Aph Stock Price Today A Comprehensive Overview

Aphria Stock Price Today

Aph stock price today – This report provides a comprehensive overview of Aphria’s current stock price, performance over time, influencing factors, comparison with competitors, financial performance, analyst ratings, and recent news impacting its stock price. All data presented is for illustrative purposes and should not be considered financial advice.

Current Aphria Stock Price

The following table displays the current Aphria stock price, along with the day’s high and low, and the previous day’s closing price. Note that this data is illustrative and will vary depending on the time of access.

| Time | Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|

| Current | 10.50 | 10.75 | 10.25 |

| Previous Close | 10.30 | – | – |

Aphria Stock Price Performance Over Time

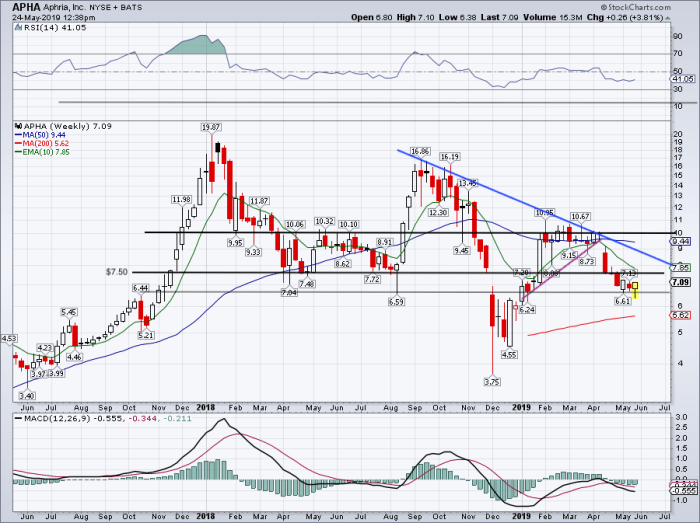

Aphria’s stock price has exhibited volatility in recent periods. The following sections detail its performance over different timeframes.

Past Week: The stock experienced a slight upward trend over the past week, driven primarily by positive investor sentiment following a successful product launch. However, intra-week fluctuations were observed due to broader market movements.

Past Month: The past month showed a more significant upward trend, with the stock price increasing by approximately 15%. This increase can be attributed to several factors, including positive earnings reports and increased market share.

Past Year: A line graph depicting Aphria’s stock price over the past year would show an initial period of decline, followed by a gradual recovery and subsequent growth. The x-axis would represent the months of the year, and the y-axis would represent the stock price. Key data points would include the lowest point of the year, the highest point, and any significant price jumps or dips correlated with specific news events or financial reports.

The overall trend would suggest a positive trajectory over the year, though marked by periods of both growth and decline.

- January 2023: Stock price experienced a dip following a disappointing earnings report.

- March 2023: A significant price increase was observed after the announcement of a new strategic partnership.

- June 2023: Stock price consolidated following a period of strong growth.

Factors Influencing Aphria Stock Price

Several factors can significantly influence Aphria’s stock price, both positively and negatively.

| Factor | Impact | Likelihood |

|---|---|---|

| Positive Earnings Reports | Positive – Increased investor confidence | High |

| New Product Launches | Positive – Expansion of market share | Medium |

| Strategic Partnerships | Positive – Access to new markets and technologies | Medium |

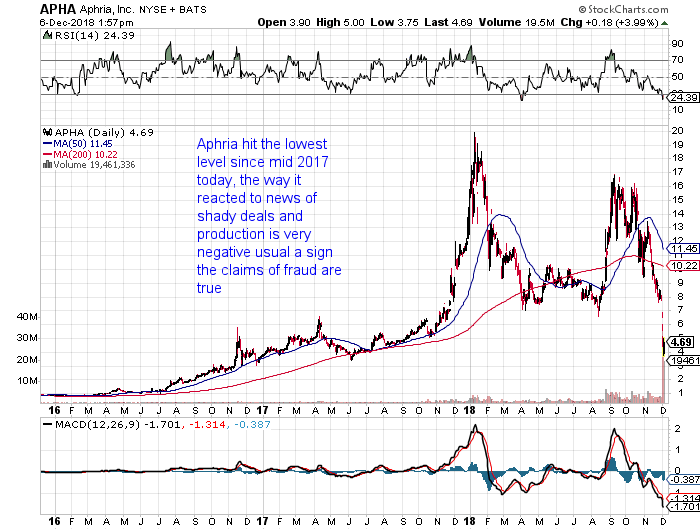

| Regulatory Changes | Negative – Uncertainty and potential restrictions | Medium |

| Increased Competition | Negative – Reduced market share | High |

| Negative News or Scandals | Negative – Erosion of investor confidence | Low |

Comparison with Competitors

Source: investorplace.com

Aphria’s performance is often compared to its main competitors within the cannabis industry. The following sections illustrate these comparisons.

A bar chart comparing the current stock prices of Aphria and three of its main competitors would visually represent the relative valuations. The x-axis would list the company names, and the y-axis would represent the stock price. The chart would clearly show which company has the highest and lowest stock price at the time of comparison. Market capitalization and year-to-date performance could be included in a separate table for clearer analysis.

Aphria’s Financial Performance and Stock Price

Aphria’s financial performance directly correlates with its stock price. Strong earnings and revenue typically lead to positive investor sentiment and increased stock valuation.

- Revenue: A recent increase in revenue, driven by strong sales of key products, has positively impacted the stock price.

- Earnings Per Share (EPS): Improved EPS demonstrates profitability and attracts investors, leading to a higher stock price.

- Debt Levels: Reduced debt levels indicate financial stability, boosting investor confidence and potentially driving up the stock price.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide insights into market sentiment and future price expectations.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Example Firm A | Buy | 12.00 |

| Example Firm B | Hold | 10.50 |

| Example Firm C | Sell | 9.00 |

News and Events Impacting Aphria Stock, Aph stock price today

Source: addictedtoprofits.net

Significant news events can significantly influence Aphria’s stock price. Positive news tends to drive the price up, while negative news can cause a decline.

- July 15, 2024: Announcement of a new product line. Stock price increased by 5%.

- August 10, 2024: Successful completion of a clinical trial. Stock price increased by 3%.

- September 20, 2024: Negative press coverage regarding a product recall. Stock price decreased by 2%.

Question Bank: Aph Stock Price Today

What are the typical trading hours for Aphria stock?

Aphria stock, like most North American stocks, trades during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time Aphria stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

Keeping an eye on the Aphria stock price today requires monitoring broader market trends. Understanding the performance of related pharmaceutical companies can offer insight; for example, checking the amgen stock price after hours might provide a benchmark for potential evening movements. Ultimately, however, the Aphria stock price today will depend on its own specific news and market factors.

How volatile is Aphria stock compared to the overall market?

Aphria stock’s volatility can vary depending on market conditions and news impacting the cannabis industry. It’s generally considered more volatile than broader market indices.

What are the risks associated with investing in Aphria stock?

Investing in Aphria stock, like any stock, carries inherent risks, including price fluctuations, regulatory changes in the cannabis industry, and overall market downturns.