Ares Management Stock Price A Comprehensive Analysis

Ares Management Corporation: A Deep Dive into Stock Performance: Ares Management Stock Price

Ares management stock price – Ares Management Corporation is a prominent global alternative asset manager, boasting a diversified portfolio and a significant presence in the financial markets. Understanding its stock performance requires analyzing its business model, financial health, and the broader economic landscape influencing its trajectory.

Ares Management Corporation Overview, Ares management stock price

Founded in 1997, Ares Management Corporation has evolved from its initial focus on distressed debt into a multifaceted firm managing assets across various alternative investment classes. Its primary business segments are Credit, Private Equity, Real Estate, and Infrastructure. Credit, traditionally a cornerstone of the firm, involves lending and investing in debt securities, while Private Equity focuses on acquiring and managing equity stakes in companies.

Real Estate and Infrastructure represent more recent diversifications, encompassing investments in real estate assets and infrastructure projects respectively. The contribution of each segment to overall revenue fluctuates based on market conditions and investment opportunities. Ares Management’s investment strategies vary across segments, employing a blend of active management, opportunistic investing, and long-term value creation. For instance, in Credit, they might utilize strategies ranging from distressed debt investments to senior secured loans, adapting their approach to prevailing market conditions.

Their Private Equity strategies range from leveraged buyouts to growth equity investments, while Real Estate focuses on both development and acquisition opportunities across various property types.

Factors Influencing Ares Management Stock Price

Source: seekingalpha.com

Several interconnected factors significantly impact Ares Management’s stock price. These include macroeconomic conditions, market sentiment, and competitive dynamics.

Interest rate fluctuations, inflation levels, and overall economic growth significantly influence investor appetite for alternative investments. Rising interest rates, for example, can increase borrowing costs for Ares Management’s portfolio companies and reduce the appeal of alternative investments, potentially putting downward pressure on the stock price. Conversely, a robust economic environment often translates to increased deal flow and higher valuations, benefiting Ares Management.

Market sentiment and investor confidence play a crucial role; periods of heightened uncertainty or risk aversion can lead to decreased valuations across the financial sector, including Ares Management. The performance of Ares Management’s competitors also influences its stock price. Direct competitors, such as Blackstone and Apollo Global Management, offer similar investment strategies and target the same investor base.

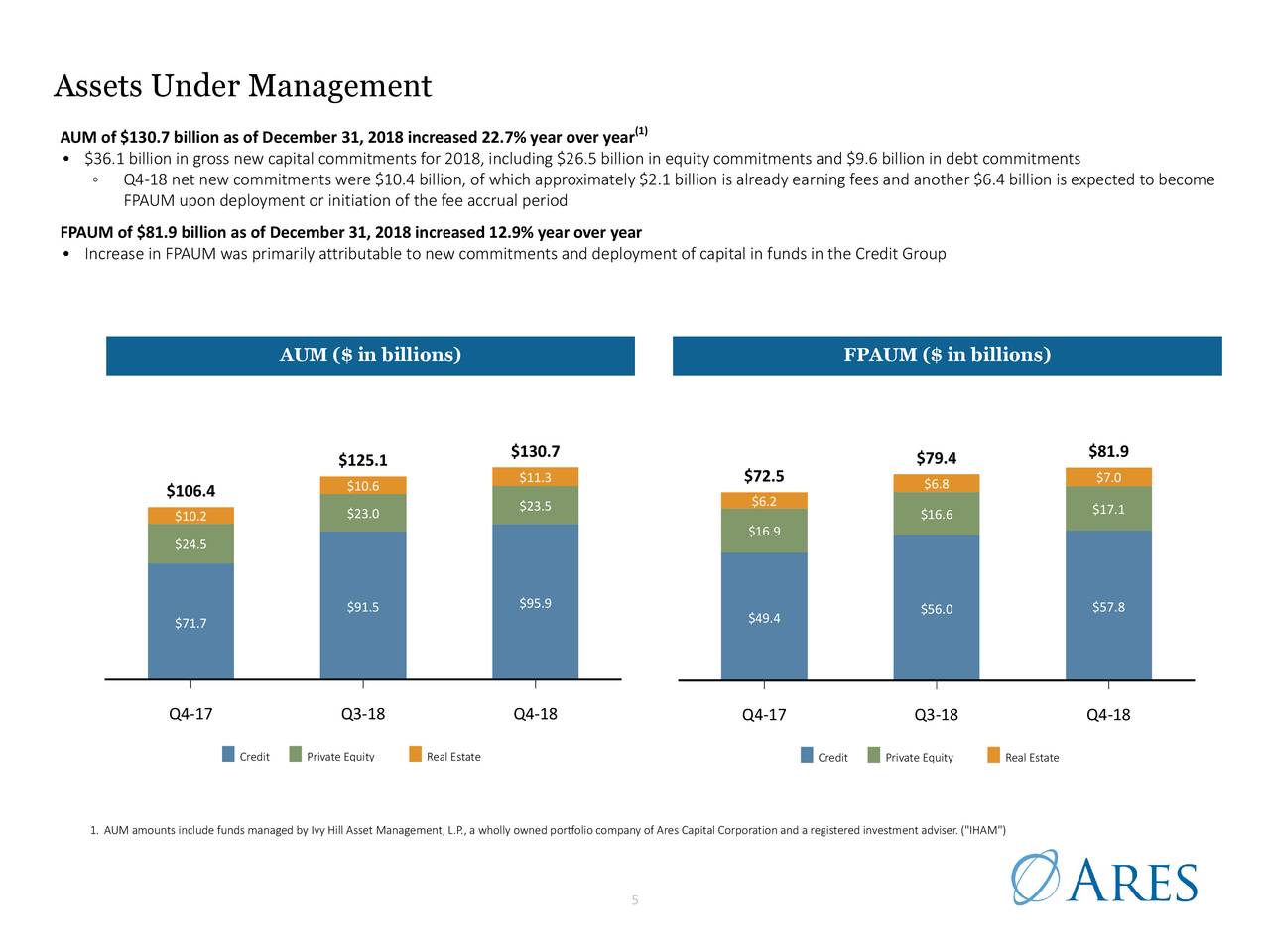

A strong performance by a competitor might divert investor interest and potentially negatively impact Ares Management’s valuation. Direct comparisons using metrics such as assets under management (AUM), return on equity (ROE), and fee-related earnings would provide a comprehensive view of relative performance. For instance, a comparison of AUM growth rates over the past five years would reveal the relative success of each firm in attracting and retaining capital.

Financial Performance Analysis of Ares Management

Source: aresmgmt.com

Analyzing Ares Management’s financial data reveals trends in profitability and overall financial health.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Assets (USD Millions) |

|---|---|---|---|

| 2023 (Estimated) | Data Placeholder | Data Placeholder | Data Placeholder |

| 2022 | Data Placeholder | Data Placeholder | Data Placeholder |

| 2021 | Data Placeholder | Data Placeholder | Data Placeholder |

| 2020 | Data Placeholder | Data Placeholder | Data Placeholder |

| 2019 | Data Placeholder | Data Placeholder | Data Placeholder |

Ares Management’s profitability ratios, such as net profit margin and return on equity, would show a trend over the past five years. A line graph depicting these metrics would illustrate their fluctuation, reflecting the impact of market cycles and the company’s strategic decisions. For example, a decline in net profit margin in a particular year might be attributed to a downturn in a specific market segment or increased operating expenses.

Ares Management’s Dividend Policy and Shareholder Returns

Source: seekingalpha.com

Ares Management’s dividend history and current policy are crucial considerations for investors. The company’s dividend decisions are influenced by factors such as profitability, financial strength, and future investment opportunities. A high payout ratio might indicate a commitment to returning capital to shareholders, while a lower ratio could suggest a focus on reinvesting earnings for growth.

Ares Management’s stock price performance often reflects broader market trends. However, understanding the interplay of various factors is crucial for accurate analysis; for instance, comparing it to the volatility seen in other sectors, such as the pre-market activity of AMC stock, as detailed on this site amc stock premarket price , can offer valuable context. Ultimately, Ares Management’s stock price trajectory is subject to its own unique set of influences.

- Potential Benefits: Regular dividend income, potential capital appreciation.

- Potential Risks: Dividend cuts during economic downturns, lower reinvestment for future growth.

Future Outlook and Potential Risks

Ares Management’s future growth hinges on several factors, including the continued expansion of its various business segments, successful deployment of capital, and adaptation to evolving market conditions. However, the company faces potential risks, such as increased competition, regulatory changes, and economic downturns.

Regulatory changes in the financial industry could significantly impact Ares Management’s operations and profitability. New regulations might increase compliance costs, limit investment strategies, or alter the competitive landscape. For example, stricter regulations on leveraged lending could reduce the firm’s opportunities in the Credit segment, affecting revenue and profitability. This, in turn, could impact the stock price, potentially leading to decreased investor confidence and lower valuations.

Comparison with Industry Benchmarks

Benchmarking Ares Management against its peers provides valuable insights into its relative performance and competitive positioning.

| Metric | Ares Management | Competitor A | Competitor B |

|---|---|---|---|

| AUM (USD Billions) | Data Placeholder | Data Placeholder | Data Placeholder |

| ROE (%) | Data Placeholder | Data Placeholder | Data Placeholder |

| Net Profit Margin (%) | Data Placeholder | Data Placeholder | Data Placeholder |

Significant deviations from industry averages might indicate areas of strength or weakness. An investment strategy for Ares Management should consider its relative performance against benchmarks, identifying opportunities for outperformance or potential areas of concern. For example, if Ares Management consistently demonstrates higher ROE than its peers, it could suggest a more efficient capital allocation strategy, making it a potentially attractive investment.

Helpful Answers

What is Ares Management’s primary source of revenue?

Ares Management generates revenue primarily through management fees and carried interest earned from its various investment strategies across credit, private equity, and real estate.

How does inflation affect Ares Management’s stock price?

High inflation generally increases interest rates, potentially impacting the value of Ares Management’s fixed-income investments and reducing investor appetite for riskier assets, thus affecting its stock price negatively.

What are the major risks associated with investing in Ares Management?

Major risks include market volatility, changes in regulatory environments, competition from other asset managers, and potential underperformance of its investment portfolios.

Does Ares Management offer a dividend?

Ares Management’s dividend policy should be reviewed directly from their investor relations materials as it can change.