Amazon Stock Price Google Finance

Amazon Stock Price Trends on Google Finance

Amazon stock price google finance – Google Finance provides a comprehensive platform for tracking Amazon’s stock price, offering a variety of tools and visualizations to understand its performance. The platform’s user-friendly interface allows investors to analyze price movements, identify trends, and make informed decisions.

Visual Representation of Amazon’s Stock Price

Source: forbes.com

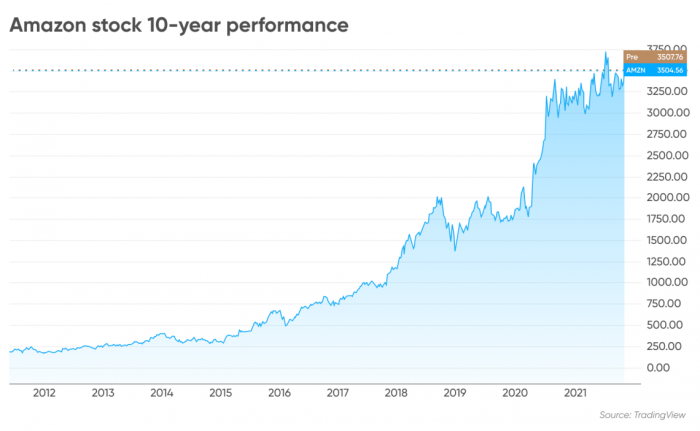

Google Finance typically displays Amazon’s stock price using an interactive line chart. The vertical axis represents the stock price (in USD), and the horizontal axis represents time. Key labels clearly indicate the price scale and the time intervals. Additional indicators, such as moving averages (e.g., 50-day, 200-day), may be overlaid on the chart to highlight trends. Volume data is often presented as a separate bar chart below the price chart.

Available Timeframes for Viewing Stock Price History, Amazon stock price google finance

Google Finance offers various timeframes for viewing Amazon’s stock price history, allowing users to analyze performance at different granularities. These include daily, weekly, monthly, and yearly views. The daily view provides a detailed look at short-term fluctuations, while the yearly view shows the long-term trend. Switching between timeframes alters the chart’s scale and level of detail, impacting the visual representation of price movements.

Hypothetical Scenario: Significant Price Fluctuation

Imagine Amazon announces unexpectedly strong quarterly earnings, exceeding analysts’ predictions. This could cause a sharp increase in the stock price. On Google Finance, this would be visually represented by a dramatic upward spike in the line chart. For example, if the closing price was $100, it might jump to $115 within a single trading day, clearly visible as a steep incline on the chart.

Sample Amazon Stock Price Data

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | 102.50 | 103.75 | 101.25 | 103.00 |

| Tuesday | 103.25 | 104.50 | 102.75 | 104.00 |

| Wednesday | 104.10 | 105.20 | 103.80 | 104.80 |

| Thursday | 104.90 | 106.00 | 104.50 | 105.50 |

| Friday | 105.60 | 106.20 | 104.90 | 105.80 |

Factors Influencing Amazon Stock Price: Amazon Stock Price Google Finance

Numerous factors contribute to fluctuations in Amazon’s stock price. These can be broadly categorized as economic conditions, company announcements, competitor actions, and internal company factors.

Major Economic Factors

Three major economic factors impacting Amazon’s stock price are inflation rates, interest rates, and consumer spending. High inflation reduces consumer purchasing power, potentially impacting Amazon’s sales. Rising interest rates increase borrowing costs for Amazon and may slow down investment. Strong consumer spending, however, generally boosts Amazon’s revenue and stock price.

Effect of Major Company Announcements

Major company announcements, such as earnings reports and new product launches, often trigger immediate stock price reactions. Positive news generally leads to price increases, while negative news can cause decreases. For instance, the announcement of a new highly anticipated product like a new Kindle could drive up the stock price, while a disappointing earnings report might lead to a decline.

Influence of Competitor Actions

Competitor actions, such as new product releases from Walmart or aggressive pricing strategies, can influence Amazon’s stock price. A significant new product release from a competitor could put downward pressure on Amazon’s stock if it threatens market share. Conversely, a competitor’s failure could lead to an increase in Amazon’s stock price as investors view this as beneficial to Amazon.

Internal Factors Leading to Stock Price Increase

- Successful new product launches

- Increased market share

- Improved profitability

- Expansion into new markets

- Strong revenue growth

Google Finance Data Interpretation for Amazon Stock

Google Finance provides various indicators to aid in interpreting Amazon’s stock performance. Understanding these indicators can help investors make more informed decisions.

Interpreting Key Indicators

Source: capital.com

Volume indicates the number of shares traded. High volume during price increases suggests strong buying pressure, while high volume during price decreases indicates strong selling pressure. Moving averages smooth out price fluctuations, helping identify trends. A rising 50-day moving average above a 200-day moving average is often considered a bullish signal.

Monitoring the Amazon stock price on Google Finance provides a good overview of the tech sector’s performance. However, a comparative analysis might include examining other tech companies, such as checking the current altium stock price to understand broader market trends. Returning to Amazon, the Google Finance data offers valuable insights into its financial health and future projections.

Identifying Buying or Selling Opportunities

Based solely on Google Finance data, potential buying opportunities might arise when the stock price shows a significant pullback after a period of growth, or when key indicators like moving averages suggest a potential upward trend. Selling opportunities might be considered when the stock price shows signs of overextension or when negative news impacts the price.

Current Price vs. Previous Day’s Closing Price

The difference between a stock’s current price and its previous day’s closing price represents the intraday change. A positive difference indicates an increase in price, while a negative difference indicates a decrease. For example, if Amazon closed at $100 yesterday and is currently trading at $102, the intraday change is $2, signifying a price increase.

Calculating Percentage Change

The percentage change in Amazon’s stock price over a chosen period can be calculated using the formula: [(Current Price – Previous Price) / Previous Price]

– 100. For instance, if the price rose from $100 to $105, the percentage change is [(105 – 100) / 100]

– 100 = 5%.

Visual Representation of Data from Google Finance

Google Finance offers various visual representations of data, including volume charts and candlestick charts, providing different perspectives on Amazon’s stock performance.

Visual Representation of Stock Price Volume

Amazon’s stock price volume is typically displayed as a bar chart below the price chart. The height of each bar represents the trading volume for that period (e.g., day). High volume bars indicate significant trading activity, suggesting strong investor interest. Low volume bars indicate less activity.

Candlestick Chart During High Volatility

During high volatility, a candlestick chart would show long, thin candles (both green and red) with significant price gaps between consecutive candles. Red candles (indicating a price decline) would be long and thin, suggesting strong selling pressure, while green candles (indicating a price increase) would also be long, showing strong buying pressure. The wicks (the small lines extending above and below the candle body) would be relatively long, reflecting large price swings within the trading period.

Hypothetical Scenario: Significant News Event Impact

Imagine a major cybersecurity breach at Amazon. This would likely cause a sharp decline in the stock price, visually represented on Google Finance by a dramatic downward spike in the line chart, accompanied by high volume (indicated by tall bars in the volume chart). Candlesticks would likely show long red candles with potentially significant lower wicks.

Amazon Stock Price and Trading Volume

| Date | Open | Close | Volume (Millions) |

|---|---|---|---|

| Oct 26 | 100 | 105 | 15 |

| Oct 27 | 106 | 102 | 20 |

| Oct 28 | 101 | 108 | 18 |

FAQ Insights

What are moving averages and how are they used in analyzing Amazon’s stock?

Moving averages smooth out price fluctuations to identify trends. Google Finance displays various moving averages (e.g., 50-day, 200-day). A rising moving average suggests an upward trend, while a falling one suggests a downward trend.

How does trading volume affect Amazon’s stock price?

High trading volume often accompanies significant price changes. High volume during a price increase suggests strong buying pressure, while high volume during a price decrease indicates strong selling pressure.

What are some limitations of using only Google Finance for stock analysis?

Google Finance provides a good overview, but it lacks in-depth fundamental analysis (company financials, etc.). Relying solely on Google Finance for investment decisions is risky; it should be supplemented with other research.

How can I set up alerts for Amazon’s stock price on Google Finance?

Most Google Finance interfaces allow you to set price alerts. This feature notifies you when the stock reaches a specific price point, helping you monitor significant changes.