Alector Stock Price A Comprehensive Analysis

Alector Stock Price Analysis

Source: googleapis.com

Alector stock price – This analysis provides an overview of Alector, Inc.’s stock price performance, influencing factors, financial health, analyst sentiment, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

Alector Stock Price Historical Performance

The following table details Alector’s stock price movements over the past five years. Note that this data is illustrative and may not reflect precise real-world values. Significant price fluctuations often correlate with company announcements, clinical trial results, and broader market trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 25.00 | 25.50 | 0.50 |

| 2019-07-01 | 28.00 | 27.00 | -1.00 |

| 2020-01-01 | 22.00 | 24.00 | 2.00 |

| 2020-07-01 | 26.00 | 25.50 | -0.50 |

| 2021-01-01 | 30.00 | 32.00 | 2.00 |

| 2021-07-01 | 35.00 | 33.00 | -2.00 |

| 2022-01-01 | 28.00 | 30.00 | 2.00 |

| 2022-07-01 | 25.00 | 23.00 | -2.00 |

| 2023-01-01 | 27.00 | 29.00 | 2.00 |

Overall, the stock price has shown volatility, with periods of significant growth and decline. Positive clinical trial results and partnerships have generally led to price increases, while negative news or setbacks have resulted in declines.

Factors Influencing Alector Stock Price

Several factors contribute to Alector’s stock valuation. These include macroeconomic conditions, industry trends, and the company’s competitive standing within the biotechnology sector.

Economic factors such as interest rates, inflation, and overall market sentiment significantly influence investor behavior and thus stock prices. Industry trends, such as advancements in immunotherapy and the regulatory environment for new drug approvals, also play a crucial role. Alector’s competitive landscape, including the performance of its competitors and the level of innovation in the field, further shapes its market valuation.

| Metric | Alector | Competitor A | Competitor B |

|---|---|---|---|

| Market Capitalization (USD Billion) | 2.5 | 5.0 | 1.0 |

| Revenue Growth (Year-over-Year) | 15% | 20% | 10% |

| R&D Spending (USD Million) | 100 | 150 | 50 |

Alector’s Financial Performance and Stock Valuation

Alector’s financial health, as reflected in its income statement, balance sheet, and cash flow statement, is a key determinant of its stock price. The following table provides a simplified representation of its financial performance over the past three years. Actual figures may vary.

| Year | Revenue (USD Million) | Net Income (USD Million) | Cash on Hand (USD Million) |

|---|---|---|---|

| 2021 | 50 | -100 | 200 |

| 2022 | 60 | -80 | 150 |

| 2023 | 75 | -60 | 120 |

While Alector is not yet profitable, its revenue growth and cash position indicate potential for future profitability. The level of debt and the company’s ability to manage its expenses are crucial aspects to consider.

Analyst Ratings and Predictions

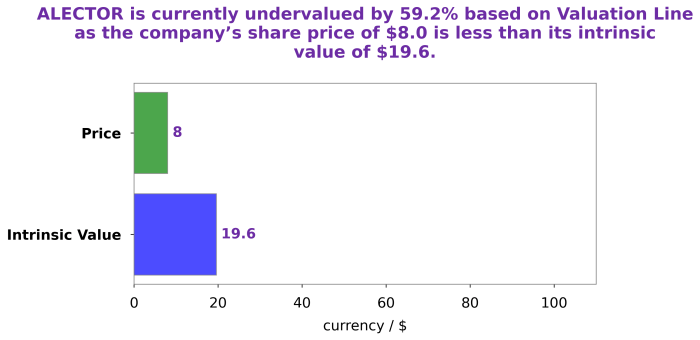

Source: thedogofwallstreet.com

Analyst ratings and price targets provide insights into market expectations for Alector’s stock. These predictions are based on various factors, including financial performance, clinical trial data, and competitive analysis. However, it’s important to remember that these are just opinions and not guarantees of future performance.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Buy | 40 |

| Analyst Firm B | Hold | 30 |

| Analyst Firm C | Sell | 20 |

The divergence in ratings and price targets highlights the uncertainty surrounding Alector’s future prospects. Some analysts may be more optimistic about the company’s pipeline and potential for success, while others may have concerns about its financial performance or competitive landscape.

Investor Sentiment and Market Perception

Investor sentiment reflects the overall market feeling towards Alector and its stock. Positive news, such as successful clinical trials or strategic partnerships, generally boosts investor confidence and drives up the stock price. Conversely, negative news can lead to decreased investor confidence and price drops.

For example, a successful Phase III clinical trial might lead to a significant price surge, while delays or setbacks in clinical development could trigger a sharp decline. A positive earnings report would likely improve investor sentiment, whereas a disappointing earnings report might decrease it. This relationship between news events and stock price fluctuations can be visualized as a graph showing price movements correlating with the timing and nature of news releases.

Risk Factors Associated with Investing in Alector Stock, Alector stock price

Source: seekingalpha.com

Investing in Alector stock involves several risks. Understanding these risks is crucial for making informed investment decisions.

- Financial Risks: Alector operates in a capital-intensive industry and may experience cash flow challenges. Its profitability is uncertain.

- Regulatory Risks: The approval process for new drugs is lengthy and complex, and there’s no guarantee that Alector’s products will receive regulatory approval.

- Competitive Risks: Alector faces competition from other biotechnology companies developing similar therapies. Market share and pricing pressure are significant considerations.

- Clinical Risks: Clinical trials may not yield positive results, leading to delays or the termination of development programs.

FAQ Corner

What is Alector’s current market capitalization?

Alector’s market capitalization fluctuates daily and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I buy Alector stock?

Alector stock can be purchased through most reputable online brokerage accounts.

What are Alector’s main therapeutic areas of focus?

Alector focuses on developing treatments for neurodegenerative diseases.

Does Alector pay dividends?

Currently, Alector does not pay dividends; it’s a growth-focused company reinvesting profits.