Alphabet Premarket Stock Price A Deep Dive

Understanding Alphabet’s Pre-Market Trading: Alphabet Premarket Stock Price

Alphabet premarket stock price – Alphabet’s pre-market trading, occurring before the official opening of the New York Stock Exchange (NYSE), offers a unique window into investor sentiment and market expectations. This period is characterized by increased volatility and lower trading volume compared to regular trading hours. Understanding the factors driving price fluctuations during this time is crucial for informed investment decisions.

Factors Influencing Alphabet’s Pre-Market Stock Price Fluctuations

Several factors influence Alphabet’s pre-market price. These include anticipated news releases (earnings reports, product announcements), broader market trends, overnight global events, and the overall sentiment towards the tech sector. For example, a positive earnings pre-announcement could significantly boost the pre-market price, while negative news about a competitor might exert downward pressure.

Typical Trading Volume During Alphabet’s Pre-Market Sessions

Pre-market trading volume for Alphabet is generally lower than during regular trading hours. This is because fewer investors actively participate in the pre-market, often limited to institutional investors, high-frequency traders, and those seeking to capitalize on early price movements. The lower volume can amplify price swings, making pre-market trading potentially riskier.

Comparison of Pre-Market and Regular Trading Hours Price Movements for Alphabet

Source: theforexguy.com

Pre-market price movements often correlate with, but are not always identical to, movements during regular trading hours. While a strong positive pre-market trend might suggest a similar performance during the regular session, unexpected news or shifts in broader market sentiment can lead to divergence. Pre-market movements serve as an early indicator, not a definitive predictor, of the day’s overall price action.

Sources of Information Impacting Pre-Market Pricing for Alphabet

Information impacting Alphabet’s pre-market price comes from various sources, including overnight news reports (both financial and general news), analyst ratings and predictions disseminated before the market opens, and trading activity in other global markets that provide early signals. Social media sentiment also plays a role, though its impact can be difficult to quantify accurately.

Comparison of Alphabet’s Pre-Market Performance to Competitors

Comparing Alphabet’s pre-market performance to its competitors provides valuable context. The following table illustrates a hypothetical comparison (actual data would vary daily):

| Date | Alphabet Pre-Market Open | Alphabet Pre-Market Close | Percentage Change |

|---|---|---|---|

| 2024-10-27 | $135.00 | $136.50 | +1.11% |

| 2024-10-28 | $137.00 | $136.00 | -0.73% |

| 2024-10-29 | $135.50 | $137.25 | +1.33% |

| 2024-10-30 | $138.00 | $137.75 | -0.18% |

News and Events Impacting Alphabet’s Pre-Market Price

Significant news events often trigger substantial pre-market price swings for Alphabet. These events can be categorized into several key areas, each with its potential impact on investor sentiment and trading activity.

Significant News Events Affecting Alphabet’s Pre-Market Price

Historically, Alphabet’s pre-market price has been significantly affected by earnings reports, major product launches (like new Pixel phones or AI advancements), regulatory announcements (antitrust investigations, privacy concerns), and unexpected events (e.g., cybersecurity breaches, executive changes).

Examples of News Impacting Alphabet’s Pre-Market Stock Price, Alphabet premarket stock price

For example, a better-than-expected earnings report often leads to a positive pre-market surge. Conversely, a disappointing earnings announcement or negative news regarding a key product could result in a significant pre-market decline. The magnitude of the impact depends on the surprise element and the overall market context.

Time Lag Between News Events and Their Effect on Alphabet’s Pre-Market Price

The time lag between a news event and its impact on Alphabet’s pre-market price varies. Breaking news often results in immediate reactions, while less significant news might have a delayed or less pronounced effect. The speed of information dissemination and investor interpretation significantly influences this time lag.

Role of Social Media Sentiment in Influencing Pre-Market Trading of Alphabet Stock

Social media sentiment plays an increasingly important role. Positive buzz on platforms like Twitter or Reddit can boost pre-market price, while negative sentiment can lead to selling pressure. However, it’s important to note that social media sentiment is not always a reliable predictor of long-term price movements.

Types of News Triggering Significant Pre-Market Price Changes for Alphabet

Source: foolcdn.com

- Earnings announcements exceeding or falling short of expectations

- Major product launches or updates

- Significant regulatory changes or legal actions

- Announcements of major partnerships or acquisitions

- Reports of cybersecurity breaches or data leaks

- Changes in key leadership positions

Analyzing Pre-Market Trading Patterns for Alphabet

Analyzing pre-market trading patterns for Alphabet requires understanding typical price trends, interpreting charts, and considering the interplay of various factors. While predicting future price movements with certainty is impossible, identifying recurring patterns can enhance trading strategies.

Typical Pre-Market Price Trends for Alphabet

Alphabet’s pre-market price often exhibits a pattern of relatively higher volatility compared to regular trading hours. It frequently shows a pronounced reaction to overnight news, with prices often moving sharply in either direction. The overall trend can be influenced by broader market sentiment and sector-specific factors.

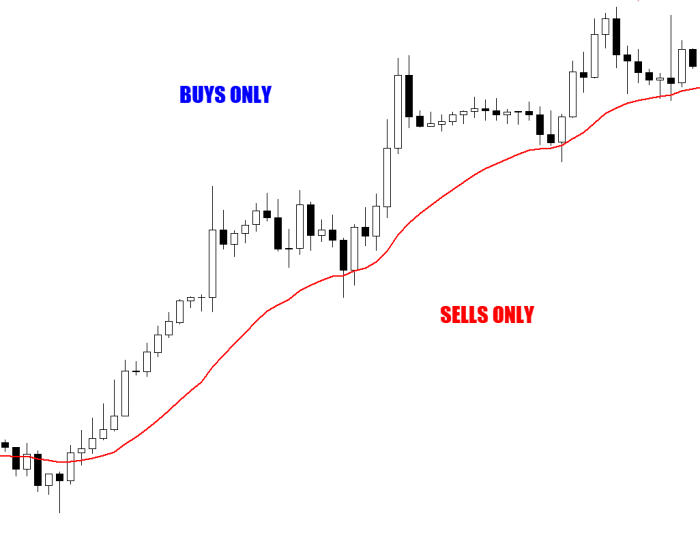

Interpreting Pre-Market Price Charts for Alphabet

Interpreting pre-market charts involves examining price movements in relation to news events, volume changes, and technical indicators. For example, a high volume of trades coupled with a significant price increase could indicate strong positive sentiment. Conversely, a large volume drop alongside a price decline might suggest increased uncertainty.

Comparison of Pre-Market and Regular Trading Session Volatility for Alphabet

Alphabet’s pre-market trading typically exhibits higher volatility than its regular trading session. This is largely due to the lower trading volume and the amplified impact of news events before the broader market fully reacts. The increased volatility presents both opportunities and risks for traders.

Hypothetical Scenario Illustrating News Impact on Alphabet’s Pre-Market Price

Imagine a scenario where Alphabet announces a significant breakthrough in AI technology. This positive news, released before the market opens, could trigger a sharp upward movement in the pre-market, potentially attracting significant buy orders from investors anticipating further gains during regular trading hours.

Summary of Common Pre-Market Trading Patterns Observed for Alphabet

| Pattern | Frequency | Typical Price Movement | Potential Causes |

|---|---|---|---|

| Sharp upward movement | Moderate | Significant price increase | Positive news, strong earnings, positive sector sentiment |

| Gradual upward movement | High | Moderate price increase | Positive sentiment, no significant news |

| Sharp downward movement | Moderate | Significant price decrease | Negative news, disappointing earnings, negative sector sentiment |

| Gradual downward movement | High | Moderate price decrease | Negative sentiment, lack of positive catalysts |

Investor Sentiment and Alphabet’s Pre-Market Price

Investor sentiment plays a crucial role in shaping Alphabet’s pre-market price. Positive sentiment drives buying, leading to price increases, while negative sentiment fuels selling, causing price declines. This sentiment is influenced by various factors, including news events, analyst ratings, and institutional investor actions.

Relationship Between Investor Sentiment and Alphabet’s Pre-Market Stock Price

A strong positive correlation exists between investor sentiment and Alphabet’s pre-market price. Optimistic outlooks lead to increased demand and higher prices, while pessimistic views result in reduced demand and lower prices. This relationship is particularly pronounced during periods of heightened market uncertainty.

Influence of Analyst Ratings and Recommendations on Pre-Market Trading Activity for Alphabet

Analyst ratings and recommendations significantly impact pre-market trading. Positive ratings often boost investor confidence, driving up the price, while negative ratings can trigger selling pressure. The influence of these ratings depends on the analyst’s reputation and the overall market context.

Impact of Major Institutional Investor Actions on Alphabet’s Pre-Market Price

Large institutional investors (mutual funds, hedge funds) can significantly influence Alphabet’s pre-market price through their buying and selling activities. Large buy orders can push the price up, while large sell orders can exert downward pressure. These actions are often driven by their assessment of Alphabet’s long-term prospects.

Examples of How Changes in Investor Confidence Have Affected Alphabet’s Pre-Market Price

For instance, a sudden shift in investor confidence following a major technological breakthrough might lead to a significant pre-market price surge. Conversely, concerns about increasing competition or regulatory hurdles could cause a drop in investor confidence and a subsequent pre-market decline.

Manifestation of Positive and Negative Investor Sentiment in Alphabet’s Pre-Market Price Action

Positive sentiment manifests as a steady or sharp upward trend in the pre-market, often with increased trading volume. Negative sentiment is characterized by a downward trend, potentially accompanied by higher volatility and reduced trading volume. The intensity of these movements reflects the strength of the underlying sentiment.

Alphabet’s premarket stock price often reflects broader market sentiment. However, it’s interesting to compare its performance to other biotech stocks; for instance, checking the current allogene therapeutics stock price offers a contrasting perspective on investor confidence in the sector. Ultimately, Alphabet’s premarket activity is a key indicator of the day’s overall economic outlook.

Risks and Opportunities in Alphabet’s Pre-Market Trading

Pre-market trading presents both opportunities and risks for Alphabet investors. While the potential for significant gains exists, understanding the inherent risks is crucial for informed decision-making. A careful assessment of risk tolerance and trading strategy is essential before engaging in pre-market activity.

Potential Risks Associated with Trading Alphabet Stock in the Pre-Market

Risks include higher volatility, lower liquidity, and the potential for significant losses due to unexpected news or market shifts. The lack of continuous price discovery compared to regular trading hours can exacerbate these risks.

Opportunities Presented by Pre-Market Trading for Alphabet Investors

Opportunities include the potential to capitalize on early price movements resulting from overnight news or anticipated events. This can provide a strategic advantage for traders who can quickly react to new information.

Comparison of Risk-Reward Profile of Pre-Market and Regular Trading Hours for Alphabet

Pre-market trading offers a higher risk-reward profile compared to regular trading hours. The potential for significant gains is greater, but so is the potential for significant losses. The increased volatility amplifies both the upside and downside potential.

Factors Investors Should Consider Before Participating in Alphabet’s Pre-Market Trading

Investors should carefully consider their risk tolerance, trading experience, and access to real-time information. A robust understanding of market dynamics and the factors influencing Alphabet’s stock price is essential.

Advantages and Disadvantages of Pre-Market Trading for Alphabet Stock

- Advantages: Potential for higher returns, early reaction to news, strategic advantage.

- Disadvantages: Higher volatility, lower liquidity, increased risk of losses, need for real-time information and quick decision-making.

Question & Answer Hub

What is the typical duration of Alphabet’s pre-market trading session?

Generally, Alphabet’s pre-market session lasts approximately 1-2 hours before the regular market opens.

How does after-hours trading differ from pre-market trading for Alphabet?

While both occur outside regular trading hours, after-hours trading happens after the market closes, whereas pre-market trading happens before the market opens. Volume and volatility can differ between the two.

Are there specific brokers that are better suited for pre-market Alphabet trading?

Many major brokerage firms offer pre-market trading; however, it’s crucial to compare commission fees and platform features before selecting a broker.

What are the potential tax implications of pre-market trading?

The tax implications are the same as for regular market trading. Consult a tax professional for specific advice related to your investment strategy.