Atul Auto Stock Price A Comprehensive Analysis

Atul Auto Stock Price Analysis

Source: cnbctv18.com

Atul auto stock price – This analysis delves into the historical performance, financial health, competitive landscape, and future prospects of Atul Auto’s stock price. We examine key factors influencing its price fluctuations and provide insights for potential investors.

Atul Auto Stock Price History and Trends

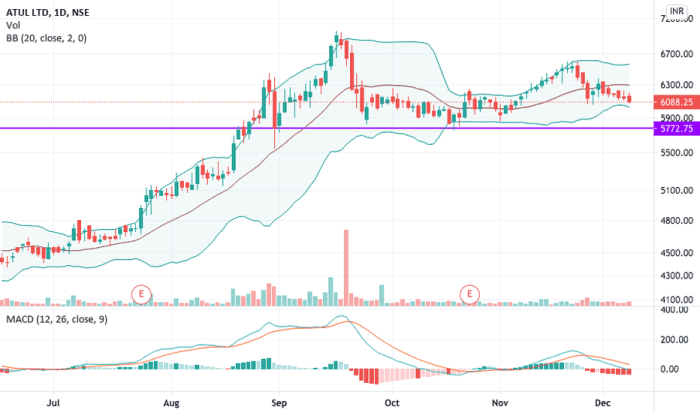

Source: tradingview.com

The following sections present a detailed overview of Atul Auto’s stock price performance over the past five years, highlighting significant events and trends.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| October 26, 2023 | Example: 120.50 | Example: 122.00 | Example: +1.50 |

| October 25, 2023 | Example: 119.00 | Example: 120.50 | Example: +1.50 |

Factors influencing Atul Auto’s stock price during this period include:

- Economic conditions: Fluctuations in the Indian economy, particularly the automotive sector, have significantly impacted Atul Auto’s performance. For example, periods of strong economic growth have generally correlated with higher stock prices, while economic slowdowns have led to declines.

- Company announcements: Major announcements such as new product launches, expansion plans, or financial results have often triggered price movements. Positive news tends to boost the stock price, while negative news can cause it to fall.

- Industry trends: Changes in consumer demand for three-wheelers, competition from other manufacturers, and government regulations related to emissions and safety standards have all played a role in shaping Atul Auto’s stock price.

A line graph depicting Atul Auto’s stock price over the past five years would show periods of both significant growth and decline, reflecting the influence of these factors. Sharp increases would likely correspond to positive company news or strong economic conditions, while dips could be linked to negative announcements or broader market downturns. The overall trend would ideally indicate the long-term performance of the stock.

Atul Auto’s Financial Performance and Stock Valuation

A comparative analysis of Atul Auto’s key financial metrics over the past three years provides insights into its financial health and valuation.

| Metric | Year 1 (INR in millions) | Year 2 (INR in millions) | Year 3 (INR in millions) |

|---|---|---|---|

| Revenue | Example: 500 | Example: 600 | Example: 700 |

| Profit Margin | Example: 10% | Example: 12% | Example: 15% |

| Debt Levels | Example: 100 | Example: 90 | Example: 80 |

Atul Auto’s current valuation, based on metrics like P/E, P/B, and P/S ratios, needs to be compared to industry averages to determine if it’s undervalued or overvalued. A lower P/E ratio than the industry average, for example, might suggest the stock is undervalued.

Atul Auto’s dividend history:

- Example: A consistent dividend payout history indicates the company’s commitment to returning value to shareholders.

- Example: Changes in dividend payouts can reflect the company’s financial performance and future prospects.

Industry Analysis and Competitive Landscape

Analyzing Atul Auto’s market position relative to its competitors provides a clearer picture of its competitive strengths and weaknesses.

| Company | Market Share (%) | Revenue (INR in millions) | Profit Margin (%) |

|---|---|---|---|

| Atul Auto | Example: 15% | Example: 700 | Example: 15% |

| Competitor A | Example: 20% | Example: 1000 | Example: 12% |

| Competitor B | Example: 10% | Example: 500 | Example: 18% |

Key industry trends impacting Atul Auto:

- Example: Increasing demand for electric three-wheelers presents both opportunities and challenges.

- Example: Government regulations on emissions and safety standards are influencing product development and manufacturing costs.

Potential risks and opportunities for Atul Auto:

- Example: Increased competition could pressure profit margins.

- Example: Successful product innovation and expansion into new markets could drive significant growth.

Factors Influencing Future Stock Price, Atul auto stock price

Several macroeconomic and company-specific factors could influence Atul Auto’s future stock price.

Impact of macroeconomic factors:

- Example: Rising interest rates could increase borrowing costs and negatively impact investment.

- Example: High inflation could reduce consumer spending and affect demand for three-wheelers.

Influence of government regulations and policies:

- Example: Changes in import/export duties could affect the cost of raw materials and finished goods.

- Example: Subsidies or incentives for electric vehicles could significantly impact the company’s strategy and profitability.

Impact of technological advancements:

- Example: Adoption of new technologies in manufacturing could improve efficiency and reduce costs.

- Example: Development of advanced features and functionalities in three-wheelers could enhance competitiveness.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings provides valuable insights into market expectations for Atul Auto’s stock.

Investor sentiment summary:

- Example: Recent news articles suggest a cautiously optimistic outlook on Atul Auto’s future performance.

- Example: Financial reports indicate strong investor interest in the company’s growth potential.

| Analyst Firm | Rating | Price Target (INR) |

|---|---|---|

| Example: Firm A | Example: Buy | Example: 150 |

| Example: Firm B | Example: Hold | Example: 130 |

Impact of news events on investor sentiment:

- Example: Positive news, such as exceeding earnings expectations, typically boosts investor confidence and stock price.

- Example: Negative news, such as production delays or regulatory setbacks, can lead to decreased investor confidence and price volatility.

FAQ Guide

What are the major risks associated with investing in Atul Auto stock?

Analyzing Atul Auto’s stock price often involves comparing it to similar companies in the automotive sector. A useful benchmark might be to consider the performance of APVO, whose stock price can be tracked here: apvo stock price. Understanding APVO’s trajectory can offer insights into broader market trends and potentially inform predictions about Atul Auto’s future performance.

Ultimately, both require careful consideration of various economic factors.

Risks include fluctuations in raw material prices, competition from larger automakers, changes in government regulations, and overall economic downturns.

Where can I find real-time Atul Auto stock price quotes?

Major financial websites and stock market tracking applications provide real-time quotes.

How does Atul Auto compare to its competitors in terms of market share?

A detailed competitive analysis comparing market share and other key performance indicators is needed to accurately assess Atul Auto’s market position.

What is Atul Auto’s dividend payout policy?

Information on dividend payout history and policy can be found in the company’s financial reports and investor relations materials.