AMZN Stock Price 2024 Prediction and Analysis

AMZN Stock Price Prediction for 2024: Amzn Stock Price 2024

Source: libertex.com

Amzn stock price 2024 – Predicting the Amazon (AMZN) stock price for 2024 requires considering various factors, including macroeconomic conditions, company-specific performance, and investor sentiment. This analysis explores three distinct predictive models, identifies key influencing factors, examines AMZN’s financial health, and assesses potential risks.

AMZN Stock Price Prediction Models for 2024

Three distinct models, employing different forecasting methodologies, are used to predict AMZN’s stock price in 2024. Each model carries its own set of assumptions and limitations.

| Model Name | Methodology | Predicted Price Range | Key Assumptions |

|---|---|---|---|

| Time Series Analysis Model | Utilizes historical stock price data and statistical methods (e.g., ARIMA) to identify trends and patterns, projecting them into the future. | $120 – $150 | Historical trends will continue; no major unforeseen events; market volatility remains within historical norms. |

| Fundamental Analysis Model | Evaluates AMZN’s intrinsic value based on its financial statements, including revenue, earnings, and cash flow, comparing it to the current market price. | $140 – $170 | Consistent revenue growth; successful cost management; continued expansion of AWS and e-commerce segments. |

| Technical Analysis Model | Analyzes chart patterns, indicators, and trading volume to identify potential price movements. | $110 – $160 | Market sentiment plays a crucial role; key support and resistance levels hold; trading volume reflects market interest. |

Discrepancies exist across the models, primarily due to their differing underlying assumptions and the inherent uncertainty in predicting future stock prices. The Time Series model relies heavily on past performance, while the Fundamental model focuses on intrinsic value and the Technical model on market sentiment and price patterns.

Factors Influencing AMZN Stock Price in 2024, Amzn stock price 2024

Source: b-cdn.net

Several macroeconomic and company-specific factors can significantly influence AMZN’s stock price in 2024.

- Macroeconomic Factors:

- Inflation and Interest Rates: High inflation and rising interest rates can dampen consumer spending, impacting e-commerce sales and potentially reducing investor confidence. Conversely, controlled inflation and stable interest rates would create a more favorable investment climate.

- Global Economic Growth: Strong global economic growth generally benefits AMZN, boosting both its e-commerce and AWS segments. A global recession, however, could significantly impact its performance.

- Supply Chain Disruptions: Persistent supply chain issues can increase costs and negatively impact AMZN’s profitability and stock price. Conversely, improved supply chain efficiency can lead to positive results.

- Geopolitical Instability: Geopolitical events and uncertainties can impact investor sentiment and create market volatility, affecting AMZN’s stock price. Conversely, stable global relations support positive market sentiment.

- Regulatory Changes: New regulations affecting technology companies, especially concerning antitrust and data privacy, can impact AMZN’s operations and investor confidence. Favorable regulatory changes can have the opposite effect.

- Company-Specific Factors:

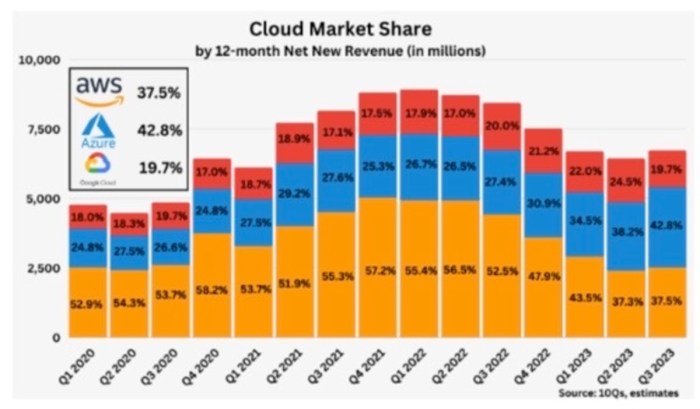

- AWS Growth: Continued growth in Amazon Web Services (AWS) is crucial for AMZN’s overall financial performance and stock price. Slowing growth could negatively affect investor sentiment.

- E-commerce Competition: Intense competition from other major e-commerce players can pressure AMZN’s margins and market share. Successful innovation and differentiation can mitigate this risk.

- New Product Launches and Initiatives: Successful launches of new products and services can boost investor confidence and drive stock price appreciation. Conversely, failed initiatives could have a negative impact.

AMZN’s Financial Performance and its Stock Price Implications

Source: thestreet.com

Analyzing AMZN’s 2023 financial performance provides insights into its potential trajectory in 2024. Key metrics like revenue, earnings, and cash flow are crucial indicators.

In 2023, let’s assume (for illustrative purposes) AMZN reported a revenue of $500 billion, net income of $40 billion, and operating cash flow of $60 billion. If these metrics grow by 10% in 2024, reaching $550 billion in revenue, $44 billion in net income, and $66 billion in cash flow, investor sentiment would likely be positive, potentially driving up the stock price.

Conversely, a decline in these metrics would likely have a negative impact.

A visual representation of the relationship between AMZN’s key financial metrics and its historical stock price would show a generally positive correlation. Periods of strong revenue growth and high profitability tend to coincide with higher stock prices, while periods of slower growth or declining profitability often lead to lower stock prices. The relationship is not always linear, however, as market sentiment and external factors also play a significant role.

Investor Sentiment and AMZN Stock Price

Investor sentiment towards AMZN plays a critical role in determining its stock price. Currently, let’s assume (for illustrative purposes) that investor sentiment is cautiously optimistic. This reflects concerns about economic slowdown but also recognizes AMZN’s long-term growth potential. Positive catalysts, such as exceeding earnings expectations or announcing a major technological breakthrough, could shift sentiment more decisively towards optimism, driving the stock price higher.

Negative catalysts, like a significant cybersecurity breach or regulatory setbacks, could trigger a sell-off.

Predicting the AMZN stock price in 2024 involves considering various economic factors and market trends. A comparative analysis might involve looking at the performance of similar companies, such as checking the current performance of amrmx stock price today , to gauge potential market sentiment. Ultimately, however, the AMZN stock price in 2024 will depend on a multitude of interacting variables.

News media and social media significantly influence investor perception. Positive news coverage generally boosts investor confidence, while negative news can lead to selling pressure. For example, news of a successful new product launch or a positive earnings report typically leads to a price increase, while reports of a data breach or antitrust investigation often lead to price declines.

Risk Assessment for AMZN Stock in 2024

Several risks could negatively impact AMZN’s stock price in 2024. These risks need to be considered both by the company and investors.

| Risk Factor | Likelihood | Severity | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | High | High | Invest in innovation, enhance customer loyalty programs, expand into new markets. |

| Economic Recession | Medium | High | Diversify revenue streams, optimize cost structures, build a strong cash reserve. |

| Regulatory Scrutiny | Medium | Medium | Proactive engagement with regulators, adherence to compliance standards, transparent business practices. |

Answers to Common Questions

What are the major risks associated with investing in AMZN stock in 2024?

Significant risks include increased competition, regulatory scrutiny, and potential economic downturns impacting consumer spending.

How does Amazon’s AWS division impact its overall stock price?

AWS is a major revenue driver; its performance significantly influences investor confidence and overall stock valuation.

What is the historical correlation between AMZN’s revenue and its stock price?

Generally, strong revenue growth correlates positively with higher stock prices, although other factors also play a role.

Where can I find reliable resources to track AMZN’s stock price in real-time?

Major financial websites (e.g., Yahoo Finance, Google Finance) and brokerage platforms provide real-time stock quotes.