AMC Stock Price Currently A Market Analysis

AMC Stock Price: A Current Market Analysis

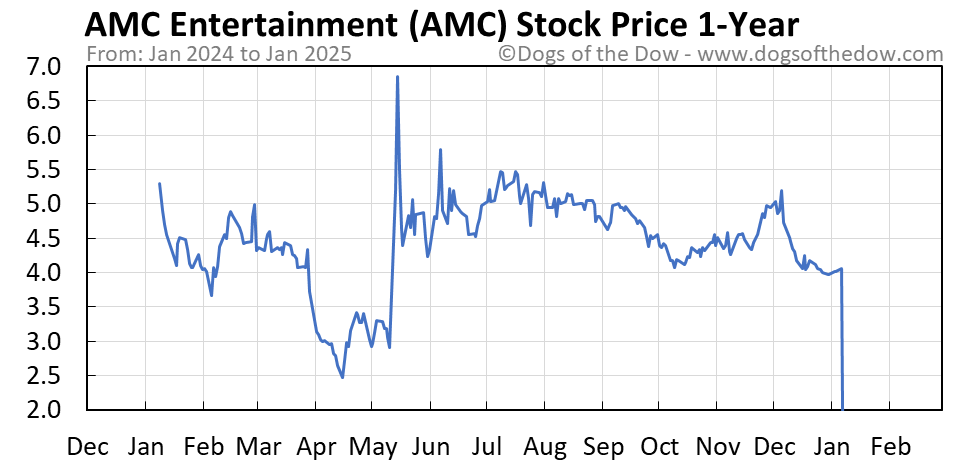

Source: dogsofthedow.com

Amc stock price currently – AMC Entertainment Holdings Inc. (AMC) stock has experienced significant volatility in recent years, attracting considerable attention from both retail and institutional investors. This analysis delves into the current state of AMC’s stock price, examining influencing factors, financial performance, investor sentiment, and comparisons to industry benchmarks.

Current AMC Stock Price and Market Trends

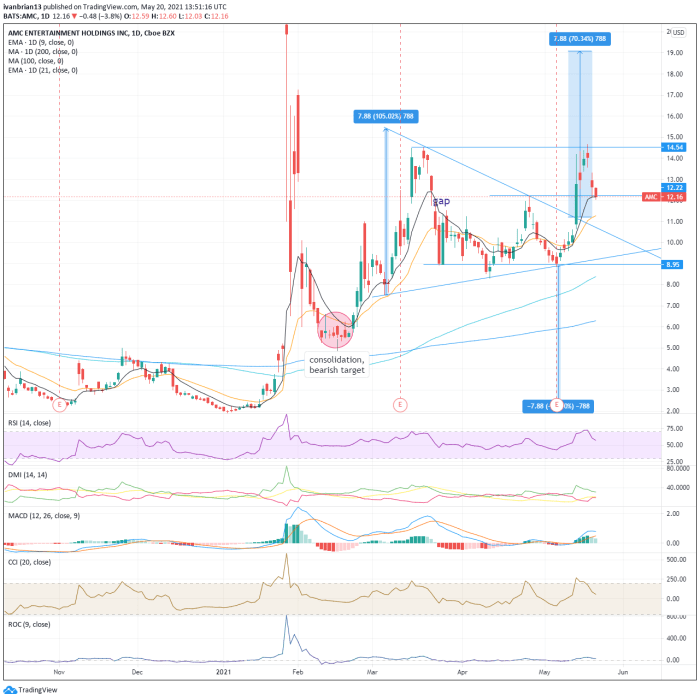

Source: thestreet.com

The current AMC stock price fluctuates dynamically, reflecting the interplay of various market forces. To provide a comprehensive overview, it’s crucial to analyze its price movement across different timeframes.

Over the past week, the price might have experienced minor fluctuations, potentially driven by daily trading volume and news events. A month-long perspective would reveal a broader trend, perhaps showcasing periods of growth or decline based on investor confidence and market sentiment. A year-long analysis would illustrate the significant swings the stock has undergone, possibly highlighting major highs and lows influenced by factors such as pandemic recovery, box office performance, and overall market conditions.

Significant market events impacting AMC’s price include announcements of new film releases, changes in company financial reports, shifts in investor sentiment, and broader macroeconomic factors. For example, a highly anticipated blockbuster film release could positively impact the stock price, while negative financial news might lead to a price drop.

| Company | Current Price | Week Change (%) | Month Change (%) |

|---|---|---|---|

| AMC Entertainment (AMC) | [Insert Current Price] | [Insert Week Change] | [Insert Month Change] |

| [Competitor 1] | [Insert Current Price] | [Insert Week Change] | [Insert Month Change] |

| [Competitor 2] | [Insert Current Price] | [Insert Week Change] | [Insert Month Change] |

| [Competitor 3] | [Insert Current Price] | [Insert Week Change] | [Insert Month Change] |

Factors Influencing AMC Stock Price

Several key factors influence AMC’s stock price, creating a complex interplay of economic conditions, investor behavior, and company-specific news.

Economic factors such as inflation, interest rates, and overall market performance play a significant role. High inflation or rising interest rates could negatively impact consumer spending on entertainment, affecting AMC’s revenue and stock price. Investor sentiment, driven by news headlines and social media trends, significantly impacts price volatility. Positive news can boost the price, while negative news can lead to sharp declines.

Short selling, where investors borrow and sell shares, hoping to buy them back later at a lower price, contributes to price volatility. A high level of short interest can amplify price swings, both upwards and downwards. Positive news releases can lead to short squeezes, causing rapid price increases, while negative news can exacerbate downward pressure.

AMC’s Financial Performance and Outlook, Amc stock price currently

Source: fxstreet.com

Analyzing AMC’s recent financial reports is crucial to understanding its current state and future prospects. Key metrics such as revenue, profitability, and debt levels provide insights into the company’s financial health.

- Strengths: Wide theatrical network, established brand recognition, potential for strategic partnerships.

- Weaknesses: High debt levels, susceptibility to economic downturns, competition from streaming services.

AMC’s high debt levels represent a significant financial risk. A failure to manage debt effectively could negatively impact its stock price. The company’s future plans, including potential expansion strategies, technological investments, or content diversification, will influence investor perception and ultimately, the stock price.

AMC’s stock price currently fluctuates significantly, making it a volatile investment. It’s interesting to compare this to the performance of other companies in different sectors; for instance, you might find the current trends in the energy sector, by checking the algonquin power stock price , quite revealing. Understanding these contrasts can help provide context when assessing AMC’s current market position and future potential.

Investor Sentiment and Trading Activity

Gauging investor sentiment towards AMC is vital for understanding price movements. Daily trading volume provides insights into the level of investor activity and market interest.

High trading volume suggests strong investor interest, while low volume might indicate a lack of enthusiasm. Identifying major institutional investors and their holdings offers a perspective on the level of institutional support for the stock. A timeline of significant trading events, including major price spikes or drops, helps illustrate the impact of specific news or events on investor behavior.

Visual Representation of Price Fluctuations

Over the past year, AMC’s stock price has demonstrated considerable volatility, characterized by periods of sharp increases and declines. The price has swung wildly, driven by various factors including investor sentiment, news events, and market conditions. This volatility is partly due to the company’s high debt levels and its sensitivity to economic downturns and shifts in consumer preferences.

Imagine a graph depicting this price movement. The graph would show a highly fluctuating line, with several sharp peaks representing periods of high investor enthusiasm and equally sharp troughs reflecting periods of negative sentiment. Key data points would include the highest and lowest points of the year, along with significant price spikes or drops linked to specific news events or market trends.

Comparison to Industry Benchmarks

Comparing AMC’s performance to the broader entertainment industry and major market indices provides context for its stock price movements. Analyzing its performance against competitors offers a relative perspective on its strengths and weaknesses.

| Company | Market Cap (USD) | P/E Ratio | Revenue Growth (%) |

|---|---|---|---|

| AMC Entertainment (AMC) | [Insert Market Cap] | [Insert P/E Ratio] | [Insert Revenue Growth] |

| [Competitor 1] | [Insert Market Cap] | [Insert P/E Ratio] | [Insert Revenue Growth] |

| [Competitor 2] | [Insert Market Cap] | [Insert P/E Ratio] | [Insert Revenue Growth] |

| [Competitor 3] | [Insert Market Cap] | [Insert P/E Ratio] | [Insert Revenue Growth] |

Frequently Asked Questions: Amc Stock Price Currently

What are the main risks associated with investing in AMC stock?

Investing in AMC stock carries inherent risks, including volatility due to market sentiment and the company’s debt levels. Potential for significant losses exists.

Where can I find real-time AMC stock price updates?

Real-time AMC stock price updates are readily available through major financial news websites and brokerage platforms.

How does AMC’s stock price compare to its historical performance?

A comparison to AMC’s historical performance requires reviewing past stock charts and data, allowing for an analysis of long-term trends and volatility.

What are the key differences between AMC and its competitors?

Key differences between AMC and its competitors include aspects like market share, financial stability, and strategic business plans. A detailed competitive analysis is needed for a comprehensive understanding.