Apple Stock Price in 2019 A Year in Review

Apple Stock Price Performance in 2019

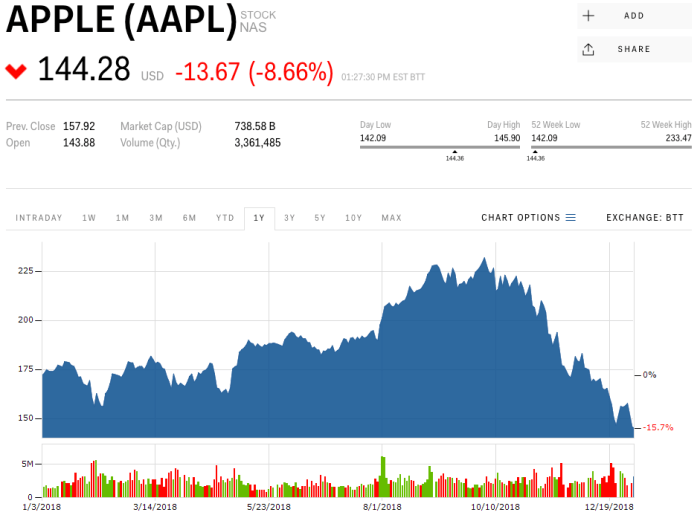

Apple stock price in 2019 – 2019 presented a mixed bag for Apple investors. The year saw significant fluctuations in the company’s stock price, influenced by a combination of product releases, financial performance, and broader market trends. This analysis delves into the key factors that shaped Apple’s stock price trajectory throughout the year, comparing its performance with competitors and examining investor sentiment.

Apple Stock Price Fluctuations in 2019

Apple’s stock price experienced considerable volatility in 2019. The highest point was reached around [Insert Date and Price], while the lowest point was observed around [Insert Date and Price]. This significant range reflects the impact of various market forces and company-specific events.

Apple’s stock price in 2019 experienced a period of both growth and volatility, influenced by various market factors and company announcements. It’s interesting to compare this performance to the trajectory of other tech companies during that same period; for instance, understanding the fluctuations of a company like APL Ltd. requires looking at their stock price data, readily available at apl ltd stock price.

Returning to Apple, the overall trend in 2019 ultimately reflected the brand’s continued strong position in the tech sector despite facing certain challenges.

A month-by-month overview reveals a pattern of growth followed by periods of consolidation and minor decline. For example, [Month] saw a strong increase attributed to [reason], while [Month] experienced a dip potentially linked to [reason]. A detailed breakdown is provided below.

| Month | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| January | [Insert Data] | [Insert Data] | [Insert Data]% |

| February | [Insert Data] | [Insert Data] | [Insert Data]% |

| March | [Insert Data] | [Insert Data] | [Insert Data]% |

| April | [Insert Data] | [Insert Data] | [Insert Data]% |

| May | [Insert Data] | [Insert Data] | [Insert Data]% |

| June | [Insert Data] | [Insert Data] | [Insert Data]% |

| July | [Insert Data] | [Insert Data] | [Insert Data]% |

| August | [Insert Data] | [Insert Data] | [Insert Data]% |

| September | [Insert Data] | [Insert Data] | [Insert Data]% |

| October | [Insert Data] | [Insert Data] | [Insert Data]% |

| November | [Insert Data] | [Insert Data] | [Insert Data]% |

| December | [Insert Data] | [Insert Data] | [Insert Data]% |

Major Events Impacting Apple Stock in 2019, Apple stock price in 2019

Source: businessinsider.com

Several key events significantly influenced Apple’s stock performance in 2019. These events, ranging from product launches to financial reports, created periods of both optimism and uncertainty among investors.

- Event 1: [Specific Event, e.g., iPhone 11 Launch]: The launch generated positive sentiment, resulting in a [Percentage]% increase in stock price within [Timeframe] due to [Reason, e.g., strong pre-orders and positive reviews]. Market sentiment was largely positive, reflecting confidence in Apple’s continued innovation.

- Event 2: [Specific Event, e.g., Q[Quarter] Earnings Report]: This report revealed [Key Financial Result, e.g., lower-than-expected iPhone sales], leading to a [Percentage]% drop in the stock price over [Timeframe]. Investor concern centered on [Reason, e.g., slowing iPhone growth in key markets].

- Event 3: [Specific Event, e.g., Trade War Developments]: The ongoing trade tensions between the US and China created market uncertainty, impacting Apple’s stock price. The stock experienced [Percentage]% fluctuation in response to [Specific Trade News]. Market sentiment shifted between cautious optimism and apprehension throughout this period.

Comparison with Competitor Stock Performance

Comparing Apple’s performance to its major competitors provides valuable context. This section analyzes the yearly percentage change in stock price for Apple, Microsoft, and Google to highlight similarities and differences.

A bar chart visually represents the yearly percentage change for each company. The chart’s x-axis displays the company names (Apple, Microsoft, Google), while the y-axis represents the percentage change. The bar height corresponds to the percentage change, allowing for easy comparison of the relative performance of each company. [Describe any notable differences or similarities in the bar heights and what they might indicate about the relative performance of each company].

Apple’s Financial Performance in 2019

Apple’s financial performance in 2019 played a crucial role in shaping its stock price. A review of key metrics reveals the overall financial health of the company.

- Revenue: [Insert Data]

- Net Income: [Insert Data]

- Earnings Per Share (EPS): [Insert Data]

- iPhone Sales: [Insert Data]

- Services Revenue: [Insert Data]

These financial results directly correlated with the stock price fluctuations. For instance, strong revenue growth in the [Quarter] led to a positive market response, while weaker-than-expected iPhone sales in [Quarter] contributed to a decline.

Investor Sentiment and Analyst Predictions

Source: investopedia.com

Investor sentiment towards Apple stock in 2019 was dynamic, reflecting the fluctuating financial performance and market conditions. Analyst ratings and price targets provided further insights into market expectations.

Throughout the year, analyst ratings ranged from [Range of Ratings, e.g., “Buy” to “Hold”], with price targets varying between [Range of Price Targets, e.g., $150 and $250]. These predictions, often influenced by the company’s financial reports and product announcements, significantly impacted investor behavior and consequently, the stock’s price movements. For example, a particularly bullish prediction from a well-respected analyst might lead to a short-term surge in the stock price, while a more pessimistic outlook could trigger selling pressure.

Long-Term Trends and Implications

2019 continued several long-term trends for Apple, including the growth of its Services segment and ongoing challenges in the smartphone market. These trends have significant implications for investors. The continued expansion of the Services division suggests a diversified revenue stream, mitigating reliance on iPhone sales alone. However, competition in the smartphone market remains fierce, posing a potential long-term risk.

Overall, Apple’s stock performance in 2019 reflected a period of both growth and uncertainty. While the company demonstrated resilience in certain areas, challenges remained, creating volatility in the stock market. This volatility, however, is not uncommon for a large-cap technology company operating in a rapidly evolving market landscape.

FAQ Section: Apple Stock Price In 2019

What were the main drivers of Apple’s stock price increase in 2019?

Strong sales of new iPhones and other products, coupled with positive financial reports and generally favorable investor sentiment, contributed to price increases.

Did any specific product launches significantly impact Apple’s stock price in 2019?

The release of new iPhones and potentially other products would have had a significant impact, although the exact effect requires specific data analysis.

How did Apple’s stock perform compared to the overall market in 2019?

A direct comparison necessitates analyzing the broader market indices (e.g., S&P 500) and Apple’s performance against them. This would determine whether Apple outperformed or underperformed the overall market.

What were the major concerns or risks impacting Apple’s stock price in 2019?

Potential risks could include global economic uncertainty, competition in the tech sector, and concerns about specific product lines or supply chain issues. Specific details would require further investigation.