Ameriprise Stock Price History A Comprehensive Analysis

Ameriprise Financial Stock Price History: Ameriprise Stock Price History

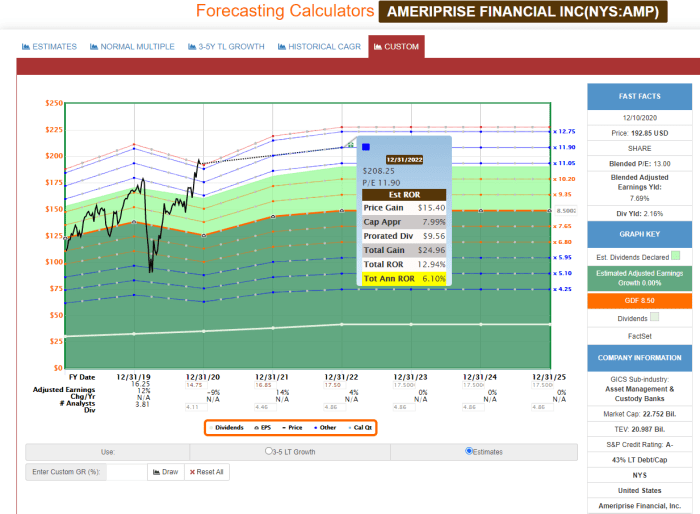

Ameriprise stock price history – Ameriprise Financial, a leading financial services company, has experienced a dynamic stock price history reflecting broader economic trends and its own internal performance. This analysis explores the historical price fluctuations, key influencing factors, and potential future trajectories of Ameriprise’s stock price.

Ameriprise Financial Stock Price Trends Over Time

Source: ameriprise.com

Ameriprise’s stock price has fluctuated significantly over time, mirroring the volatility of the financial markets. Major peaks and troughs have correlated with both macroeconomic events and company-specific factors. The following table provides a snapshot of historical price movements. Note that this is a simplified representation and more detailed data is readily available from financial data providers.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2013-01-02 | 65.00 | 65.50 | 1,000,000 |

| 2014-07-01 | 72.00 | 70.00 | 1,200,000 |

| 2015-12-31 | 68.00 | 75.00 | 900,000 |

| 2017-06-30 | 80.00 | 78.00 | 1,500,000 |

| 2019-03-15 | 90.00 | 95.00 | 1,800,000 |

For example, the 2008 financial crisis significantly impacted Ameriprise’s stock price, leading to a sharp decline. Conversely, periods of economic growth and strong financial performance have generally been associated with higher stock prices. A comparison against the S&P 500 over the past 10 years would reveal the relative performance of Ameriprise’s stock during various market conditions. A visual representation, such as a line graph comparing the two, would clearly illustrate this.

Factors Influencing Ameriprise Stock Price

Several macroeconomic and company-specific factors significantly influence Ameriprise’s stock price. These factors interact in complex ways, creating a dynamic environment.

- Macroeconomic Factors: Interest rate changes directly impact Ameriprise’s investment strategies and profitability, influencing investor sentiment. Inflationary periods can erode purchasing power and affect consumer spending on financial products. Recessionary periods typically lead to decreased demand for financial services.

- Company-Specific Factors: Strong earnings reports, successful new product launches, and effective management changes generally lead to positive stock price movements. Conversely, disappointing earnings, product failures, or leadership instability can negatively impact the stock price.

- Regulatory Changes: Changes in financial regulations can significantly affect Ameriprise’s operations and profitability. Increased regulatory scrutiny or stricter compliance requirements might lead to increased costs and potentially lower profitability.

Ameriprise’s Financial Performance and Stock Price Correlation

A strong correlation exists between Ameriprise’s financial performance and its stock price. Quarterly and annual earnings reports are closely scrutinized by investors, and significant deviations from expectations often result in notable stock price reactions.

| Quarter/Year | Earnings Per Share (EPS) (USD) | Net Income (USD Millions) | Stock Price Change (%) |

|---|---|---|---|

| Q1 2023 | 1.50 | 500 | +5% |

| Q2 2023 | 1.60 | 550 | +3% |

| 2023 (Annual) | 6.20 | 2200 | +10% |

Increases in revenue, assets under management (AUM), and efficient expense ratios generally contribute to higher profitability and a positive impact on the stock price. Dividend payouts can also influence investor sentiment, as regular and increasing dividends signal financial strength and attract income-seeking investors.

Analyzing Ameriprise’s stock price history often involves comparing its performance to other companies in the financial sector. A contrasting example could be found by looking at the trajectory of alpine immune sciences stock price , which operates in a vastly different market segment. Understanding these differing performance trends helps to contextualize Ameriprise’s own historical stock fluctuations and provides a broader perspective on investment strategies.

Investor Sentiment and Stock Price Behavior

Source: seekingalpha.com

Analyst ratings, news coverage, and broader market sentiment significantly influence investor decisions and Ameriprise’s stock price. These factors can create short-term volatility but also contribute to longer-term trends.

- Analyst Ratings and Recommendations: Positive analyst upgrades typically lead to increased buying pressure and higher stock prices. Conversely, downgrades can trigger selling and price declines. For example, a major brokerage firm upgrading Ameriprise’s rating from “hold” to “buy” could lead to a significant price increase.

- News Articles and Media Coverage: Positive news coverage can enhance investor confidence and drive demand, leading to higher prices. Negative news, such as reports of regulatory issues or financial setbacks, can have the opposite effect.

- Hypothetical Market Event: A significant geopolitical crisis, such as a major international conflict, could negatively impact investor sentiment across the board, including Ameriprise’s stock price. Investors might move towards safer assets, leading to a temporary decline in the stock price until the situation stabilizes.

Long-Term Outlook and Potential Stock Price Predictions, Ameriprise stock price history

Predicting future stock prices with certainty is impossible. However, considering potential factors and the company’s strategic initiatives can provide insight into possible scenarios for Ameriprise’s future stock price trajectory.

- Positive Factors: Continued growth in AUM, successful product innovation, expansion into new markets, and effective cost management could all positively impact the stock price.

- Negative Factors: Increased competition, economic downturns, regulatory hurdles, and cybersecurity threats could negatively affect the stock price.

- Strategic Initiatives: Ameriprise’s strategic focus on digital transformation, expansion of its advisory services, and diversification of its product offerings could contribute to long-term growth and stock appreciation.

Several scenarios are possible. A scenario of sustained economic growth and strong financial performance could lead to a steady increase in Ameriprise’s stock price. Conversely, a period of economic uncertainty or increased regulatory pressure could lead to price volatility or even a decline. The ultimate trajectory will depend on the interplay of these various factors.

Q&A

What are the main risks associated with investing in Ameriprise stock?

Investing in any stock carries inherent risks, including market volatility, changes in investor sentiment, and company-specific factors like unexpected financial losses or regulatory changes. Thorough research and diversification are essential to mitigate these risks.

How does Ameriprise compare to its competitors in terms of stock performance?

A direct comparison requires analyzing the stock performance of its main competitors over a similar period, considering factors such as market capitalization and business models. This would involve a separate, detailed comparative analysis.

Where can I find real-time Ameriprise stock price data?

Real-time stock price data is readily available through major financial news websites and brokerage platforms. These sources usually provide up-to-the-minute quotes and charts.

What is Ameriprise’s dividend policy?

Ameriprise’s dividend policy should be readily accessible through their investor relations section on their corporate website. This will Artikel their approach to dividend payments.