BNS Stock Price Today A Comprehensive Overview

BNS Stock Price Today: A Comprehensive Overview

Source: simplywall.st

Bns stock price today – This report provides a detailed analysis of BNS stock performance, encompassing current price and volume, recent trends, influencing factors, competitor comparisons, analyst predictions, and potential risks and opportunities. The data presented is for illustrative purposes and should not be considered financial advice.

Current BNS Stock Price and Volume

As of [Insert Date and Time], the BNS stock price stands at [Insert Current Price]. The trading volume for the day is currently at [Insert Current Volume]. The day’s high was [Insert Day’s High] and the low was [Insert Day’s Low].

| Open | High | Low | Close |

|---|---|---|---|

| [Open Price Day 1] | [High Price Day 1] | [Low Price Day 1] | [Close Price Day 1] |

| [Open Price Day 2] | [High Price Day 2] | [Low Price Day 2] | [Close Price Day 2] |

| [Open Price Day 3] | [High Price Day 3] | [Low Price Day 3] | [Close Price Day 3] |

| [Open Price Day 4] | [High Price Day 4] | [Low Price Day 4] | [Close Price Day 4] |

| [Open Price Day 5] | [High Price Day 5] | [Low Price Day 5] | [Close Price Day 5] |

Recent BNS Stock Price Trends

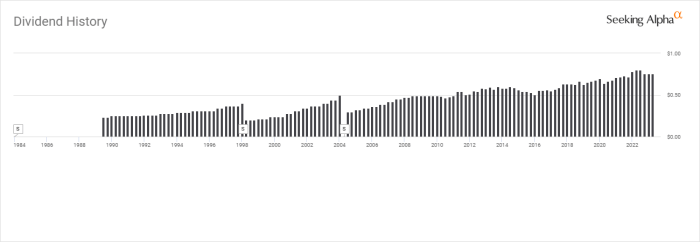

Source: seekingalpha.com

Over the past month, BNS stock price has shown a [Insert Overall Trend: e.g., slight upward trend, significant decline, consolidation]. The last week witnessed [Describe Significant Price Movements: e.g., a sharp increase following a positive earnings report, a gradual decrease due to market uncertainty]. Compared to its price one year ago, BNS is currently trading at [Percentage Change] – [Higher/Lower].

The three-month line graph illustrates a [Describe Graph Shape: e.g., generally upward sloping trend with periods of volatility, a downward trend with a recent recovery]. The graph shows a clear peak around [Date] and a trough around [Date], indicating periods of significant price fluctuation influenced by [Mention potential factors like news events or market trends].

Factors Influencing BNS Stock Price

Three major factors influencing BNS’s stock price recently include [Factor 1: e.g., changes in interest rates], [Factor 2: e.g., market sentiment towards the financial sector], and [Factor 3: e.g., the company’s recent financial performance].

Recent economic news, such as [Specific News Event], has [Impact on BNS Stock Price: e.g., positively impacted BNS due to increased consumer confidence]. Interest rate changes typically [Impact of Interest Rate Changes: e.g., negatively affect BNS, as higher rates increase borrowing costs]. Recent company announcements, such as [Specific Announcement], have resulted in [Effect on Stock Price: e.g., a short-term price increase].

BNS Stock Price Compared to Competitors

Compared to competitors [Competitor 1] and [Competitor 2], BNS has demonstrated [Comparative Performance: e.g., stronger performance in the last quarter, weaker performance due to specific market challenges]. BNS’s relative strengths include [Strengths: e.g., a strong brand reputation, innovative product portfolio], while its weaknesses include [Weaknesses: e.g., high debt levels, dependence on a specific market segment].

| Metric | BNS | Competitor 1 | Competitor 2 |

|---|---|---|---|

| P/E Ratio | [Value] | [Value] | [Value] |

| Dividend Yield | [Value] | [Value] | [Value] |

| [Another relevant metric] | [Value] | [Value] | [Value] |

Analyst Ratings and Predictions for BNS

Recent analyst ratings for BNS stock range from [Lowest Rating] to [Highest Rating], with a median rating of [Median Rating]. Price targets vary from [Lowest Price Target] to [Highest Price Target], with an average target price of [Average Price Target].

- [Analyst 1]: [Rating] and price target of [Price Target] – reasoning: [Reasoning].

- [Analyst 2]: [Rating] and price target of [Price Target] – reasoning: [Reasoning].

- [Analyst 3]: [Rating] and price target of [Price Target] – reasoning: [Reasoning].

Potential Risks and Opportunities for BNS, Bns stock price today

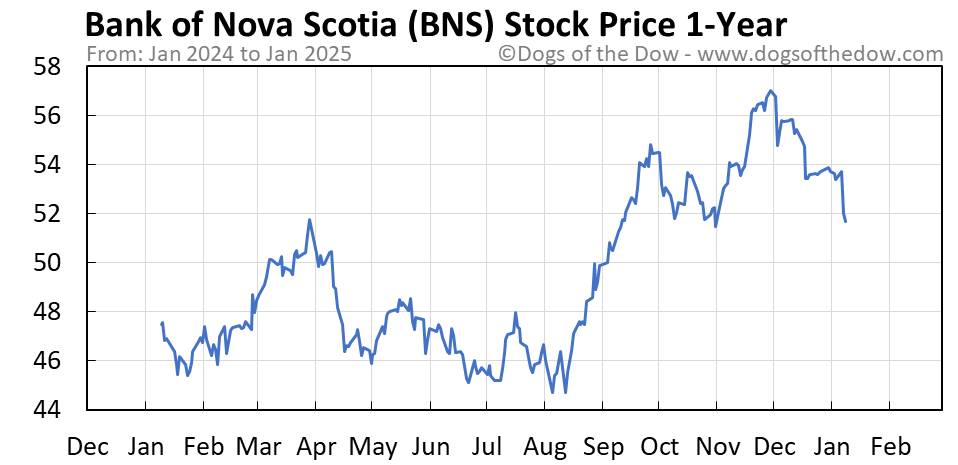

Source: dogsofthedow.com

Potential risks for BNS include [Risk 1: e.g., increased competition], [Risk 2: e.g., regulatory changes], and [Risk 3: e.g., economic downturn]. Opportunities for BNS include [Opportunity 1: e.g., expansion into new markets], [Opportunity 2: e.g., technological innovation], and [Opportunity 3: e.g., strategic partnerships].

Geopolitical events, such as [Geopolitical Event Example], could [Impact on BNS: e.g., negatively impact BNS’s international operations]. The company’s strategic initiatives, such as [Strategic Initiative Example], are expected to [Impact on Stock Price: e.g., positively impact long-term growth].

Query Resolution

What are the typical trading hours for BNS stock?

Typical trading hours for BNS stock will depend on the exchange it’s listed on. Check the specific exchange’s website for precise hours.

Where can I find real-time BNS stock quotes?

Real-time quotes are available through many financial websites and brokerage platforms. Major financial news sources also provide up-to-the-minute information.

What does the P/E ratio for BNS indicate?

The P/E ratio (Price-to-Earnings ratio) indicates how much investors are willing to pay for each dollar of BNS’s earnings. A higher P/E ratio suggests higher growth expectations.

Monitoring the BNS stock price today requires a keen eye on market trends. It’s interesting to consider how such fluctuations might be influenced by broader tech sector performance; for instance, projections for the amd stock price 2025 could impact investor sentiment across the board. Ultimately, understanding the interplay between various tech giants helps in better assessing the BNS stock price today and its potential future movements.

How often is BNS stock price data updated?

BNS stock price data is typically updated in real-time throughout the trading day, reflecting every trade executed.