B2B Gold Stock Price A Market Overview

Understanding the B2B Gold Market

The business-to-business (B2B) gold market is a significant component of the global gold market, characterized by large-scale transactions between established players. This market differs considerably from the retail gold investment market, impacting price dynamics and investment strategies. Understanding its key features is crucial for anyone interested in B2B gold stock prices.

Key Characteristics of the B2B Gold Market

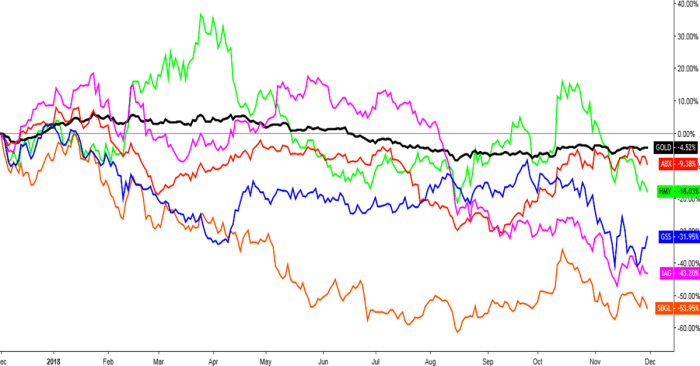

Source: ino.com

The B2B gold market is characterized by its substantial size, involving billions of dollars in annual transactions. Key participants include mining companies, refineries, central banks, and large institutional investors. Trading mechanisms are primarily based on over-the-counter (OTC) transactions, often facilitated by specialized brokers and trading platforms. These transactions involve large quantities of gold, typically in the form of bars or ingots, with pricing determined through negotiation and referencing global spot prices.

Differences Between B2B and Retail Gold Trading

Unlike retail gold investment, which focuses on smaller quantities and individual investors, B2B gold trading involves significant volumes and institutional players. Retail investors typically purchase gold coins, bars, or exchange-traded funds (ETFs), while B2B transactions involve larger quantities of refined gold, often for industrial or investment purposes. Pricing and transaction costs also differ significantly between the two markets, with B2B transactions generally having lower markups.

Factors Influencing Price Volatility in the B2B Gold Market

Several factors contribute to the volatility of B2B gold prices. These include macroeconomic conditions (inflation, interest rates, currency fluctuations), geopolitical events (wars, political instability), and supply and demand dynamics (mining production, jewelry demand, industrial use).

| Factor | B2B Gold | Silver | Platinum |

|---|---|---|---|

| Inflation | Positive correlation (safe haven asset) | Positive correlation (industrial demand) | Positive correlation (industrial demand) |

| Interest Rates | Negative correlation (opportunity cost) | Negative correlation (industrial demand) | Negative correlation (industrial demand) |

| Currency Fluctuations | Influenced by USD value (gold priced in USD) | Influenced by USD value | Influenced by USD value |

| Industrial Demand | Moderate impact | Significant impact | Significant impact |

Major Players in B2B Gold Trading

The B2B gold market is dominated by a few key players, each playing a distinct role in price determination and market stability. Understanding their roles and strategies is crucial for navigating this complex market.

Dominant Players and Their Roles

- Mining Companies: These companies extract gold from the earth and are major suppliers to the market. Their production levels significantly influence supply and, consequently, prices.

- Refineries: These companies purify and refine gold, transforming it into standardized forms suitable for various applications. They act as intermediaries between miners and end-users.

- Central Banks: Central banks hold significant gold reserves, influencing market liquidity and price stability through their buying and selling activities.

- Investment Banks and Brokers: These institutions facilitate trading, providing liquidity and price discovery mechanisms in the OTC market.

Trading Strategies of B2B Participants

Different players employ varying strategies. Mining companies typically focus on hedging price risks, while refineries prioritize efficient processing and timely delivery. Central banks often manage their gold reserves strategically, influencing market sentiment and price stability. Investment banks utilize sophisticated trading models to capitalize on market opportunities.

Tracking B2B gold stock prices requires careful consideration of various market factors. Understanding the interplay of global economic trends is crucial, and sometimes a comparison to other sectors can be insightful. For example, observing the current performance of arvl stock price today can offer a contrasting perspective on market volatility. Ultimately, a thorough analysis of both the gold market and related sectors like ARVL is necessary for informed investment decisions in the B2B gold sector.

Factors Affecting B2B Gold Stock Prices

B2B gold stock prices are influenced by a complex interplay of macroeconomic factors, geopolitical events, and supply and demand dynamics. Understanding these factors is essential for effective investment decision-making.

Influence of Macroeconomic Factors

- Inflation: High inflation often drives investors towards gold as a hedge against inflation, increasing demand and prices.

- Interest Rates: Lower interest rates can boost gold prices as the opportunity cost of holding non-interest-bearing assets like gold decreases.

- Currency Fluctuations: Gold is typically priced in US dollars, so fluctuations in the value of the dollar can significantly impact gold prices.

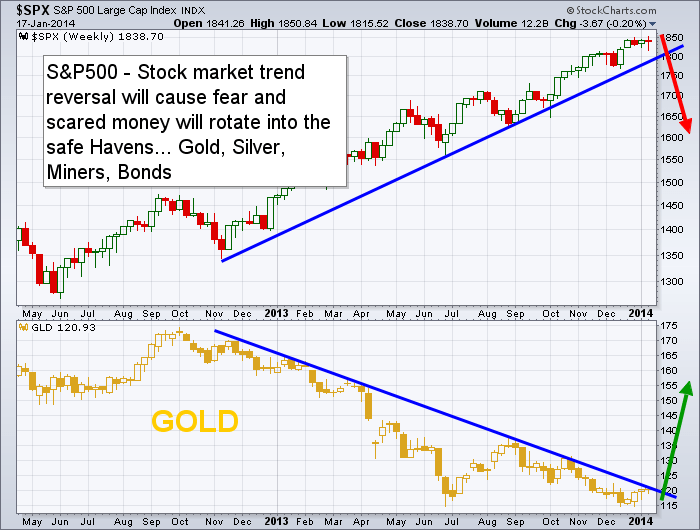

Impact of Geopolitical Events and Global Uncertainty

- Geopolitical Instability: Periods of global uncertainty often lead to increased demand for gold as a safe-haven asset, pushing prices higher.

- Political Risks: Political risks in major gold-producing countries can disrupt supply and impact prices.

Role of Supply and Demand Dynamics

- Mining Production: Changes in gold mining output directly influence the supply of gold available in the market.

- Jewelry Demand: Fluctuations in consumer demand for gold jewelry can affect overall gold demand and prices.

- Industrial Use: The use of gold in electronics and other industries also impacts demand.

Analyzing B2B Gold Stock Price Trends

Analyzing historical price movements and their correlation with other market indicators provides valuable insights for future investment decisions. This involves understanding past trends and identifying potential future patterns.

Historical Overview of B2B Gold Stock Prices

Over the past decade, B2B gold stock prices have generally followed the trend of the gold spot price, though with some divergence due to company-specific factors. Significant periods of growth were often associated with periods of macroeconomic uncertainty or geopolitical instability, while declines often mirrored corrections in the broader equity markets. For example, the 2008 financial crisis saw a significant surge in gold prices, reflected in the performance of B2B gold stocks.

Conversely, periods of strong economic growth and rising interest rates have sometimes led to declines.

Correlations with Market Indicators

B2B gold stock prices typically exhibit a strong positive correlation with the gold spot price. However, correlations with equity market performance can be more complex, varying depending on the overall economic climate and investor sentiment. During times of economic uncertainty, gold stocks may act as a safe haven, showing a negative correlation with equity markets. Conversely, during periods of strong economic growth, they might show a positive correlation.

Visual Representation of Price Trends

A line graph illustrating the relationship between B2B gold stock prices (represented by a major B2B gold producer’s stock price index) and key macroeconomic variables (e.g., inflation rate, 10-year Treasury yield, USD index) over the past decade would show a clear correlation. The graph would demonstrate how periods of high inflation or low interest rates tend to coincide with higher gold stock prices, while periods of economic strength and rising interest rates often correlate with lower gold stock prices.

The USD index would show an inverse relationship, with a stronger dollar usually corresponding to lower gold stock prices and vice-versa.

Investment Strategies in B2B Gold Stocks

Several investment strategies can be employed when investing in B2B gold stocks, each carrying different levels of risk and potential returns. Careful consideration of risk tolerance and investment goals is crucial.

Different Investment Strategies

- Long-term Buy-and-Hold: This strategy involves investing in B2B gold stocks for the long term, benefiting from the potential for long-term growth in the gold market.

- Short-term Trading: This strategy involves actively trading B2B gold stocks based on short-term price movements and market analysis.

- Value Investing: This strategy involves identifying undervalued B2B gold stocks with strong fundamentals and long-term growth potential.

Potential Returns and Risks

Long-term buy-and-hold strategies offer the potential for substantial returns over time but carry the risk of market volatility and long-term price stagnation. Short-term trading strategies can generate quick profits but involve higher risk due to the potential for significant price swings. Value investing requires thorough research and analysis but can yield attractive returns if successful.

Fundamental and Technical Analysis, B2b gold stock price

Fundamental analysis involves evaluating the financial health and long-term prospects of B2B gold companies, while technical analysis involves studying price charts and other market indicators to identify trading opportunities. A combination of both approaches is often recommended for effective investment decision-making.

Risks and Opportunities in B2B Gold Stocks

Investing in B2B gold stocks presents both opportunities and risks. Understanding these aspects is essential for making informed investment choices.

Potential Risks

- Market Volatility: Gold prices are inherently volatile, impacting the price of B2B gold stocks.

- Geopolitical Risks: Political instability in gold-producing regions can disrupt supply and affect prices.

- Regulatory Changes: Changes in mining regulations or environmental policies can impact the profitability of gold mining companies.

Potential Opportunities

Source: thegoldandoilguy.com

- Long-term Growth: The long-term outlook for gold demand remains positive, driven by factors such as inflation and global economic uncertainty.

- Dividend Income: Some B2B gold companies pay dividends, providing a steady stream of income for investors.

- Diversification: B2B gold stocks can provide diversification benefits within a broader investment portfolio.

| Factor | B2B Gold Stocks | Other Stocks (e.g., Tech) | Bonds |

|---|---|---|---|

| Potential Returns | Moderate to High (depending on market conditions) | High (but also higher risk) | Low to Moderate (stable) |

| Risk | Moderate to High (market volatility, geopolitical risks) | High (market volatility, technological disruption) | Low (but potential for inflation erosion) |

| Liquidity | Moderate (depending on the stock) | Generally High | High |

| Inflation Hedge | Yes | No | No |

Question Bank

What are the typical transaction sizes in the B2B gold market?

Transaction sizes in the B2B gold market are significantly larger than in retail markets, often involving hundreds or thousands of ounces of gold.

How does the B2B gold market differ from the gold futures market?

The B2B market involves physical gold transactions, while the futures market deals with contracts for future delivery. B2B transactions often have longer lead times.

Are there any regulatory bodies specifically overseeing B2B gold trading?

Regulation varies by jurisdiction but generally involves national and international agencies overseeing financial markets and precious metal trading.

What are some common risks associated with investing in B2B gold mining companies specifically?

Risks include operational challenges, fluctuating gold prices, environmental concerns, and geopolitical instability in mining regions.