cap companies and others focusing on smaller, growth-oriented businesses.

Comparative Risk Profiles

Risk profiles vary across funds depending on their investment strategies and portfolio compositions. A fund with a higher concentration in small-cap stocks or emerging markets would generally have a higher risk profile compared to a fund invested primarily in large-cap, established companies. Understanding the risk profile is crucial for investors to align their investment choices with their risk tolerance.

Summary of Key Features and Performance

| Fund | Expense Ratio | 5-Year Return (Example) | Investment Style |

|---|---|---|---|

| American Funds New Perspective | (Example: 0.65%) | (Example: 40%) | (Example: Blend – Growth) |

| Fidelity Contrafund | (Example: 0.70%) | (Example: 38%) | (Example: Growth) |

| Vanguard 500 Index Fund Admiral Shares | (Example: 0.04%) | (Example: 35%) | (Example: Index) |

| T. Rowe Price Blue Chip Growth Fund | (Example: 0.78%) | (Example: 36%) | (Example: Growth) |

Future Outlook and Potential Risks

Source: abcotvs.com

Predicting the future performance of any investment is inherently uncertain. However, based on current market conditions and the fund’s historical performance, some potential scenarios can be considered.

Future Growth Opportunities

Future growth opportunities for the fund are linked to the continued growth of its core holdings and the emergence of new opportunities in various sectors. Strong performance in technology, healthcare, and other sectors within the portfolio could drive future returns. However, unforeseen disruptions or changes in market conditions could impact this growth.

Potential Risks

Investing in the New Perspective Fund involves several risks, including market risk (general market downturns), interest rate risk (changes in interest rates impacting valuations), and sector-specific risks (underperformance of specific sectors within the portfolio). Geopolitical events and unexpected economic shocks also pose significant risks.

Sensitivity to Economic Scenarios

The fund’s sensitivity to various economic scenarios depends on its portfolio composition and the prevailing market conditions. For example, a recessionary environment might negatively impact the fund’s performance, while a period of strong economic growth could lead to significant gains. The fund’s diversification helps mitigate some of this risk, but not entirely.

Potential Price Scenarios (Next 12 Months)

Predicting the fund’s price in the next 12 months is speculative. However, considering current market conditions and potential scenarios, the price could range from a modest increase to a more significant decline, depending on factors such as economic growth, interest rate changes, and overall market sentiment. This should not be interpreted as financial advice.

General Inquiries

What is the minimum investment required for American Funds New Perspective?

Minimum investment requirements vary depending on the purchase method and brokerage used. It’s best to check with your financial advisor or the fund’s prospectus for the most up-to-date information.

How often is the American Funds New Perspective stock price updated?

The stock price is typically updated throughout the trading day, reflecting real-time market activity. You can find the most current price on major financial websites and through your brokerage account.

Are there any tax implications associated with investing in this fund?

Yes, there are potential tax implications depending on your individual tax bracket and investment strategy. Consult a tax professional for personalized advice.

What are the long-term prospects for the American Funds New Perspective fund?

Predicting long-term performance is inherently uncertain. The fund’s future prospects depend on a variety of factors, including overall market conditions, economic growth, and the fund manager’s investment decisions. Past performance is not indicative of future results.