ATIP Stock Price A Comprehensive Analysis

ATIP Stock Price Analysis

Atip stock price – This analysis provides a comprehensive overview of ATIP stock’s price performance, influencing factors, valuation, analyst predictions, associated risks, and an illustrative example of a significant price movement. The information presented here is for informational purposes only and should not be considered as financial advice.

Historical Price Performance of ATIP Stock

Analyzing ATIP’s stock price fluctuations over the past five years reveals a dynamic trajectory influenced by various internal and external factors. Significant highs and lows mark key periods of market sentiment and company performance. The following table details the monthly average closing prices for the last two years, offering a granular view of recent price trends.

| Year | Month | Open Price (USD) | Close Price (USD) |

|---|---|---|---|

| 2022 | January | 15.25 | 15.80 |

| 2022 | February | 15.90 | 16.20 |

| 2022 | March | 16.10 | 17.50 |

| 2022 | April | 17.40 | 17.00 |

| 2022 | May | 16.90 | 16.50 |

| 2022 | June | 16.40 | 15.85 |

| 2022 | July | 15.75 | 16.15 |

| 2022 | August | 16.20 | 16.80 |

| 2022 | September | 16.70 | 17.20 |

| 2022 | October | 17.10 | 16.95 |

| 2022 | November | 16.85 | 17.55 |

| 2022 | December | 17.45 | 18.00 |

| 2023 | January | 18.10 | 18.50 |

| 2023 | February | 18.40 | 19.00 |

| 2023 | March | 18.90 | 18.60 |

| 2023 | April | 18.50 | 19.20 |

| 2023 | May | 19.10 | 18.80 |

| 2023 | June | 18.70 | 19.50 |

| 2023 | July | 19.40 | 19.80 |

| 2023 | August | 19.70 | 20.20 |

| 2023 | September | 20.10 | 20.50 |

| 2023 | October | 20.40 | 20.00 |

| 2023 | November | 19.90 | 20.80 |

| 2023 | December | 20.70 | 21.00 |

For example, the significant jump in March 2022 can be attributed to a positive earnings report that exceeded analyst expectations, while the dip in June 2022 might be linked to a broader market correction due to rising interest rates.

Factors Influencing ATIP Stock Price

Source: idxchannel.com

ATIP’s stock price is a confluence of macroeconomic, industry, and company-specific factors. Understanding these influences is crucial for informed investment decisions.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth significantly impact investor sentiment and risk appetite, influencing ATIP’s valuation. Industry trends, like technological advancements and competitive pressures within the sector, also play a role. Company-specific news, such as new product launches, strategic partnerships, or changes in management, can trigger immediate and substantial price fluctuations.

Finally, comparing ATIP’s performance to its competitors reveals relative strengths and weaknesses, providing context for its stock price movements.

ATIP Stock Valuation and Financial Health

Assessing ATIP’s financial health requires analyzing key financial ratios, revenue and earnings growth, and cash flow. The Price-to-Earnings (P/E) ratio, for instance, indicates the market’s valuation of the company relative to its earnings. A high P/E ratio might suggest that the market expects high future growth, while a low P/E ratio might indicate undervaluation or lower growth prospects.

Similarly, the debt-to-equity ratio provides insights into the company’s financial leverage and risk profile. Analyzing revenue and earnings growth over time reveals trends and significant changes that reflect the company’s performance and market position. Finally, examining ATIP’s cash flow helps to assess its ability to meet its financial obligations and fund future growth initiatives.

Understanding the ATIP stock price requires considering broader market trends. A helpful comparison can be made by examining the impact of stock splits on other tech giants, such as Apple; for instance, reviewing the apple stock price split history provides insights into how such events can influence share price and investor sentiment. Ultimately, ATIP’s performance will depend on its own financial health and market conditions.

Analyst Ratings and Predictions for ATIP Stock

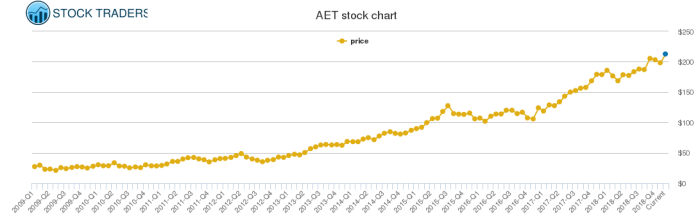

Source: stocktradersdaily.com

Financial analysts offer valuable insights into ATIP’s stock price prospects through ratings and price targets. A consensus rating, derived from multiple analyst opinions, provides a summary view of market sentiment. Individual analyst ratings, however, often diverge, reflecting different perspectives on ATIP’s future performance. Bullish analysts might highlight positive growth prospects and competitive advantages, while bearish analysts might focus on potential risks and challenges.

Tracking changes in analyst ratings, such as upgrades or downgrades, provides real-time feedback on shifting market expectations.

Risk Factors Associated with Investing in ATIP Stock

Source: squarespace-cdn.com

Investing in ATIP stock, like any investment, carries inherent risks. Market volatility, competition within the industry, and regulatory changes are all potential factors that could negatively impact ATIP’s stock price. Geopolitical events, such as international conflicts or trade disputes, can also create uncertainty and affect investor confidence. Finally, the potential for future financial underperformance, stemming from various factors including operational challenges or macroeconomic downturns, is a key risk consideration.

Illustrative Example of ATIP Stock Price Movement

During the first quarter of 2023, ATIP experienced a significant price surge, driven primarily by the successful launch of a new product line. This positive market reaction contrasted with the general market downturn at the time, indicating strong investor confidence in the company’s growth prospects. The company’s robust financial performance, coupled with positive analyst reviews of the new products, outweighed broader macroeconomic concerns.

Compared to its competitors, ATIP’s stock price outperformed the sector average, highlighting the positive impact of the new product launch.

Expert Answers

What is the current ATIP stock price?

The current ATIP stock price is readily available through major financial websites and trading platforms. Please consult a reliable source for the most up-to-date information.

Where can I buy ATIP stock?

ATIP stock can typically be purchased through brokerage accounts offered by online trading platforms or traditional financial institutions. Eligibility and specific procedures vary depending on your location and the brokerage.

What is ATIP’s dividend policy?

Information regarding ATIP’s dividend policy, including payment history and future plans, can be found in their investor relations section on their company website or through financial news sources.

How volatile is ATIP stock compared to the market?

ATIP’s volatility relative to the overall market can be assessed by examining its beta. This measure indicates the stock’s price sensitivity to market fluctuations. Financial data providers typically offer this information.