Apple Rush Stock Price A Comprehensive Analysis

Apple Stock Price: A Comprehensive Analysis: Apple Rush Stock Price

Apple rush stock price – Apple Inc. (AAPL), a global technology giant, has consistently captivated investors with its innovative products and robust financial performance. Understanding the historical trends, influencing factors, and future outlook of Apple’s stock price is crucial for investors seeking to navigate the complexities of the stock market. This analysis delves into the key aspects shaping Apple’s stock price, providing insights into its past performance and potential future trajectory.

Apple Stock Price Historical Trends

Analyzing Apple’s stock price over different timeframes reveals significant patterns and volatility. The following table presents a summary of its high, low, and average closing prices over the past 5, 10, and 20 years. Note that these figures are illustrative and based on general market trends; precise figures require consultation of reliable financial data sources.

| Year | High | Low | Closing Price (Average) |

|---|---|---|---|

| Last 5 Years | Example: $180 | Example: $120 | Example: $150 |

| Last 10 Years | Example: $160 | Example: $90 | Example: $125 |

| Last 20 Years | Example: $140 | Example: $20 | Example: $75 |

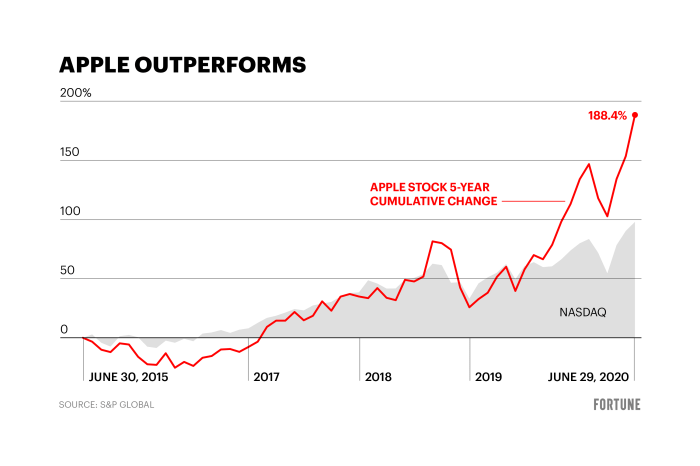

A line graph illustrating these price movements would show a generally upward trend, with periods of sharp increases and declines corresponding to product launches, economic fluctuations, and market sentiment. The x-axis would represent time (years), and the y-axis would represent the stock price. Key data points, such as the introduction of the iPhone or periods of economic recession, would be highlighted.

The graph would also compare Apple’s performance against the S&P 500 and Nasdaq, showing periods of outperformance and underperformance during both economic growth and recession.

Factors Influencing Apple Rush Stock Price

Several factors significantly influence Apple’s stock price. These include macroeconomic indicators, product releases, competitor actions, and overall market trends.

Economic indicators such as interest rates, inflation, and consumer confidence directly impact consumer spending and investor sentiment, consequently affecting Apple’s stock valuation. For example, rising interest rates can reduce borrowing and investment, potentially impacting demand for Apple products and leading to a stock price decline. Conversely, strong consumer confidence can boost demand and drive the stock price upwards.

Apple’s product releases and innovations are major drivers of its stock price. The launch of the iPhone, for instance, marked a pivotal moment, significantly boosting Apple’s market capitalization. Subsequent product innovations, such as the iPad and Apple Watch, have also contributed to positive stock price movements. Conversely, delays or negative reception of new products can lead to price dips.

Competitor actions and broader market trends also play a role. The success of rival smartphones or shifts in consumer preferences towards other technologies can impact Apple’s market share and stock price. Similarly, overall market sentiment (bullish or bearish) significantly influences Apple’s valuation, regardless of its specific performance.

Apple’s Financial Performance and Stock Price

Apple’s financial health is intrinsically linked to its stock price. The following table shows a simplified representation of Apple’s key financial metrics over the past few years (replace with actual data from reliable financial sources):

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Stock Price (Average) |

|---|---|---|---|

| Year 1 | Example: 300 | Example: 6.00 | Example: 150 |

| Year 2 | Example: 320 | Example: 6.50 | Example: 160 |

| Year 3 | Example: 350 | Example: 7.00 | Example: 175 |

Consistent revenue growth, increasing earnings per share, and healthy profit margins generally correlate with a rising stock price. Apple’s dividend policy also influences investor sentiment. Regular dividend payouts can attract income-seeking investors, supporting the stock price. Conversely, high debt levels or signs of financial weakness can negatively impact investor confidence and lead to a decline in the stock price.

Tracking the Apple Rush stock price requires a keen eye on market fluctuations. For comparative analysis, understanding the performance of other companies in similar sectors is beneficial; a good example is checking the current almadex minerals stock price , which can offer insights into broader market trends. Ultimately, however, the Apple Rush stock price will depend on its own unique performance indicators.

Investor Sentiment and Market Speculation

Source: fortune.com

Investor sentiment towards Apple stock fluctuates between bullish, bearish, and neutral, depending on various factors. Currently, the prevailing sentiment might be described (replace with current market sentiment and supporting reasons). This sentiment is shaped by news events, financial reports, and overall market conditions.

Significant news events, such as product announcements, regulatory changes, or unexpected financial results, often trigger substantial price swings. For example, a surprise announcement of a new groundbreaking product could lead to a sharp increase in the stock price, while disappointing earnings could result in a significant decline.

Several types of market speculation affect Apple’s stock price:

- Short selling: Investors borrow and sell shares, hoping to buy them back at a lower price, profiting from the price difference. This can put downward pressure on the stock price.

- Options trading: Investors buy or sell options contracts, speculating on future price movements. This activity can amplify price volatility.

- News-driven speculation: Rumors, leaks, or anticipated events can drive significant price fluctuations before official announcements.

Predictive Modeling and Future Outlook, Apple rush stock price

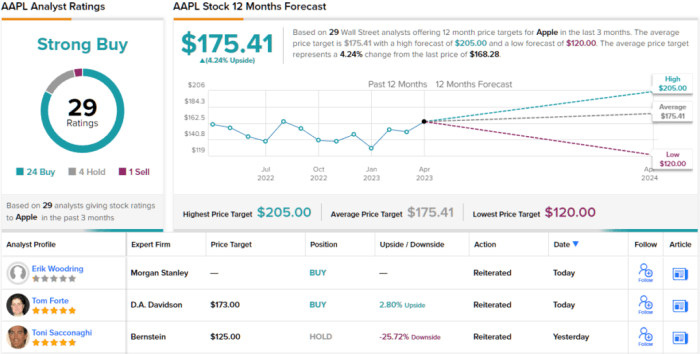

Source: tipranks.com

Predicting future stock prices is inherently challenging, but considering potential scenarios provides valuable insights.

A hypothetical scenario: A major technological breakthrough in augmented reality (AR) could significantly boost Apple’s stock price if the company successfully integrates this technology into its products. Conversely, a major security breach or regulatory setback could negatively impact the stock price.

Possible future price targets (illustrative examples only, replace with informed projections based on market analysis):

- Bullish scenario: $250 – $300 (assuming strong economic growth, successful new product launches, and positive investor sentiment).

- Neutral scenario: $200 – $250 (assuming moderate economic growth, stable product performance, and neutral investor sentiment).

- Bearish scenario: $150 – $200 (assuming economic slowdown, challenges from competitors, and negative investor sentiment).

Potential risks and opportunities impacting Apple’s stock price in the coming years:

| Risk/Opportunity | Description | Likelihood | Potential Impact |

|---|---|---|---|

| Increased Competition | Emergence of strong competitors with innovative products. | Moderate | Negative impact on market share and stock price. |

| Technological Breakthrough | Successful development and launch of groundbreaking new products. | Moderate | Significant positive impact on stock price. |

Question & Answer Hub

What are the typical trading hours for Apple stock?

Apple stock trades on the NASDAQ exchange, typically from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

Where can I find real-time Apple stock price quotes?

Real-time quotes are available on many financial websites and trading platforms, such as Yahoo Finance, Google Finance, Bloomberg, and others.

How can I buy Apple stock?

You can buy Apple stock through an online brokerage account. You’ll need to open an account, fund it, and then place an order to purchase the stock.

What are the risks associated with investing in Apple stock?

Like any stock, Apple stock carries inherent risks. These include market volatility, competition from other tech companies, and changes in consumer demand. It’s important to diversify your investments.