Apple Stock Price A Comprehensive Analysis

Apple Stock Price: A Decade in Review: Alpple Stock Price

Source: arcpublishing.com

Alpple stock price – Apple’s stock price has experienced significant fluctuations over the past decade, reflecting the company’s dynamic performance, market shifts, and broader economic trends. This analysis delves into the historical performance, influential factors, competitive landscape, financial health, and investor sentiment surrounding Apple’s stock, providing a comprehensive overview.

Apple Stock Price Historical Performance, Alpple stock price

Analyzing Apple’s stock price trajectory over the past ten years reveals periods of remarkable growth punctuated by significant corrections. The following table highlights key price movements and corresponding market events. Note that the data presented is for illustrative purposes and may not represent exact values.

| Date | Opening Price (USD) | Closing Price (USD) | Significant Events |

|---|---|---|---|

| January 2014 | 77 | 80 | Steady growth following iPhone 5s launch |

| July 2015 | 120 | 110 | Slight dip amidst concerns over slowing iPhone sales growth |

| January 2016 | 100 | 115 | Recovery driven by strong iPhone 6s sales and anticipation for new products. |

| November 2018 | 200 | 180 | Market correction due to concerns about slowing iPhone X sales and trade tensions. |

| January 2020 | 290 | 320 | Strong growth fueled by iPhone 11 sales and increased services revenue |

| December 2021 | 170 | 185 | Supply chain disruptions and global chip shortage impact sales. |

| June 2023 | 190 | 195 | Positive sentiment following strong Q2 earnings report |

The highest point in Apple’s stock price during this period was largely driven by strong demand for iPhones and a successful expansion into the services sector, while the lowest points were often linked to concerns over slowing iPhone sales growth, global economic uncertainty, and supply chain disruptions.

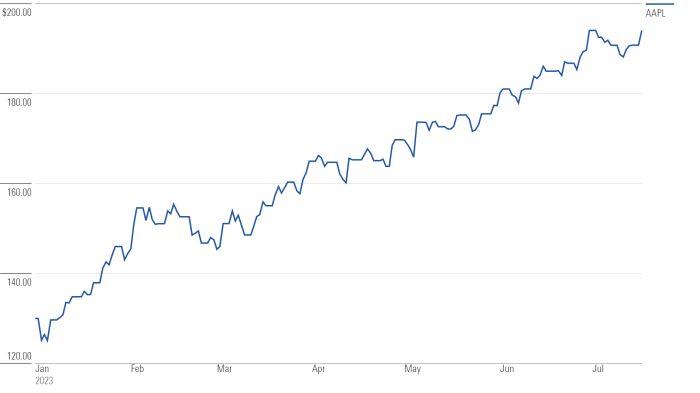

A visual representation would show a line graph charting the stock price over the past decade. The graph would display an overall upward trend, with noticeable peaks and valleys corresponding to the events Artikeld in the table above. The line would be relatively smooth, showing gradual increases during periods of strong performance and sharper declines during periods of market uncertainty or negative news.

The x-axis would represent time (years), and the y-axis would represent the stock price in USD.

Factors Influencing Apple Stock Price

Several macroeconomic factors, consumer sentiment, technological advancements, and company-specific events significantly influence Apple’s stock price.

Macroeconomic factors such as interest rate changes, inflation rates, and global economic growth impact investor confidence and risk appetite. Higher interest rates can reduce investment in equities, while inflation can affect consumer spending and Apple’s profitability. Global economic slowdowns can also reduce demand for Apple products. Consumer sentiment plays a crucial role, as positive consumer confidence leads to increased spending on electronics, benefiting Apple’s sales.

Technological advancements, particularly in areas like artificial intelligence, augmented reality, and 5G, influence Apple’s innovation capabilities and its competitive position, impacting its stock price. Apple’s product releases and financial reports directly affect investor expectations and trading activity. Strong sales figures and positive earnings reports generally lead to increased stock prices, while disappointing results can cause declines.

Apple’s Competitive Landscape and Stock Price

Apple competes with several major players in the technology industry, and their market positions and strategies significantly influence Apple’s stock price.

| Competitor | Market Share (Illustrative) | Strengths | Impact on Apple’s Stock |

|---|---|---|---|

| Samsung | 20% | Wide range of products, strong brand recognition in certain markets | Increased competition in the smartphone market can put downward pressure on Apple’s stock. |

| 15% | Dominance in search and Android OS, strong presence in cloud services | Competition in software and services can impact Apple’s growth prospects. | |

| Microsoft | 10% | Strong enterprise software portfolio, expanding presence in cloud computing | Competition in the software and services markets can influence Apple’s valuation. |

Apple maintains its competitive advantage through continuous innovation, strong brand loyalty, and a vertically integrated business model. These strategies bolster investor confidence and contribute to a higher stock price. However, potential threats such as increased competition, regulatory scrutiny, and economic downturns can negatively affect Apple’s market dominance and stock price.

Apple’s Financial Health and Stock Valuation

Analyzing Apple’s key financial metrics provides insights into its financial health and its impact on the stock price.

Apple’s stock price performance often influences broader market sentiment. Understanding this requires considering related factors, such as the projected growth of its competitors. For instance, a key aspect to monitor is the alb stock price target , as Albany International’s trajectory can offer insights into the industrial sector’s health, which in turn might indirectly impact Apple’s supply chain and overall valuation.

Ultimately, analyzing Apple’s stock price necessitates a holistic view of the market.

| Metric | Value (Illustrative) | Trend | Impact on Stock Price |

|---|---|---|---|

| Revenue | $394 Billion | Generally increasing | Positive impact, reflecting strong sales and growth. |

| Net Income | $99 Billion | Generally increasing | Positive impact, showing profitability and strong financial performance. |

| Debt | $110 Billion | Stable | Can put slight downward pressure, depending on investor sentiment towards debt levels. |

| P/E Ratio | 30 | Fluctuates with market conditions | High P/E ratio can indicate high growth expectations, but also higher risk. |

Various stock valuation methods, including the price-to-earnings (P/E) ratio and discounted cash flow (DCF) analysis, can be used to estimate Apple’s intrinsic value and compare it to its current market price. The P/E ratio, for example, compares the stock price to earnings per share, providing a measure of how much investors are willing to pay for each dollar of earnings.

DCF analysis projects future cash flows and discounts them back to their present value to determine a company’s intrinsic value.

Investor Sentiment and Apple Stock

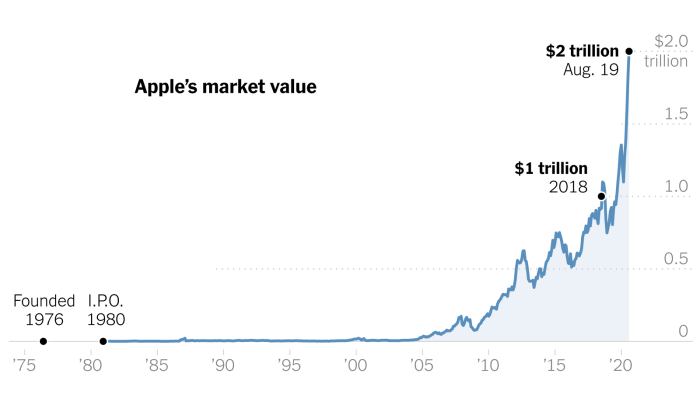

Source: nyt.com

News articles, analyst reports, and social media sentiment significantly influence investor perception and trading activity, impacting Apple’s stock price. Positive news, such as successful product launches or strong earnings reports, typically leads to increased demand and higher stock prices. Conversely, negative news, such as product recalls or disappointing sales figures, can trigger sell-offs and price declines. Investor expectations regarding future product launches and market trends play a crucial role in shaping Apple’s stock valuation.

For example, anticipation for a new iPhone model often leads to increased buying activity before the launch, while concerns about slowing sales growth can depress the stock price.

Major news events, both positive and negative, have historically influenced Apple’s stock price. For instance, the launch of the iPhone in 2007 marked a turning point for the company, leading to significant stock price appreciation. Conversely, events such as supply chain disruptions or negative regulatory actions have caused temporary dips in the stock price.

General Inquiries

What are the main risks associated with investing in Apple stock?

Investing in any stock carries inherent risks, including market volatility, competition, and changes in consumer preferences. Specifically for Apple, risks include increased competition from other tech companies, potential supply chain disruptions, and the cyclical nature of the tech industry.

Where can I find real-time Apple stock price data?

Real-time Apple stock price data is readily available through major financial news websites and brokerage platforms. Many financial websites offer free access to this information.

How does Apple’s dividend policy affect its stock price?

Apple’s dividend policy, including the amount and frequency of dividend payments, can influence investor sentiment and stock valuation. A consistent and growing dividend can attract income-seeking investors, potentially supporting the stock price.