ALGN Stock Price Target Analysis & Outlook

Align Technology (ALGN) Stock Price Target Analysis: Algn Stock Price Target

Algn stock price target – Align Technology (ALGN), a leading provider of clear aligner orthodontic systems, has experienced considerable price fluctuations recently. This analysis examines ALGN’s current stock price, market trends, analyst ratings, financial performance, potential risks, and offers a hypothetical investment strategy. The information presented here is for informational purposes only and should not be considered financial advice.

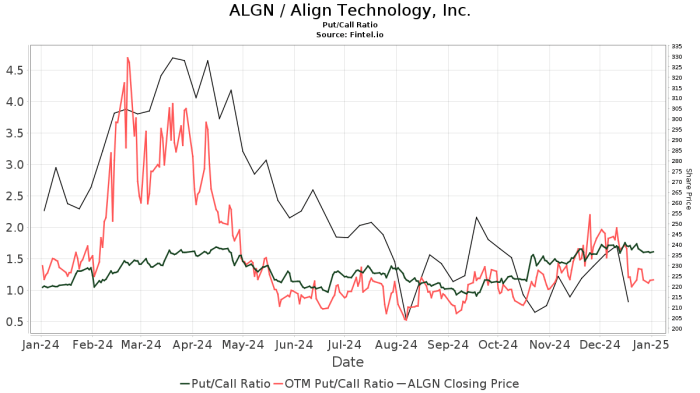

Current ALGN Stock Price and Market Trends

Source: fintel.io

ALGN’s stock price has shown volatility in recent months, influenced by various market factors and company-specific news. The following table illustrates price movements over different timeframes. Note that these are illustrative examples and actual figures may vary based on the data source and timeframe.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $280 | $285 | $275 | $282 |

| Oct 25, 2023 | $278 | $280 | $276 | $279 |

| Oct 24, 2023 | $275 | $280 | $270 | $278 |

| … | … | … | … | … |

Recent market events, such as changes in interest rates and broader economic uncertainty, have contributed to ALGN’s price fluctuations. Additionally, news regarding the company’s product innovation, competitive landscape, and financial performance has played a significant role. For example, a successful new product launch could boost investor confidence and drive the stock price upward, while disappointing earnings reports could lead to a decline.

A comparison against competitors like Straumann or Dentsply Sirona reveals that ALGN’s performance has been relatively strong, though susceptible to similar market pressures.

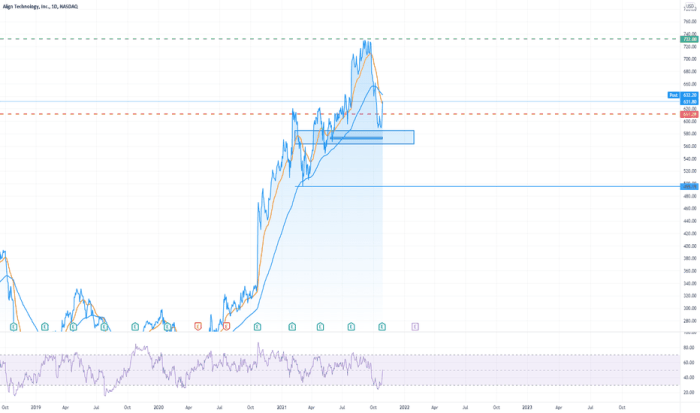

Analyst Ratings and Price Targets for ALGN, Algn stock price target

Source: tradingview.com

Several financial analysts have issued price targets for ALGN stock, reflecting diverse perspectives on the company’s future prospects. These targets vary based on differing assumptions regarding growth rates, market share, and profitability.

- Analyst A: $300

- Analyst B: $275

- Analyst C: $320

- Analyst D: $290

The discrepancies in price targets stem from different methodologies and assumptions used by analysts. Some analysts might adopt a more conservative approach, factoring in potential risks and challenges, while others may be more optimistic, projecting higher growth rates. The consensus price target, a weighted average of various analysts’ predictions, can provide a more balanced outlook. Comparing the consensus target to the current market price offers insights into whether the stock is currently undervalued or overvalued, though this is not definitive.

ALGN’s Financial Performance and Future Outlook

ALGN’s financial health is a key determinant of its stock price. The following table summarizes key financial metrics.

| Metric | Current Value (Illustrative) | Year-over-Year Change (Illustrative) |

|---|---|---|

| Revenue | $2 Billion | +15% |

| Earnings per Share (EPS) | $5 | +10% |

| Profit Margin | 20% | +2% |

Recent financial reports and earnings calls suggest a positive outlook, with management projecting continued growth driven by factors such as increasing demand for clear aligners, expansion into new markets, and technological advancements. However, several factors could influence future performance, including increased competition, regulatory changes, and potential supply chain disruptions.

Potential Risks and Uncertainties Affecting ALGN’s Stock Price

Several factors could negatively impact ALGN’s stock price. Understanding these risks is crucial for informed investment decisions.

Analysts are currently projecting a range of targets for the ALGN stock price, influenced by various market factors. Understanding these projections often involves comparing performance with similar companies; for instance, a look at the alector stock price can offer a comparative perspective within the broader medical device sector. Ultimately, the ALGN stock price target remains subject to ongoing market analysis and investor sentiment.

- Increased Competition: The clear aligner market is becoming increasingly competitive, with new entrants and existing players constantly innovating.

- Regulatory Changes: Changes in regulations could impact the company’s ability to market and sell its products.

- Economic Downturn: A general economic slowdown could reduce consumer spending on discretionary healthcare items like clear aligners.

- Supply Chain Disruptions: Disruptions in the supply chain could impact production and delivery of products.

Each of these risks could negatively affect ALGN’s financial performance and stock valuation. The company is likely to mitigate these risks through strategic planning, diversification, and proactive risk management.

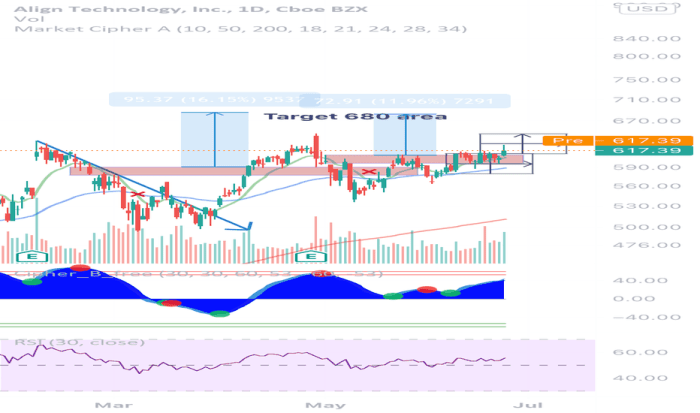

Investment Implications and Strategies for ALGN Stock

Source: tradingview.com

A hypothetical investment strategy for ALGN would depend on the investor’s risk tolerance and investment horizon. The following scenario analysis illustrates potential outcomes.

| Scenario | Potential Outcome |

|---|---|

| Bullish Market: Strong growth and positive earnings surprises | Significant price appreciation, exceeding analyst price targets |

| Neutral Market: Moderate growth and stable earnings | Price movement in line with market trends and analyst consensus |

| Bearish Market: Economic downturn and reduced consumer spending | Price decline, potentially below analyst price targets |

Different market conditions significantly impact ALGN’s stock price. A strong market generally benefits ALGN, while an economic downturn could negatively affect its performance. A well-diversified portfolio, coupled with a thorough understanding of ALGN’s business model and risk profile, is crucial for successful investment.

Popular Questions

What are the major risks associated with investing in ALGN?

Major risks include increased competition, regulatory changes affecting the medical device industry, potential economic downturns impacting consumer spending on elective procedures, and the company’s reliance on technological advancements.

How does ALGN compare to its main competitors?

A comparative analysis of ALGN against its key competitors, considering market share, revenue growth, and technological innovation, is necessary to fully assess its competitive position. This analysis would need to be based on publicly available financial data and market research.

What is the historical performance of ALGN stock?

Examining historical stock price data, including long-term trends and volatility, is essential for understanding past performance and informing future investment decisions. Access to financial data providers is needed for a comprehensive analysis.