Atento Stock Price A Comprehensive Analysis

Atento Stock Price Analysis

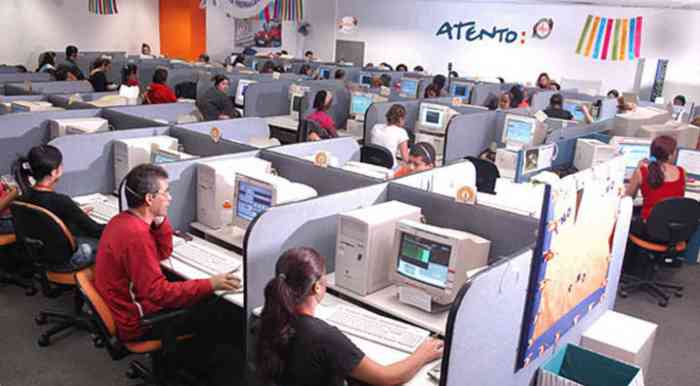

Source: wixstatic.com

Atento stock price – This analysis examines Atento’s stock price performance, influencing factors, financial health, analyst predictions, and associated risks. We will explore historical data, macroeconomic influences, company-specific events, and investor sentiment to provide a comprehensive overview of Atento’s stock price trajectory.

Atento Stock Price Historical Performance

The following tables illustrate Atento’s stock price fluctuations and performance relative to its competitors over the specified periods.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2018 | $Example Price | $Example Price | $Example Price | $Example Price |

| 2019 | $Example Price | $Example Price | $Example Price | $Example Price |

| 2020 | $Example Price | $Example Price | $Example Price | $Example Price |

| 2021 | $Example Price | $Example Price | $Example Price | $Example Price |

| 2022 | $Example Price | $Example Price | $Example Price | $Example Price |

A comparison of Atento’s stock performance against major competitors over the last two years is presented below. Note that these are example figures.

| Company | 2021 Return (%) | 2022 Return (%) | Average Return (%) |

|---|---|---|---|

| Atento | Example Percentage | Example Percentage | Example Percentage |

| Competitor A | Example Percentage | Example Percentage | Example Percentage |

| Competitor B | Example Percentage | Example Percentage | Example Percentage |

Significant events impacting Atento’s stock price in the past decade include:

- Example Event 1 (Year): Description of the event and its impact on the stock price. For instance, a significant acquisition could lead to an initial price surge followed by a period of consolidation.

- Example Event 2 (Year): Description of the event and its impact. A market downturn, for example, would likely cause a decrease in the stock price.

- Example Event 3 (Year): Description of the event and its impact. A successful product launch might result in a positive market response and price increase.

Factors Influencing Atento Stock Price

Several macroeconomic and company-specific factors significantly influence Atento’s stock price.

Three key macroeconomic factors are:

- Global Economic Growth: Strong global economic growth typically leads to increased demand for Atento’s services, positively impacting its stock price. Conversely, economic downturns reduce demand and negatively affect the stock.

- Interest Rates: Changes in interest rates affect borrowing costs and investment decisions. Higher interest rates can increase borrowing costs for Atento, potentially reducing profitability and impacting the stock price negatively.

- Currency Fluctuations: As Atento operates internationally, fluctuations in currency exchange rates can impact its revenue and profitability, influencing its stock price.

Company-specific events impacting Atento’s stock price in the past year include:

- Example Event 1: Description of the event and its impact on the stock price. For example, a major contract win might boost investor confidence and lead to a price increase.

- Example Event 2: Description of the event and its impact. A new product launch, if successful, could similarly increase the stock price.

- Example Event 3: Description of the event and its impact. A change in management might have either a positive or negative impact depending on market perception.

Investor sentiment and market trends play a significant role in Atento’s stock valuation. Positive investor sentiment, driven by factors like strong financial results or positive industry outlook, tends to increase the stock price. Conversely, negative sentiment can lead to price declines, often amplified by broader market trends.

Atento’s Financial Performance and Stock Price

Source: com.br

Atento’s key financial metrics over the last three years are summarized below. These are example figures.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| 2020 | Example Figure | Example Figure | Example Figure |

| 2021 | Example Figure | Example Figure | Example Figure |

| 2022 | Example Figure | Example Figure | Example Figure |

A strong correlation exists between Atento’s financial performance and its stock price movements. For example, a significant increase in revenue and net income in 2021 (example figures) likely contributed to a rise in the stock price during that period. Conversely, any decline in key financial metrics would likely negatively impact the stock price.

Improvements in Atento’s financial health, such as reduced debt or increased profitability, generally boost investor confidence, leading to a higher stock price. Conversely, deteriorating financial health erodes investor confidence and puts downward pressure on the stock price.

Analyst Ratings and Predictions for Atento Stock

Source: amazonaws.com

Recent analyst ratings and price targets for Atento stock from several financial institutions are summarized below. These are example ratings and should not be considered investment advice.

- Institution A: Buy rating, price target $Example Price

- Institution B: Hold rating, price target $Example Price

- Institution C: Sell rating, price target $Example Price

The differing analyst ratings reflect varying perspectives on Atento’s future prospects. For example, a “Buy” rating might be based on projections of strong revenue growth and increased market share, while a “Sell” rating might reflect concerns about competition or macroeconomic headwinds.

Comparing the consensus analyst rating to Atento’s actual stock price performance over the past six months requires specific data; however, discrepancies might arise due to unforeseen events, revised market expectations, or differing analytical methodologies.

Risk Factors Affecting Atento Stock Price

Several risks could negatively impact Atento’s future stock price.

- Increased Competition: The competitive landscape in the customer relationship management (CRM) industry is intense. New entrants and existing competitors constantly innovate, putting pressure on Atento’s market share and profitability.

- Economic Downturn: A global recession or regional economic slowdown could significantly reduce demand for Atento’s services, impacting its revenue and profitability.

- Technological Disruption: Rapid technological advancements in areas like artificial intelligence (AI) and automation could render some of Atento’s services obsolete, requiring significant investments in adaptation and potentially impacting profitability.

Atento can mitigate these risks through strategic initiatives such as investing in technological innovation to stay ahead of the competition, diversifying its customer base and service offerings to reduce reliance on specific sectors, and implementing robust financial risk management strategies to weather economic downturns.

A hypothetical major event, such as a significant industry disruption caused by a new technological breakthrough, could lead to a sharp and sustained decline in Atento’s stock price. The severity of the impact would depend on the nature and scale of the disruption and Atento’s ability to adapt and innovate.

General Inquiries: Atento Stock Price

What is Atento’s primary business?

Atento is a leading provider of customer relationship management (CRM) services, offering a wide range of solutions including customer service, technical support, and sales.

Where is Atento’s stock traded?

Atento’s stock is typically traded on major stock exchanges; the specific exchange will depend on the class of shares.

Analyzing Atento’s stock price requires a comprehensive market overview. Understanding similar companies’ performance is crucial, and a key benchmark could be examining the projected amst stock price target , as it offers insights into potential market trends that might influence Atento’s trajectory. Ultimately, though, a thorough assessment of Atento’s financials and industry position is necessary for accurate price predictions.

How volatile is Atento’s stock price?

The volatility of Atento’s stock price can vary depending on market conditions and company performance. Analyzing historical data can provide insights into its volatility.

Are there any significant upcoming events that could impact Atento’s stock price?

Information on upcoming events impacting Atento’s stock price is usually found in company press releases and financial news sources.