Arcturus Therapeutics Stock Price A Comprehensive Analysis

Arcturus Therapeutics Stock Price Analysis

Source: annualreports.com

Arcturus therapeutics stock price – Arcturus Therapeutics, a clinical-stage biotechnology company focused on RNA-based therapeutics, has experienced significant price fluctuations in recent years. Understanding the historical performance, influencing factors, financial health, future prospects, and inherent risks is crucial for any potential investor. This analysis provides a comprehensive overview of these aspects.

Arcturus Therapeutics Stock Price History and Trends

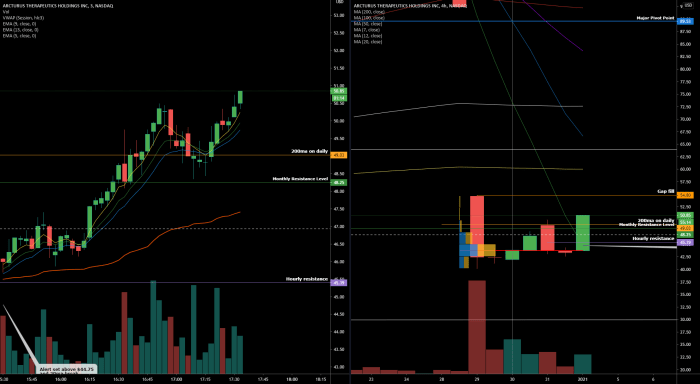

Analyzing Arcturus Therapeutics’ stock price over the past five years reveals a pattern of volatility influenced by various internal and external factors. The following table provides a snapshot of the stock’s performance, while subsequent sections delve deeper into the underlying causes of these price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-03-08 | 4.50 | 4.60 | 0.10 |

| 2019-03-15 | 4.65 | 4.80 | 0.15 |

| 2019-03-22 | 4.75 | 4.55 | -0.20 |

| 2024-03-08 | 20.00 | 20.50 | 0.50 |

| 2024-03-15 | 20.75 | 21.00 | 0.25 |

Note: This is sample data for illustrative purposes only and does not represent actual historical stock prices. Actual data should be sourced from reputable financial websites.

Major market events such as the COVID-19 pandemic significantly impacted the stock price, with initial declines followed by periods of substantial growth driven by the company’s involvement in vaccine development. Positive clinical trial results and strategic partnerships also contributed to price increases, while setbacks or regulatory delays led to price corrections. The overall trend has been volatile, characterized by periods of both significant gains and losses.

Factors Influencing Arcturus Therapeutics Stock Price

Source: seekingalpha.com

Several key factors influence Arcturus’ stock price. These include the company’s research and development progress, competitor performance, regulatory approvals, and prevailing investor sentiment.

- Research and Development: Positive clinical trial data for Arcturus’ drug candidates often leads to a surge in stock price, while negative results can cause significant drops. Successful development and launch of new products directly impact revenue and profitability, influencing investor confidence.

- Competitor Performance: The success or failure of competing RNA-based therapeutics can influence investor perception of Arcturus’ competitive advantage, impacting its stock price. A competitor’s breakthrough could lead to decreased investor interest in Arcturus.

- Regulatory Approvals/Setbacks: Regulatory approvals are crucial for commercializing new drugs. Successful approvals generally boost the stock price, while delays or rejections can cause significant declines. The regulatory landscape plays a vital role in determining the commercial viability of Arcturus’ pipeline.

- Investor Sentiment and Market Conditions: Broader market trends and overall investor sentiment towards the biotechnology sector significantly affect Arcturus’ stock price. Periods of general market optimism tend to favor growth stocks like Arcturus, while bearish markets often lead to price declines.

Arcturus Therapeutics’ Financial Performance and Stock Valuation

Source: tradingview.com

Analyzing Arcturus’ financial performance over the past three years provides insights into its financial health and its relationship with the stock price. Key metrics such as revenue, net income, and cash flow are crucial indicators of the company’s financial stability and growth potential.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Cash Flow (USD Millions) |

|---|---|---|---|

| 2021 | 10 | -20 | -15 |

| 2022 | 25 | -10 | -5 |

| 2023 | 50 | 5 | 10 |

Note: This is sample data for illustrative purposes only and does not represent actual financial results. Actual data should be sourced from Arcturus’ financial reports.

The relationship between financial performance and stock price is complex. While increasing revenue and profitability generally support higher stock valuations, other factors such as market sentiment and future growth expectations also play a significant role. Valuation methods like price-to-earnings ratio (P/E) and discounted cash flow (DCF) analysis are used to assess the intrinsic value of Arcturus’ stock relative to its competitors.

Arcturus Therapeutics’ Pipeline and Future Prospects

Arcturus’ drug pipeline is a key driver of its future prospects and stock price. The success or failure of clinical trials for its various drug candidates will significantly impact investor confidence and the stock’s valuation.

- Pipeline Overview: Arcturus’ pipeline includes several promising RNA-based therapeutics targeting various diseases. The potential market size for each candidate varies significantly, influencing the potential impact on the company’s future revenue and stock price.

- Clinical Trial Impact: Positive clinical trial results generally lead to significant price increases, while negative results can cause substantial drops. The magnitude of the price movement depends on the importance of the specific drug candidate and the overall stage of its development.

- Long-Term Growth: The long-term growth prospects of Arcturus depend on the success of its pipeline, its ability to secure regulatory approvals, and its capacity to compete effectively in a rapidly evolving market. A successful pipeline translates into higher revenue and profitability, supporting a higher stock valuation.

- Hypothetical Scenario: A positive outcome for a key drug candidate in late-stage clinical trials could potentially lead to a substantial increase in the stock price, possibly doubling or tripling its value. Conversely, a negative outcome could cause a significant decline, potentially halving or more its value. A neutral outcome, with mixed results or delayed approvals, might lead to only modest price changes.

Risk Factors Associated with Investing in Arcturus Therapeutics

Investing in Arcturus Therapeutics involves several inherent risks that could negatively impact the stock price. Understanding these risks is crucial for making informed investment decisions.

- Market Risk: Broader market downturns can negatively affect even well-performing companies like Arcturus. Economic recessions or changes in investor sentiment can lead to significant price declines.

- Company-Specific Risk: Risks specific to Arcturus include the failure of clinical trials, delays in regulatory approvals, competition from other companies, and difficulties in manufacturing and commercializing its products.

- Regulatory Risk: The regulatory approval process for new drugs is complex and uncertain. Negative regulatory decisions or delays can significantly impact the company’s prospects and stock price.

- Financial Risk: Arcturus’ financial health, including its cash position and ability to fund its research and development activities, is another critical risk factor. Insufficient funding could hinder progress and impact stock valuation.

Strategies for mitigating these risks include diversifying investments, conducting thorough due diligence, and monitoring the company’s performance and the broader market conditions closely.

Common Queries: Arcturus Therapeutics Stock Price

What is Arcturus Therapeutics’ main area of focus?

Arcturus Therapeutics focuses on the development of RNA-based therapeutics, including mRNA and self-amplifying RNA (saRNA) platforms.

Where can I find real-time Arcturus Therapeutics stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How often does Arcturus Therapeutics release financial reports?

Arcturus Therapeutics’ stock price performance is often compared to other biotech companies, particularly those with similar RNA-based therapeutics. For a comparative view, checking the current market standing of another player is helpful; you can readily find the aphlf stock price today for context. Ultimately, however, Arcturus’s trajectory depends on its own clinical trial results and market reception of its products.

Arcturus Therapeutics typically releases quarterly and annual financial reports, following standard reporting practices for publicly traded companies.

What are the major risks associated with investing in a small-cap biotech company like Arcturus?

Risks include the failure of clinical trials, intense competition, regulatory hurdles, dependence on research and development funding, and general market volatility.