AMD Stock Price Live Real-Time Tracking

AMD Stock Price Live: A Comprehensive Overview

Amd stock price live – This analysis provides a current overview of AMD’s stock price, encompassing market context, influential factors, historical performance, analyst predictions, investor sentiment, and technical and fundamental analyses. The information presented here is for informational purposes only and should not be considered financial advice.

Current AMD Stock Price & Market Context

AMD’s stock price fluctuates constantly, reflecting the dynamic nature of the semiconductor industry and broader market conditions. To obtain the most up-to-date price, refer to a live financial data source. Trading volume signifies the number of shares exchanged within a given period. High volume often indicates significant investor interest and potential price volatility. Market conditions, such as overall economic health, investor confidence, and competing technology advancements, significantly influence AMD’s price performance.

A bearish market trend, for instance, can negatively impact even strong performing stocks.

| Company | Current Price | Day Change % | Volume |

|---|---|---|---|

| AMD | (Obtain from live data source) | (Obtain from live data source) | (Obtain from live data source) |

| Intel | (Obtain from live data source) | (Obtain from live data source) | (Obtain from live data source) |

| Nvidia | (Obtain from live data source) | (Obtain from live data source) | (Obtain from live data source) |

Factors Influencing AMD Stock Price

Source: googleapis.com

Several factors contribute to AMD’s stock price movements. These include the success of new product launches, macroeconomic conditions, and overall investor sentiment influenced by news coverage. Positive news, such as strong earnings reports or innovative product announcements, tends to boost investor confidence and drive the price upward. Conversely, negative news, like production delays or weaker-than-expected sales figures, can lead to price declines.

- New product releases significantly impact AMD’s stock price. Successful launches of high-performing CPUs and GPUs can generate substantial positive market reaction.

- Macroeconomic factors such as inflation and interest rates influence investor behavior and market sentiment. High inflation and rising interest rates can dampen investor enthusiasm, potentially leading to lower stock prices.

- Positive news coverage, highlighting strong financial performance or technological advancements, typically increases investor confidence, resulting in price appreciation. Negative news, conversely, often leads to decreased investor confidence and price drops.

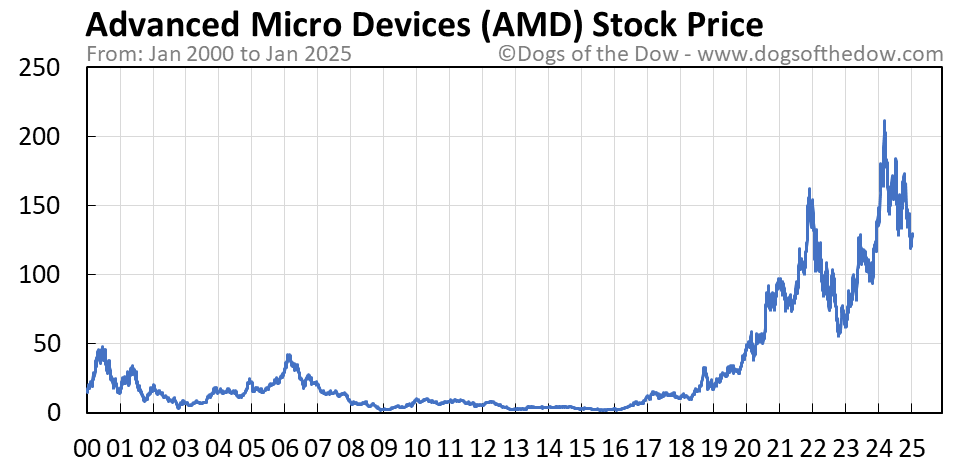

Historical AMD Stock Price Performance

Analyzing AMD’s stock price over the past year reveals significant fluctuations influenced by various factors including product launches, market competition, and macroeconomic conditions. The following timeline highlights key events and price movements.

- Date: (e.g., January 2023) Price: (e.g., $80) Event: (e.g., Strong Q4 earnings report released)

- Date: (e.g., March 2023) Price: (e.g., $95) Event: (e.g., Announcement of new Ryzen processor series)

- Date: (e.g., June 2023) Price: (e.g., $75) Event: (e.g., Market correction due to broader economic concerns)

- Date: (e.g., October 2023) Price: (e.g., $90) Event: (e.g., Positive analyst upgrades and increased investor confidence)

Overall, the past year has shown periods of significant growth interspersed with corrections reflecting the volatile nature of the technology sector.

Analyst Predictions and Ratings

Analyst ratings and price targets provide insights into market expectations for AMD’s future performance. These predictions vary based on individual analysts’ interpretations of market conditions, financial forecasts, and competitive landscapes. It’s crucial to remember that these are predictions, not guarantees.

- Analyst A: (e.g., Buy rating, $110 price target)

- Analyst B: (e.g., Hold rating, $95 price target)

- Analyst C: (e.g., Sell rating, $80 price target)

The divergence in analyst opinions reflects the uncertainty inherent in predicting future stock performance. Investors should consider multiple perspectives before making investment decisions.

Investor Sentiment and News, Amd stock price live

Investor sentiment towards AMD is a crucial factor influencing its stock price. Positive news generally leads to increased buying pressure, while negative news can trigger selling pressure. The following table illustrates the correlation between recent news and stock price changes.

| Date | News Event | Stock Price Change | Volume Change |

|---|---|---|---|

| (e.g., Oct 26, 2023) | (e.g., Strong Q3 Earnings Beat Expectations) | (e.g., +5%) | (e.g., +20%) |

| (e.g., Oct 27, 2023) | (e.g., Concerns about supply chain disruptions) | (e.g., -2%) | (e.g., +10%) |

Technical Analysis of AMD Stock

Source: dogsofthedow.com

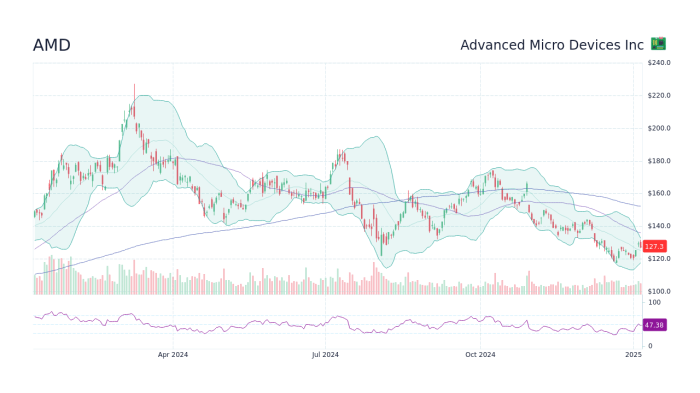

Technical analysis uses charts and indicators to predict future price movements. Moving averages, such as the 50-day and 200-day moving averages, are commonly used to identify trends. The Relative Strength Index (RSI) measures momentum and can signal overbought or oversold conditions. A rising 50-day moving average above the 200-day moving average is often considered a bullish signal, while an RSI above 70 might suggest the stock is overbought.

Interpretations of technical indicators can vary, and it is essential to consider multiple indicators alongside other forms of analysis.

Fundamental Analysis of AMD

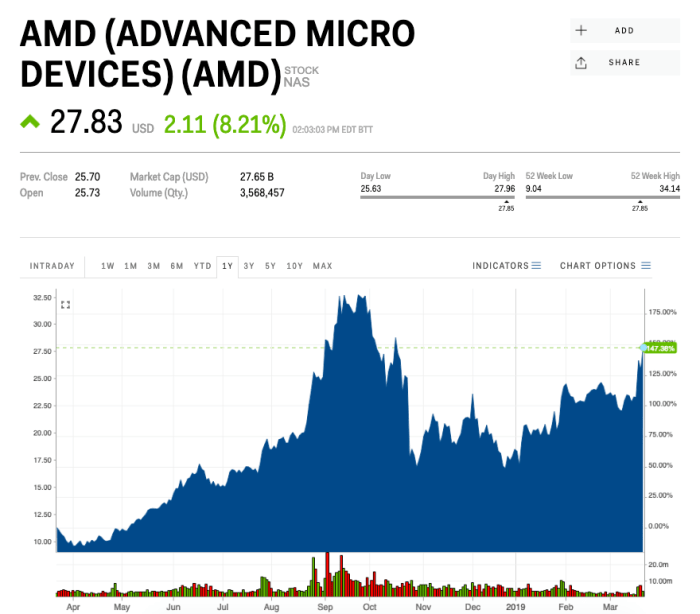

Source: businessinsider.com

Fundamental analysis focuses on evaluating AMD’s intrinsic value based on its financial performance, competitive landscape, and growth prospects. This involves examining revenue growth, profitability, market share, and the company’s overall strategic position within the semiconductor industry. Key financial metrics like revenue, earnings per share (EPS), and price-to-earnings (P/E) ratio can provide valuable insights into AMD’s financial health and valuation compared to its competitors.

AMD’s competitive advantages include its strong presence in the CPU and GPU markets, its innovative product designs, and its strategic partnerships. However, challenges include intense competition from Intel and Nvidia, and potential economic downturns that can affect demand for semiconductors.

Keeping an eye on the AMD stock price live is crucial for many investors. It’s interesting to compare its performance against other similar stocks, such as the volatility often seen with the amc stock price currently , which offers a contrasting perspective on market trends. Ultimately, understanding both AMD and AMC’s price fluctuations provides a broader view of the current investment climate.

Essential FAQs

What are the major risks associated with investing in AMD stock?

Investing in AMD, like any stock, carries inherent risks. These include volatility due to market fluctuations, competition from established players, dependence on technological advancements, and macroeconomic factors impacting the semiconductor industry.

Where can I find real-time AMD stock price data?

Real-time AMD stock price data is available through many financial websites and brokerage platforms. Major financial news sources and dedicated stock tracking websites provide live updates.

How frequently does AMD release earnings reports?

AMD typically releases quarterly earnings reports, usually following a consistent schedule announced in advance. These reports provide insights into the company’s financial performance and can significantly influence the stock price.

What is the typical trading volume for AMD stock?

AMD’s average daily trading volume varies, but you can find this information on financial websites displaying stock data. High trading volume often suggests increased investor activity and potential price volatility.