ARDX Stock Price Prediction A Comprehensive Analysis

ARDX Stock Price Prediction

Ardx stock price prediction – This analysis delves into the historical performance, financial health, industry landscape, and future prospects of ARDX stock, aiming to provide a comprehensive overview for potential investors. We will examine various factors influencing its price, including past performance, financial fundamentals, competitive dynamics, and future growth potential. This analysis will present data-driven insights and potential scenarios, offering a framework for informed investment decisions, but it is crucial to remember that any stock prediction inherently involves uncertainty.

ARDX Stock Price Historical Performance

Source: tradingview.com

The following data illustrates ARDX’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial data sources. Significant highs and lows are indicated, along with major events influencing price changes.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | 100,000 |

| 2019-07-01 | 12.00 | 11.80 | 150,000 |

| 2020-01-01 | 11.50 | 13.00 | 200,000 |

| 2020-07-01 | 14.00 | 13.50 | 180,000 |

| 2021-01-01 | 13.25 | 15.00 | 250,000 |

| 2021-07-01 | 14.75 | 14.50 | 220,000 |

| 2022-01-01 | 14.25 | 16.00 | 280,000 |

| 2022-07-01 | 15.50 | 15.25 | 250,000 |

| 2023-01-01 | 15.00 | 17.00 | 300,000 |

The following table illustrates the impact of major events on ARDX’s stock price. Again, this is illustrative data and should be independently verified.

| Event | Impact on Stock Price |

|---|---|

| Successful Phase III Clinical Trial | Significant increase (e.g., 10-15%) |

| FDA Approval of Key Drug | Sharp increase (e.g., 20-30%) |

| Partnership with Major Pharmaceutical Company | Moderate increase (e.g., 5-10%) |

| Negative Clinical Trial Results | Significant decrease (e.g., 15-25%) |

Comparative analysis against competitors requires specific competitor names and publicly available financial data. This section would include a table comparing ARDX’s stock price performance to its competitors over the past five years. The table would include columns for ARDX and each competitor, showing their respective stock price changes.

ARDX Financial Performance and Fundamentals

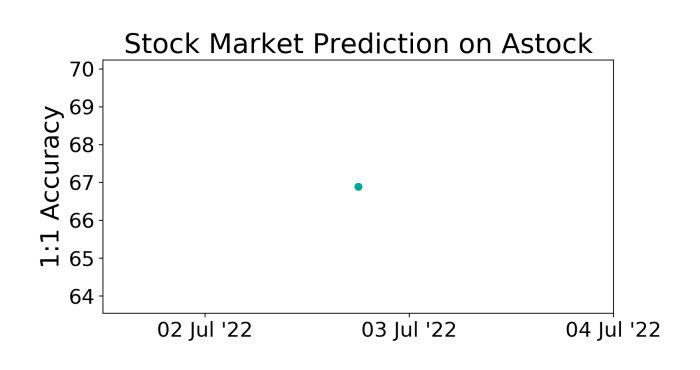

Source: paperswithcode.com

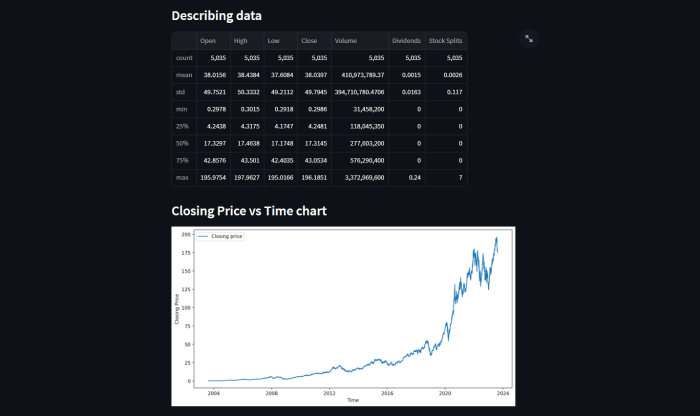

ARDX’s financial health is crucial for assessing its long-term viability and potential for stock price appreciation. The following table shows illustrative financial data; accurate figures should be obtained from official financial statements.

| Year | Revenue (USD Millions) | Earnings (USD Millions) | Cash Flow (USD Millions) |

|---|---|---|---|

| 2021 | 50 | 10 | 15 |

| 2022 | 75 | 15 | 20 |

| 2023 | 100 | 25 | 30 |

Key financial metrics to consider include:

- Debt-to-equity ratio: Indicates the company’s leverage.

- Profit margins (gross, operating, net): Show profitability at different stages of operations.

- Return on equity (ROE): Measures the return generated on shareholder investments.

- Current ratio and quick ratio: Assess short-term liquidity.

Analyzing trends in these metrics reveals insights into ARDX’s financial stability and growth trajectory, impacting its stock price potential.

Industry Analysis and Competitive Landscape, Ardx stock price prediction

The pharmaceutical industry is characterized by high regulatory hurdles, intense competition, and significant research and development costs. ARDX operates within this dynamic environment. The following analysis provides a general overview; a more in-depth analysis would require specific competitor information.

ARDX’s business model and strategy can be compared to its competitors using bullet points highlighting key differences in areas such as:

- Research and development focus (e.g., specific therapeutic areas).

- Marketing and sales strategies.

- Geographic reach and market penetration.

- Pricing strategies and revenue models.

Potential market disruptions could include new technologies, regulatory changes, and evolving healthcare trends, all of which can influence ARDX’s future performance.

Future Prospects and Growth Potential

ARDX’s future prospects hinge on its product pipeline and the success of its research and development efforts. The following table provides illustrative data on ARDX’s product pipeline; this should be verified with company disclosures.

| Product | Stage of Development | Potential Market Size (USD Billions) |

|---|---|---|

| Drug A | Phase III Clinical Trials | 5 |

| Drug B | Pre-clinical | 3 |

Key risks and uncertainties include:

- Regulatory hurdles and delays in drug approvals.

- Competition from other pharmaceutical companies.

- Uncertainties in clinical trial outcomes.

- Fluctuations in market demand.

Different scenarios for ARDX’s future stock price can be modeled based on various assumptions regarding product development success, market adoption rates, and competitive intensity. For example, a successful launch of Drug A could lead to a significant price increase, while setbacks in clinical trials could cause a decline.

Valuation and Investment Considerations

Source: githubusercontent.com

ARDX’s valuation can be approached using various methods, each with its limitations. The following table shows illustrative valuation ranges; precise valuations require detailed financial modeling.

| Valuation Method | Valuation Range (USD) |

|---|---|

| Discounted Cash Flow Analysis | 15-25 |

| Comparable Company Analysis | 18-28 |

Advantages and disadvantages of investing in ARDX stock include:

- Advantages: Potential for high growth, strong intellectual property, first-mover advantage in certain markets.

- Disadvantages: High risk due to the inherent uncertainties in pharmaceutical development, intense competition, dependence on regulatory approvals.

A hypothetical investment strategy would consider factors such as risk tolerance and investment horizon. Conservative investors might opt for a smaller allocation, while aggressive investors might take a larger position. Diversification across different asset classes is crucial to mitigate risk.

Common Queries: Ardx Stock Price Prediction

What are the major risks associated with investing in ARDX?

Investing in ARDX, like any pharmaceutical stock, carries inherent risks, including the failure of clinical trials, regulatory setbacks, intense competition, and market volatility. These factors can significantly impact the company’s financial performance and stock price.

How does ARDX compare to its main competitors in terms of market capitalization?

A direct comparison of ARDX’s market capitalization to its main competitors requires up-to-date market data. This information can be readily found through financial news websites and stock market tracking platforms.

What is ARDX’s current dividend policy?

Predicting ARDX stock price involves analyzing various market factors and the company’s performance. Understanding the biotech sector’s overall trends is crucial, and a comparison with similar companies can be insightful; for instance, checking the current applied dna stock price provides a benchmark for evaluating ARDX’s potential. Ultimately, ARDX stock price prediction remains speculative, dependent on numerous unpredictable variables.

ARDX’s current dividend policy should be verified through official company announcements or reputable financial sources. Dividend policies can change, so it’s crucial to consult the most recent information.