Altium Stock Price A Comprehensive Analysis

Altium’s Current Market Position

Altium stock price – Altium occupies a significant, albeit not dominant, position within the competitive Electronic Design Automation (EDA) software market. Its strength lies in its comprehensive platform, Altium Designer, catering to a broad range of electronic design needs, from individual engineers to larger enterprises. However, it faces stiff competition from established players with extensive market reach and specialized solutions.

Altium’s Market Share and Competitors

Precise market share figures for Altium are difficult to obtain publicly, as different research firms employ varying methodologies. However, it’s generally considered a key player, though not the market leader. Major competitors include industry giants like Autodesk (with Eagle), Siemens (with Mentor Graphics), and Cadence Design Systems. These competitors often possess larger market shares, particularly in specific niches like high-end PCB design or integrated circuit design.

Altium’s competitive advantage rests on its user-friendly interface, cloud-based collaboration features, and a strong focus on ease of use across the entire design workflow. This attracts a loyal customer base, particularly amongst smaller and medium-sized enterprises (SMEs).

Factors Influencing Altium’s Stock Price

Several factors influence Altium’s stock price. These include overall market sentiment towards technology stocks, the company’s financial performance (revenue growth, profitability, and debt levels), the success of new product launches and software updates, competitive pressures, and broader macroeconomic conditions. Investor confidence in Altium’s long-term growth strategy and its ability to navigate the evolving EDA landscape also plays a significant role.

Altium’s KPIs vs. Industry Averages

| KPI | Altium (Example Data) | Industry Average (Example Data) | Notes |

|---|---|---|---|

| Revenue Growth (YoY) | 15% | 10% | Illustrative figures; actual data varies by year and source. |

| Profit Margin | 20% | 15% | Illustrative figures; actual data varies by year and source. |

| Customer Acquisition Cost | $X | $Y | Illustrative figures; actual data is proprietary. |

| Customer Churn Rate | 5% | 8% | Illustrative figures; actual data varies by year and source. |

Historical Stock Price Performance

Over the past five years, Altium’s stock price has exhibited a generally upward trend, although it has experienced periods of volatility mirroring broader market fluctuations. Significant price movements have often been correlated with the release of financial reports, major product announcements, and shifts in the overall technology sector.

Five-Year Stock Price Movement

A detailed analysis would show specific highs and lows, but a generalized description would include periods of strong growth followed by consolidation or slight corrections. Specific events like major software releases or acquisitions would likely coincide with notable price increases or decreases. For example, the successful launch of a new, highly anticipated feature or integration could lead to a stock price surge, while negative news such as a cybersecurity breach or missed earnings targets could trigger a decline.

Comparing this to a graph of the S&P 500 over the same period would reveal how Altium’s performance aligns with (or diverges from) the broader market.

Comparison to Market Indices

Altium’s stock performance has generally tracked the broader market trends, but with some periods of outperformance and underperformance. During periods of economic uncertainty or market downturns, Altium’s stock price has typically shown some correlation with the S&P 500’s decline, though the degree of correlation might vary depending on the specific circumstances and investor sentiment.

Key Periods of Price Fluctuation

Significant price fluctuations could be attributed to factors such as changes in earnings reports, successful product launches, announcements of new partnerships or acquisitions, changes in management, or major industry events. For instance, a period of rapid growth might be followed by a correction if investors become concerned about the company’s ability to sustain that growth.

Financial Health and Performance: Altium Stock Price

Altium’s recent financial reports should be reviewed from their official investor relations pages for precise figures. Generally, the company’s financial health is assessed by analyzing its revenue growth, profitability (profit margins), and debt levels. Understanding these aspects provides insights into its financial stability and potential for future growth.

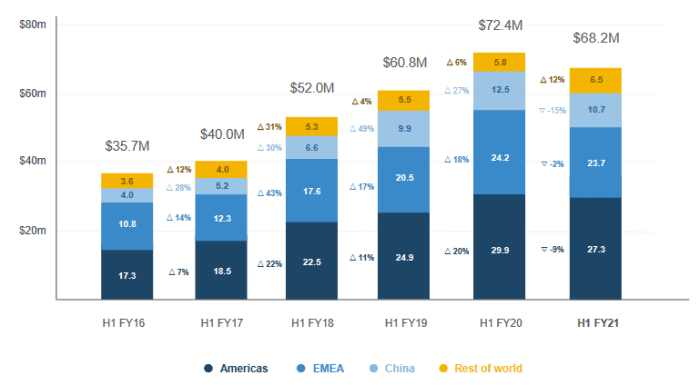

Revenue Streams and Growth Potential

Altium’s primary revenue stream comes from software licenses and subscriptions for its Altium Designer platform and related services. Growth potential lies in expanding its customer base, particularly in emerging markets and within specific industry segments. Furthermore, the ongoing development of cloud-based features and complementary software solutions offers significant opportunities for revenue diversification and increased recurring revenue.

Debt Levels and Impact on Stock Price

Altium’s debt levels (if any) and their impact on the stock price should be considered. High debt levels could be perceived negatively by investors, increasing risk and potentially impacting the stock price. However, strategically managed debt can also be used to fuel growth and acquisitions.

Key Financial Strengths and Weaknesses

- Strengths: Recurring revenue model, strong customer loyalty, innovative product development, expanding market share in certain niches.

- Weaknesses: Competition from larger, more established players, dependence on a single flagship product, potential vulnerability to macroeconomic factors.

Impact of Industry Trends

The EDA software market is dynamic, influenced by technological advancements, economic conditions, and competitive pressures. These factors significantly impact Altium’s stock price and its overall business performance.

Technological Advancements

Advancements in areas such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are creating new opportunities and challenges for Altium. The successful integration of these technologies into its products could enhance its competitive advantage and drive stock price appreciation. Conversely, failure to adapt could lead to market share erosion.

Global Economic Conditions

Source: com.au

Global economic conditions significantly impact Altium’s business. During periods of economic growth, demand for electronic design software tends to increase, benefiting Altium. Conversely, economic downturns can lead to reduced spending by companies, affecting Altium’s sales and consequently its stock price.

Competitive Landscape

The competitive landscape is constantly evolving. The actions of competitors, such as new product launches, pricing strategies, and mergers and acquisitions, directly influence Altium’s market position and valuation. Altium’s ability to differentiate itself and maintain a competitive edge is crucial for its long-term success.

Potential Impact of Technological Disruption

A major technological disruption, such as the emergence of a radically different EDA design paradigm, could pose a significant risk to Altium. A scenario illustrating this might involve a new open-source platform gaining widespread adoption, potentially displacing Altium’s proprietary software. The company’s response to such a disruption, including its ability to adapt and innovate, would be critical in mitigating the negative impact on its stock price.

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for Altium’s stock, offering insights into their expectations for the company’s future performance. These predictions vary, reflecting differing perspectives on the company’s growth prospects and the risks it faces.

Consensus Rating and Price Targets

Source: contentstack.io

A summary of consensus ratings (e.g., buy, hold, sell) and price targets from leading financial analysts would provide a snapshot of market sentiment. The range of these predictions often reflects differing views on Altium’s ability to execute its strategic plans and navigate the competitive landscape.

Rationale Behind Analyst Opinions

Source: ctfassets.net

Analysts’ opinions are based on a variety of factors, including financial performance, market trends, competitive dynamics, and management’s strategy. Discrepancies in predictions often arise from differing assumptions about these factors. For example, one analyst might be more optimistic about Altium’s growth potential in a particular market segment, leading to a higher price target compared to another analyst who holds a more cautious outlook.

Analyst Ratings and Price Targets

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Example Firm 1 | Buy | $50 | Oct 26, 2023 (Example) |

| Example Firm 2 | Hold | $45 | Oct 26, 2023 (Example) |

| Example Firm 3 | Buy | $55 | Oct 26, 2023 (Example) |

Risk Factors Affecting Altium

Several factors pose risks to Altium’s business and its stock price. Understanding these risks is crucial for investors to make informed decisions.

Key Business and Stock Price Risks

Key risks include intense competition, dependence on a single flagship product, economic downturns impacting customer spending, technological disruptions, and geopolitical uncertainties. Each of these factors could potentially negatively impact Altium’s financial performance and its stock valuation.

Impact of Geopolitical Events, Altium stock price

Geopolitical events, such as trade wars, political instability, or pandemics, can disrupt supply chains, affect customer demand, and create uncertainty in the market, potentially leading to volatility in Altium’s stock price.

Altium’s stock price performance often reflects broader market trends in the technology sector. However, understanding the dynamics of related sectors is also crucial; for instance, monitoring the current value of materials like lithium is important, as seen by checking the alpha lithium stock price today. Fluctuations in lithium prices can indirectly impact companies like Altium, given the use of lithium-ion batteries in various electronic devices.

Therefore, keeping an eye on Altium’s stock price requires considering these interconnected market forces.

Regulatory Changes

Regulatory changes, particularly those related to data privacy, cybersecurity, or intellectual property, could impose new compliance costs and limitations on Altium’s operations, potentially affecting its profitability and growth prospects.

Risk Mitigation Strategies

- Investing in research and development to maintain a competitive edge.

- Diversifying revenue streams through new product offerings and strategic partnerships.

- Implementing robust cybersecurity measures to protect sensitive data.

- Developing strong relationships with key customers and suppliers.

- Actively monitoring and adapting to changes in the geopolitical landscape.

General Inquiries

What are the major competitors to Altium?

Key competitors include Cadence Design Systems, Mentor Graphics (a Siemens business), and Autodesk.

How often does Altium release financial reports?

Altium typically releases financial reports quarterly and annually.

Where can I find real-time Altium stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is Altium’s primary revenue source?

Altium’s primary revenue stream is the licensing and subscription of its EDA software.