ARM Live Stock Price A Comprehensive Analysis

ARM Holdings’ Business Model

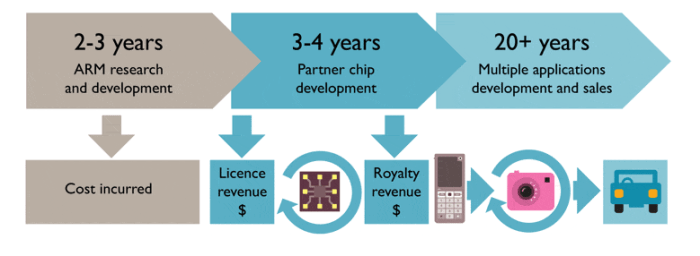

Arm live stock price – ARM Holdings operates under a unique licensing model, significantly impacting its profitability and differentiating it from traditional semiconductor manufacturers. This model allows ARM to generate revenue without directly manufacturing chips, focusing instead on designing and licensing its processor architectures to various companies. This strategy minimizes capital expenditure and maximizes return on investment.

ARM’s Licensing Model and Profitability

ARM licenses its intellectual property (IP), including processor designs and related technologies, to various clients. These clients, often chip manufacturers, integrate ARM’s designs into their own products. ARM receives royalties on each chip sold incorporating its technology, creating a recurring revenue stream. This model reduces the financial risks associated with manufacturing and allows ARM to focus on innovation and design.

The high profitability is directly linked to the vast number of devices using ARM-based processors, making even a small royalty per unit a significant revenue generator.

ARM’s Revenue Streams

ARM’s revenue primarily comes from licensing fees and royalties. Licensing fees are paid upfront for access to ARM’s IP, while royalties are based on the number of chips sold incorporating that IP. Additionally, ARM generates revenue from services such as support, training, and engineering consulting. These services provide additional value to its clients and contribute to overall revenue diversification.

ARM’s Key Customer Segments

ARM’s customer base spans various sectors, including mobile device manufacturers (a significant contributor), consumer electronics companies, automotive manufacturers, and embedded systems developers. The mobile segment historically held the largest market share, but ARM has been actively expanding into other sectors like automotive and IoT to mitigate reliance on a single market. Each segment contributes differently to revenue, with the mobile sector remaining a major driver but other segments showing significant growth potential.

Comparison to Competitors

Unlike companies like Intel or AMD that manufacture and sell their own processors, ARM operates a fabless business model. This significantly reduces capital investment and allows for higher profit margins. Competitors like RISC-V offer open-source architectures, posing a potential long-term challenge, but ARM’s established ecosystem and extensive IP portfolio remain significant competitive advantages.

Monitoring ARM’s live stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other financial giants; for instance, you might find it useful to check the current american express stocks price for a broader perspective on the market’s overall health. Ultimately, understanding ARM’s trajectory necessitates a comprehensive view of the financial landscape.

Factors Influencing ARM Stock Price

Several factors influence ARM’s stock price, ranging from macroeconomic trends to technological advancements and competitive pressures. Understanding these factors is crucial for assessing investment opportunities and potential risks.

Macroeconomic Factors

Global economic conditions, particularly in key markets like the US and China, significantly influence ARM’s stock price. Recessions or slowdowns in these markets can reduce demand for electronic devices, impacting ARM’s licensing revenues. Conversely, periods of economic growth generally boost demand, leading to increased stock valuations.

Technological Advancements

The rapid pace of technological advancements in the semiconductor industry directly impacts ARM’s valuation. The introduction of new processor architectures, such as those focused on AI or high-performance computing, can either create new opportunities for ARM or present challenges if it fails to adapt quickly enough. Successful innovation and timely adaptation are key to maintaining a competitive edge.

Competitive Pressure

Competition from other companies offering processor designs, particularly RISC-V’s open-source alternative, puts pressure on ARM’s market share and profitability. The emergence of new competitors and their success in attracting clients directly impacts ARM’s stock price. ARM’s response to competitive threats, such as strategic partnerships or product diversification, influences investor confidence.

Past Events Impacting Stock Performance

Significant events, such as major acquisitions, licensing agreements with key players, or announcements of new technologies, have historically had a substantial impact on ARM’s stock price. For example, a major partnership with a leading smartphone manufacturer could significantly boost investor sentiment and drive up the stock price, while unexpected regulatory hurdles could have the opposite effect.

Analyzing Financial Statements

A comprehensive analysis of ARM’s financial statements provides valuable insights into its financial health and future prospects. Key metrics such as revenue, net income, earnings per share, and price-to-earnings ratio provide a clear picture of the company’s performance.

Key Financial Metrics

The following table presents a snapshot of ARM’s key financial metrics (Note: These are hypothetical examples for illustrative purposes only. Actual figures should be obtained from ARM’s official financial reports):

| Year | Revenue (in millions) | Net Income (in millions) | Earnings Per Share (EPS) | Price-to-Earnings Ratio (P/E) |

|---|---|---|---|---|

| 2022 | 2500 | 500 | 2.50 | 20 |

| 2023 | 2750 | 600 | 3.00 | 18 |

| 2024 | 3000 | 650 | 3.25 | 17 |

| 2025 | 3250 | 700 | 3.50 | 16 |

| 2026 | 3500 | 750 | 3.75 | 15 |

Revenue Growth (Illustrative Bar Chart)

A bar chart visualizing ARM’s revenue growth over the past five years would show a generally upward trend, reflecting consistent year-on-year increases. The height of each bar would represent the revenue for a given year, allowing for easy visual comparison of growth rates. A clear upward slope would visually reinforce the positive growth trajectory. Any significant fluctuations in revenue from year to year would be clearly visible, providing insights into potential market influences or company-specific events.

Comparison of Financial Ratios

A table comparing ARM’s key financial ratios (such as return on equity, profit margins, and debt-to-equity ratio) to those of its major competitors would highlight ARM’s relative financial strength and performance within the industry. This comparison would provide a benchmark for assessing ARM’s efficiency and profitability compared to its peers.

Return on Equity (ROE) Calculation and Significance

Return on Equity (ROE) is calculated by dividing net income by shareholder equity. A higher ROE indicates that ARM is effectively using its shareholders’ investment to generate profits. A consistently high ROE suggests strong financial management and a healthy return for investors.

Market Sentiment and Investor Behavior: Arm Live Stock Price

Understanding market sentiment and investor behavior is crucial for predicting ARM’s stock price movements. Investor confidence, driven by various news events and market trends, directly impacts stock valuations.

Prevailing Market Sentiment

Market sentiment towards ARM is generally positive, driven by its strong market position, consistent revenue growth, and expansion into new markets. However, investor confidence can fluctuate based on various factors, including competitive pressures and macroeconomic conditions. Positive news, such as the launch of a new technology or a strategic partnership, typically boosts investor confidence, while negative news can have the opposite effect.

Major Investor Groups and Strategies

ARM’s investor base likely includes a mix of institutional investors (such as mutual funds and hedge funds), individual investors, and potentially some strategic investors. Institutional investors often employ long-term investment strategies, while individual investors may be more susceptible to short-term market fluctuations. Strategic investors might be interested in ARM’s technology and its potential for future growth.

News Events Affecting Investor Sentiment

Major news events, such as significant partnerships, product launches, or regulatory changes, can dramatically influence investor sentiment. Positive news generally leads to increased demand and higher stock prices, while negative news can trigger selling pressure and lower prices. For example, the announcement of a large-scale licensing agreement with a major technology company would likely boost investor confidence.

Role of Social Media

Social media platforms can play a significant role in shaping investor perception of ARM. News and opinions shared on platforms like Twitter or Reddit can influence market sentiment, sometimes leading to rapid price swings. While social media can provide valuable insights, it’s crucial to critically evaluate the information shared, as it may not always be accurate or reliable.

Future Outlook and Predictions

Source: seekingalpha.com

ARM’s future prospects depend on several factors, including its ability to innovate, adapt to changing market conditions, and maintain its competitive edge. Predicting future stock performance requires careful consideration of potential growth drivers and risks.

Future Growth Drivers, Arm live stock price

Several factors could drive future growth for ARM, including the continued expansion of the mobile market, growth in the automotive and IoT sectors, and the increasing demand for high-performance computing. ARM’s ability to develop innovative technologies and maintain its leading market position will be crucial for sustained growth.

Potential Risks and Challenges

ARM faces several potential risks and challenges, including increasing competition from open-source architectures like RISC-V, the cyclical nature of the semiconductor industry, and the potential for geopolitical instability to disrupt supply chains. Managing these risks effectively will be critical for maintaining profitability and investor confidence.

Expert Opinions on Long-Term Prospects

Expert opinions on ARM’s long-term prospects vary, depending on the analyst’s perspective and assumptions about future market conditions. Some analysts may be optimistic about ARM’s ability to maintain its market leadership, while others might be more cautious due to increasing competition. The overall consensus among analysts would need to be assessed from reputable sources.

Hypothetical Scenario: Stock Price Performance

Under a scenario of continued strong growth in the mobile and IoT sectors, coupled with successful innovation and strategic partnerships, ARM’s stock price could experience significant appreciation. However, in a scenario of a global economic downturn or increased competitive pressure, the stock price could experience a decline. The actual outcome will depend on a complex interplay of various factors.

ARM’s Competitive Landscape

ARM operates in a highly competitive landscape, with several companies vying for market share in the processor design industry. Understanding ARM’s competitive position is crucial for evaluating its future prospects.

Comparison with Main Competitors

A table comparing ARM’s technology and market position with its main competitors (e.g., RISC-V, Intel, AMD) would highlight key differentiators. This comparison would include factors such as licensing model, market share, technological capabilities, and target markets. This analysis would demonstrate ARM’s strengths and weaknesses relative to its competitors.

| Feature | ARM | RISC-V | Intel | AMD |

|---|---|---|---|---|

| Licensing Model | Proprietary Licensing | Open Source | Direct Sales | Direct Sales |

| Market Share (Illustrative) | High | Growing | High (x86) | High (x86) |

| Target Markets | Mobile, Embedded, Automotive | Diverse | Data Centers, PCs | Data Centers, PCs |

Potential Mergers, Acquisitions, and Partnerships

Source: fxstreet.com

Mergers, acquisitions, or strategic partnerships could significantly impact ARM’s future. A merger with a larger semiconductor company could provide access to new technologies and markets, while an acquisition of a smaller company could enhance ARM’s existing capabilities. Strategic partnerships could help expand ARM’s reach into new markets or accelerate innovation.

Disruptive Technologies

Emerging technologies, such as quantum computing or neuromorphic computing, could potentially disrupt ARM’s business model. ARM’s ability to adapt to and incorporate these new technologies into its offerings will be critical for maintaining its competitive edge.

Strategic Moves to Maintain Competitive Edge

Source: prose.digital

ARM is likely employing several strategies to maintain its competitive edge, including continuous innovation in processor design, expansion into new markets, and strategic partnerships with key players in the industry. Investing in research and development, acquiring smaller companies with specialized expertise, and fostering a strong ecosystem of partners are crucial elements of ARM’s long-term strategy.

Frequently Asked Questions

What are the major risks facing ARM’s future growth?

Increased competition from other chip designers, shifts in market demand, and the potential for technological disruption are all significant risks.

How does ARM’s licensing model compare to its competitors?

Unlike companies that manufacture and sell chips directly, ARM licenses its designs, creating a different revenue stream and risk profile.

What is the role of geopolitical factors in influencing ARM’s stock price?

Geopolitical events and trade tensions can significantly impact the global semiconductor industry, affecting demand and supply chains, thereby influencing ARM’s stock price.

Where can I find reliable financial data on ARM Holdings?

Reliable financial data can be found on ARM’s investor relations website, reputable financial news sources, and through financial data providers.