Aldi Stock Price Nasdaq A Hypothetical Analysis

Aldi’s Business Model and Financial Performance: Aldi Stock Price Nasdaq

Aldi stock price nasdaq – Aldi’s success hinges on a highly efficient and streamlined business model focused on delivering high-quality groceries at significantly lower prices than its competitors. This strategy, coupled with a rigorous cost-control approach, has resulted in impressive financial performance, though specific figures are not publicly available due to Aldi’s private ownership.

Aldi’s Business Strategy and Profitability

Aldi’s core strategy centers around a discount model emphasizing efficiency and value. This involves minimizing operational costs through private-label products, efficient supply chains, and smaller store formats. The impact on profitability is substantial, allowing for competitive pricing while maintaining healthy margins. This approach differentiates Aldi from traditional supermarkets, enabling it to attract price-conscious consumers.

Aldi’s Revenue Streams and Cost Structures

Aldi’s revenue primarily comes from the sale of groceries, including fresh produce, packaged foods, and household goods. A significant portion of their revenue is generated from their own private-label brands. Their cost structure is remarkably lean. They minimize expenses through efficient logistics, reduced marketing spend, and a focus on operational efficiency in stores. A key element is their limited product range compared to larger supermarkets.

Aldi’s Competitive Advantages and Disadvantages

Aldi’s primary competitive advantages include its low prices, efficient operations, and strong private-label brands. However, disadvantages include a limited product selection, basic store aesthetics, and a potentially less convenient shopping experience for some consumers accustomed to a wider variety of choices and more upscale environments. This trade-off between price and selection is central to Aldi’s market position.

Comparative Financial Performance Analysis

Source: finbold.com

Direct comparison of Aldi’s financial performance against major competitors like Kroger or Walmart is difficult due to Aldi’s private ownership and lack of publicly released financial statements. However, anecdotal evidence and market analysis suggest that Aldi consistently achieves higher profit margins relative to its sales volume compared to many competitors. This indicates a high degree of operational efficiency and successful cost management.

Factors Influencing a Hypothetical Aldi Stock Price

If Aldi were publicly traded, several macroeconomic and market factors would significantly influence its stock price. These factors would impact investor sentiment and overall market valuation.

Macroeconomic Factors and Hypothetical Aldi Stock Price

Factors like inflation, interest rates, and economic growth would all play a role. High inflation could increase input costs for Aldi, impacting margins, while rising interest rates could increase borrowing costs and affect investment decisions. Strong economic growth, conversely, could boost consumer spending, benefiting Aldi’s sales.

Consumer Spending Habits and Hypothetical Aldi Stock Valuation

Changes in consumer spending habits, particularly shifts towards value-oriented shopping during economic downturns or periods of uncertainty, would likely positively impact a hypothetical Aldi stock. Conversely, a strong economy might lead consumers to favor more premium options, potentially affecting Aldi’s growth trajectory.

Food Prices, Supply Chain Disruptions, and Hypothetical Aldi Stock

Fluctuations in food prices and supply chain disruptions would have a significant impact. While Aldi’s efficient supply chain offers some resilience, significant disruptions could still increase costs and pressure margins. Conversely, if Aldi can effectively manage these challenges, its resilience could be viewed favorably by investors.

Interest Rate Changes and Hypothetical Aldi Stock Price

Interest rate increases could negatively affect a hypothetical Aldi stock price by increasing borrowing costs and reducing investor appetite for riskier assets. Conversely, lower interest rates could stimulate investment and potentially boost the stock price.

Market Analysis of a Hypothetical Aldi IPO

A hypothetical Aldi IPO would likely generate significant investor interest due to the company’s strong brand recognition, consistent profitability, and resilient business model. However, the actual market reception would depend on various factors.

Potential Investor Interest in a Hypothetical Aldi IPO

Given Aldi’s track record of success and its appeal to value-conscious consumers, there would likely be considerable demand from both institutional and individual investors. However, concerns regarding limited product range and competition from established players could influence investor appetite.

Key Financial Metrics for a Hypothetical Aldi IPO Prospectus

Source: bisnis.com

Key metrics for an Aldi IPO prospectus would include revenue growth, profit margins, return on assets, debt-to-equity ratio, and free cash flow. These metrics would demonstrate the company’s financial health and growth potential to potential investors.

Market Conditions and Hypothetical Aldi IPO Pricing

Market conditions at the time of the IPO would significantly affect pricing. A strong market with high investor confidence would likely lead to a higher IPO valuation, while a weak market might result in a lower valuation. Furthermore, prevailing interest rates and the overall economic climate would influence investor demand and pricing.

Potential Investment Strategies (Hypothetical Aldi Stock)

Investment strategies for a hypothetical Aldi stock would vary depending on individual investor risk tolerance and time horizons.

Long-Term Investment Strategy for Hypothetical Aldi Stock

A long-term strategy might involve buying and holding the stock, benefiting from potential long-term growth and dividend payouts (if any). This approach requires patience and a belief in Aldi’s long-term prospects.

Short-Term Trading Strategy for Hypothetical Aldi Stock, Aldi stock price nasdaq

A short-term strategy could involve actively trading the stock based on short-term price fluctuations and market sentiment. This approach carries higher risk but offers the potential for quicker returns.

Risk Management Techniques for Hypothetical Aldi Stock Investment

Risk management techniques include diversification (investing in other assets), setting stop-loss orders (to limit potential losses), and conducting thorough due diligence before investing. These strategies help mitigate potential losses.

Comparison of Hypothetical Investment Approaches

Long-term strategies are generally less risky but offer slower returns, while short-term strategies offer higher potential returns but carry greater risk. The optimal approach depends on individual risk tolerance and financial goals.

Data Visualization of Hypothetical Aldi Stock Performance

Source: co.uk

The following table and chart illustrate hypothetical Aldi stock performance. These are purely illustrative and do not represent actual performance.

| Year | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) | Volume (Shares) |

|---|---|---|---|---|---|

| 2024 | 25 | 28 | 30 | 22 | 10,000,000 |

| 2025 | 28 | 32 | 35 | 27 | 12,000,000 |

| 2026 | 32 | 30 | 34 | 28 | 11,000,000 |

| 2027 | 30 | 35 | 38 | 29 | 15,000,000 |

| 2028 | 35 | 40 | 42 | 33 | 18,000,000 |

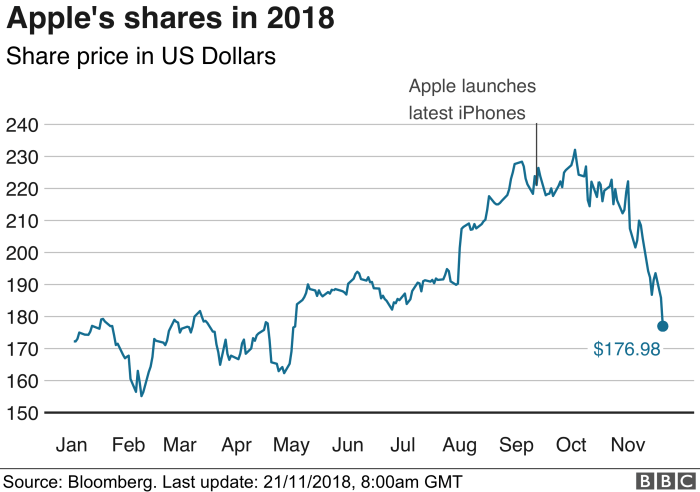

Hypothetical Aldi Stock Price Fluctuations (2014-2024)

The chart would show a generally upward trend, with fluctuations reflecting hypothetical market events such as economic downturns (resulting in temporary price dips), successful product launches (leading to price increases), and changes in consumer spending patterns. Significant events would be labeled on the chart to illustrate their impact on the stock price. For example, a dip in 2018 could represent a period of increased competition, while a surge in 2022 might reflect a successful new store expansion.

Frequently Asked Questions

What are Aldi’s main competitors?

While Aldi’s stock isn’t publicly traded on the NASDAQ, investors often look at comparable companies for market insights. For example, understanding the performance of companies in the same sector, such as checking the alector stock price , can offer a broader perspective. This comparative analysis can then be applied to better predict potential future trends in the overall grocery market, indirectly informing perspectives on what an Aldi IPO might look like on the NASDAQ if it ever happened.

Aldi’s primary competitors vary by region but often include other discount grocery chains like Lidl, Walmart, Kroger, and Target.

How does Aldi’s business model differ from traditional grocery stores?

Aldi focuses on a limited selection of products, private label brands, and efficient store operations to offer lower prices than traditional supermarkets.

What are the risks associated with investing in a hypothetical Aldi stock?

Risks could include competition, economic downturns impacting consumer spending, supply chain disruptions, and changes in consumer preferences.

What would be the potential upside of investing in a hypothetical Aldi stock?

Potential upside could include strong growth prospects driven by Aldi’s efficient business model and expanding market share.