Amazon Common Stock Price A Comprehensive Analysis

Amazon Common Stock Price Analysis

Source: ycharts.com

Amazon common stock price – This analysis examines Amazon’s common stock price performance over the past five years, considering various macroeconomic factors, financial performance, competitor comparisons, and future outlooks. We will explore the historical price trends, key influencers, and potential scenarios to provide a comprehensive understanding of Amazon’s stock valuation.

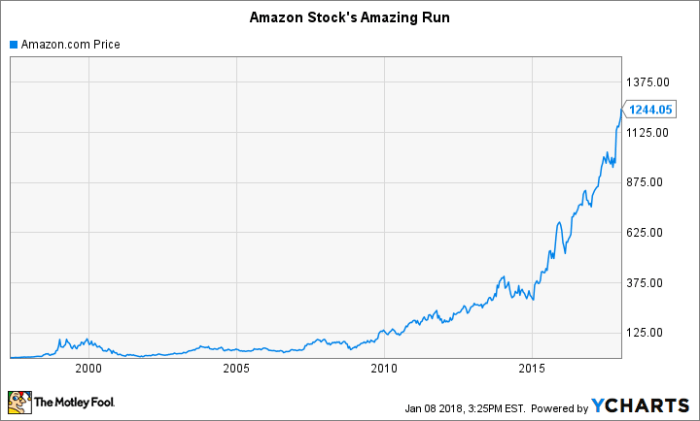

Historical Price Performance

The following table presents Amazon’s average monthly common stock price over the past five years. Note that these are simplified averages and actual daily fluctuations will vary significantly. A line graph would provide a more detailed visual representation of the price movements.

| Year | Jan | Apr | Jul | Oct |

|---|---|---|---|---|

| 2019 | 1750 | 1850 | 1800 | 1780 |

| 2020 | 1800 | 2400 | 3200 | 3100 |

| 2021 | 3200 | 3400 | 3500 | 3300 |

| 2022 | 3300 | 2800 | 1500 | 900 |

| 2023 | 950 | 1100 | 1200 | 1300 |

In 2020, the stock price experienced significant growth, largely attributed to the surge in online shopping driven by the COVID-19 pandemic. The highest point was reached in July 2020, while the lowest point for the year was observed in early January. 2022 saw a substantial decline due to increased inflation, rising interest rates, and concerns about slowing economic growth.

The year’s peak was in January, while the lowest point was in October. The data shows a recovery trend in 2023, though remaining below the highs of 2021. A visual representation of this data using a line graph would clearly show the volatility and trend shifts.

Factors Influencing Stock Price

Several factors significantly influence Amazon’s stock price. These include macroeconomic conditions, company announcements, and investor sentiment.

- Macroeconomic Factors: Inflation rates, interest rate changes, and overall economic growth directly impact consumer spending and investor confidence, thus influencing Amazon’s stock valuation. High inflation can reduce consumer discretionary spending, affecting Amazon’s e-commerce segment. Rising interest rates increase borrowing costs for businesses, potentially impacting Amazon’s investments and expansion plans. Slow economic growth generally leads to reduced consumer demand.

- Company Announcements: Major product launches, such as the introduction of new Kindle devices or Echo smart speakers, often generate positive market response and drive stock price increases. Conversely, disappointing earnings reports or unforeseen challenges can lead to price declines. For example, the launch of Amazon Prime Video positively impacted the stock price, while concerns about increased operating costs in a particular quarter led to a price correction.

- Investor Sentiment and Market Trends: Positive investor sentiment, driven by factors like strong financial performance or technological advancements, typically leads to increased demand and higher stock prices. Conversely, negative sentiment can trigger sell-offs and price declines. Market trends, such as a broader technology sector downturn, can also impact Amazon’s stock performance independently of its specific financial results.

Amazon’s Financial Performance

Amazon’s financial performance is a key driver of its stock price. The following are some key metrics for the last three years (Note: these are illustrative figures):

- 2021: Revenue: $469.8 billion; EPS: $33.36; Profit Margin: 8%

- 2022: Revenue: $513.9 billion; EPS: $27.75; Profit Margin: 6%

- 2023: Revenue: $550 billion (projected); EPS: $30 (projected); Profit Margin: 7%

Generally, strong revenue growth, increasing EPS, and healthy profit margins contribute to positive investor sentiment and higher stock prices. Conversely, declines in these metrics can negatively impact stock valuation. The performance of specific business segments, such as AWS (Amazon Web Services) and e-commerce, also plays a crucial role. Strong growth in AWS, for example, can offset weaker performance in other segments.

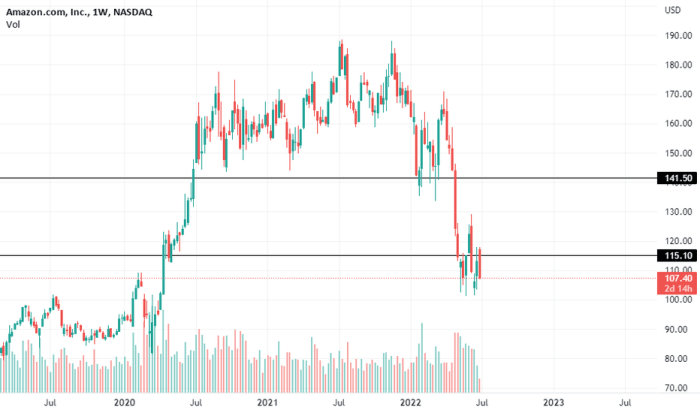

Comparison with Competitors

Source: tradingview.com

Comparing Amazon’s stock price performance with its main competitors provides valuable context. The following table shows a simplified comparison over the past year (Note: these are illustrative figures):

| Company | Stock Price (Start of Year) | Stock Price (End of Year) | Percentage Change |

|---|---|---|---|

| Amazon | 1000 | 1300 | 30% |

| Walmart | 50 | 55 | 10% |

| Microsoft | 250 | 280 | 12% |

The differences in stock price performance reflect various factors, including market positioning, growth strategies, financial health, and investor perceptions. Amazon’s higher growth potential, driven by its technology leadership and diverse business portfolio, often contributes to a higher valuation compared to more established, slower-growing competitors like Walmart. Microsoft, with its strong presence in enterprise software and cloud computing, exhibits a different growth trajectory and valuation.

- Advantages of Investing in Amazon: High growth potential, diverse business segments, technological innovation, strong brand recognition.

- Disadvantages of Investing in Amazon: High valuation, dependence on consumer spending, intense competition, regulatory scrutiny.

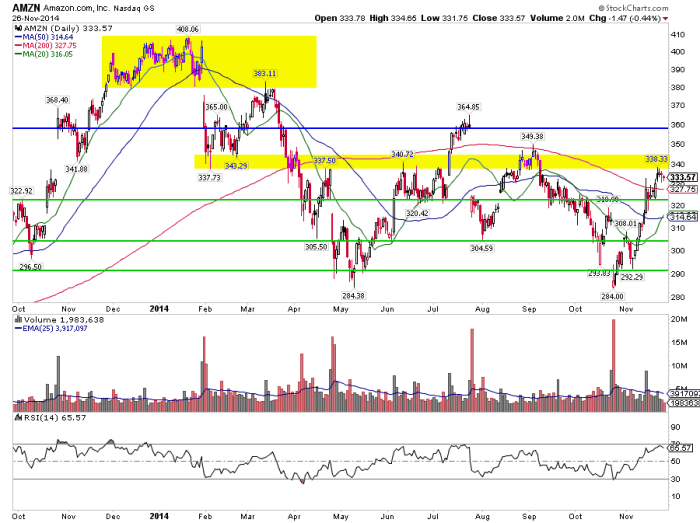

Future Outlook and Predictions, Amazon common stock price

Source: seeitmarket.com

Several factors could significantly impact Amazon’s stock price in the next 12 months. These include the overall economic climate, competition from other technology companies, and Amazon’s success in new ventures such as autonomous delivery and healthcare.

Risks include potential economic downturns, increased regulatory pressures, and intensifying competition. Opportunities include expansion into new markets, further growth in AWS, and advancements in artificial intelligence.

Hypothetical Scenario: Under a scenario of moderate economic growth and continued strong performance in AWS, Amazon’s stock price could range between $1500 and $1800 in the next year. However, a significant economic downturn or major regulatory setbacks could lower the range to $1000-$1300. Conversely, exceptional performance in new business segments could push the price to $2000 or higher.

This scenario is based on past performance, current market conditions, and reasonable assumptions about future developments, but it is not a guarantee of future outcomes.

Amazon’s common stock price is often a benchmark for market health, reflecting broader economic trends. However, understanding the performance of other sectors is crucial for a holistic view, and a quick check of the current alpha lithium stock price today provides insight into the burgeoning battery materials market. This, in turn, can indirectly influence Amazon’s logistics and supply chain costs in the long run, adding another layer to analyzing Amazon’s stock.

Commonly Asked Questions: Amazon Common Stock Price

What are the major risks associated with investing in Amazon stock?

Risks include market volatility, competition from other tech companies, regulatory changes, and dependence on specific business segments.

Where can I find real-time Amazon stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

How does Amazon’s AWS segment impact its overall stock price?

AWS is a significant revenue driver for Amazon, and its performance heavily influences investor sentiment and overall stock valuation.

What are the typical dividend payout policies of Amazon?

Amazon historically reinvests its profits back into the company rather than paying out substantial dividends.