Appl Pre-Market Stock Price A Deep Dive

Pre-Market Apple Stock Price: A Deep Dive: Appl Pre Market Stock Price

Appl pre market stock price – Apple’s pre-market trading activity offers a unique glimpse into market sentiment and potential price movements before the regular trading session begins. Understanding the dynamics of this period can be valuable for both seasoned and novice investors. This analysis explores the key factors influencing Apple’s pre-market price, providing insights into its behavior and potential trading strategies.

Pre-Market Trading Dynamics

Several factors influence Apple’s pre-market stock price fluctuations. These include global market trends, overnight news affecting the tech sector, and anticipation of upcoming events. Pre-market trading volume for Apple, while significantly lower than during regular hours, still reflects substantial investor interest. Compared to competitors like Microsoft and Google, Apple’s pre-market price often exhibits higher volatility, potentially due to its large market capitalization and significant influence on the tech index.

This volatility presents both opportunities and risks for traders.

The following table illustrates the average pre-market price change for Apple over the past year, categorized by day of the week. Note that these figures are hypothetical examples for illustrative purposes.

Monitoring the appl pre market stock price is crucial for many investors. Understanding the semiconductor sector’s performance is also key, and a significant player there is AMD, whose pre-market activity often influences Apple. To gain insight into this relationship, checking the amat premarket stock price can provide valuable context before the market opens, ultimately informing a more comprehensive view of appl pre market stock price movements.

| Day | Average Price Change (%) |

|---|---|

| Monday | -0.2% |

| Tuesday | 0.1% |

| Wednesday | 0.0% |

| Thursday | 0.3% |

| Friday | -0.1% |

News and Events Impact

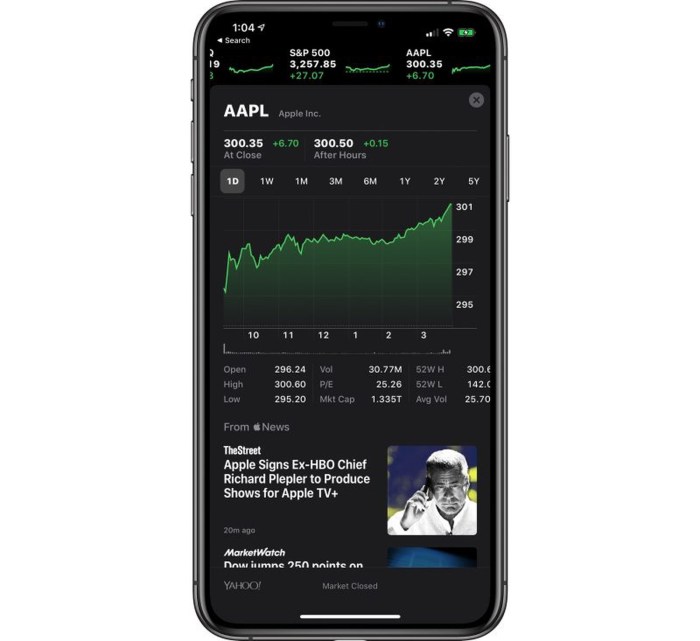

Source: macrumors.com

Significant news events dramatically affect Apple’s pre-market price. Earnings reports, for instance, often trigger substantial price swings, reflecting investor reactions to the company’s financial performance. Product launches, such as the release of a new iPhone model, typically generate considerable pre-market excitement and price increases. Conversely, negative news, such as supply chain disruptions or product recalls, can lead to sharp price declines.

For example, a surprise announcement of a major security flaw in iOS could cause a significant negative impact on the pre-market price. In contrast, a positive review of a new product by a prominent tech reviewer could result in a surge in pre-market value.

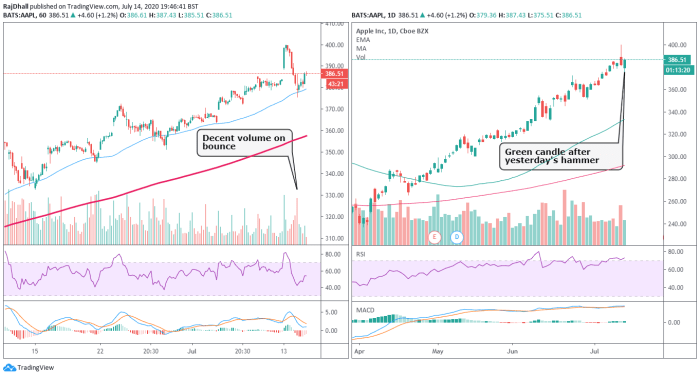

Technical Analysis of Pre-Market Data

Analyzing Apple’s pre-market price patterns can provide valuable insights for traders. Common patterns include gaps (significant price differences between the closing price of the previous day and the opening price in the pre-market), and trends (consistent upward or downward movements). A hypothetical trading strategy could involve identifying these patterns and placing orders accordingly. For example, a consistent upward trend during the pre-market could suggest buying opportunities.

Conversely, a noticeable gap down could indicate a potential short-selling opportunity. Interpreting candlestick patterns, such as bullish engulfing patterns or bearish harami patterns, can further refine trading decisions. Technical indicators like Relative Strength Index (RSI), Moving Averages, and Bollinger Bands are frequently used to analyze pre-market price action.

Traders might utilize the following technical indicators:

- Relative Strength Index (RSI)

- Moving Averages (e.g., 50-day, 200-day)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

Sentiment and Market Conditions, Appl pre market stock price

Source: fxstreet.com

Apple’s pre-market price is highly correlated with overall market sentiment. During periods of high market volatility, Apple’s price tends to fluctuate more dramatically, reflecting investor risk aversion or enthusiasm. Conversely, during periods of low volatility, price movements are generally less pronounced. Investor sentiment, as reflected in social media discussions and news articles, can significantly influence pre-market trading. For example, widespread positive social media buzz around a new product announcement can boost pre-market prices.

A hypothetical scenario illustrating macroeconomic influence could involve a sudden increase in interest rates, potentially leading to a decline in Apple’s pre-market price due to reduced investor confidence.

Risk and Reward in Pre-Market Trading

Pre-market trading of Apple stock presents both significant risks and potential rewards. Lower liquidity compared to regular trading hours means wider bid-ask spreads and the possibility of larger price slippage. However, the potential for significant price movements during this period can lead to substantial profits for successful traders. The risk/reward profile of pre-market trading is generally considered higher than during regular market hours due to increased volatility and reduced liquidity.

To mitigate risks, traders should:

- Use stop-loss orders to limit potential losses.

- Employ smaller position sizes.

- Thoroughly research and analyze before trading.

- Monitor market conditions closely.

- Diversify investments.

FAQ Section

What time does Apple’s pre-market trading begin?

Pre-market trading for Apple (AAPL) typically begins around 4:00 AM Eastern Time (ET).

How liquid is Apple’s pre-market trading?

While generally less liquid than regular trading hours, Apple’s pre-market trading enjoys relatively high volume compared to many other stocks due to its popularity and market capitalization.

Are there specific brokerage accounts needed for pre-market trading?

Most major online brokerage accounts offer access to pre-market trading. Check with your specific broker for details and any associated fees.

What are the typical spreads in Apple’s pre-market trading?

Spreads (the difference between the bid and ask price) tend to be wider during pre-market hours due to lower liquidity, potentially impacting profitability.