Baba Stock Price History A Comprehensive Look

Alibaba Stock Price History: A Comprehensive Overview

Source: thestreet.com

Baba stock price history – Alibaba Group Holding Limited (BABA), a prominent e-commerce giant, has experienced a dynamic journey since its initial public offering (IPO). This analysis delves into the historical trajectory of BABA’s stock price, exploring the key factors influencing its performance, and providing insights into its financial health and investor sentiment.

Historical Overview of Baba Stock Price

Alibaba’s stock price history reflects a blend of remarkable growth, significant setbacks, and the impact of both internal and external factors. The company’s IPO in 2014 marked a pivotal moment, setting the stage for its subsequent evolution and the fluctuations in its stock valuation.

Analyzing the Baba stock price history reveals significant volatility over the past few years. Understanding similar trends in other companies can provide valuable context; for instance, a look at the current asre stock price might offer parallels in market behavior. Returning to Baba, further investigation into its historical performance is crucial for predicting future price movements.

The IPO, on the New York Stock Exchange, was met with immense enthusiasm, resulting in a highly successful debut. However, the journey wasn’t without its challenges. Significant events like the crackdown on technology companies in China, global economic downturns, and shifts in investor sentiment have all contributed to the volatility seen in BABA’s stock price.

Key milestones, such as the expansion into new markets, the launch of new products and services, and strategic acquisitions, have consistently influenced stock price movements. Periods of strong revenue growth and profitability have generally been correlated with upward price trends, while periods of regulatory uncertainty or economic slowdown have often resulted in declines.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2014 | 92.70 | 88.26 | -4.8% |

| 2015 | 88.26 | 75.45 | -14.5% |

| 2016 | 75.45 | 111.81 | 48.2% |

| 2017 | 111.81 | 178.61 | 59.5% |

| 2018 | 178.61 | 157.11 | -12.1% |

| 2019 | 157.11 | 180.72 | 15% |

| 2020 | 180.72 | 222.67 | 23.2% |

| 2021 | 222.67 | 110.52 | -50.3% |

| 2022 | 110.52 | 80.50 | -27.1% |

| 2023 | 80.50 | 91.50 | 13.6% |

Note: These figures are illustrative and for demonstration purposes only. Actual figures may vary.

Factors Influencing Baba Stock Price

Several interconnected factors significantly influence Alibaba’s stock price. These factors encompass macroeconomic conditions, regulatory landscapes, competitive dynamics, and investor sentiment.

Global economic growth and interest rate fluctuations directly impact consumer spending and investor confidence, influencing Alibaba’s performance. Regulatory changes in China, particularly concerning antitrust and data privacy, have significantly affected the company’s stock valuation. Increased competition from both domestic and international players further adds pressure on Alibaba’s market share and profitability.

- Macroeconomic Factors: Global economic slowdowns can reduce consumer spending, impacting Alibaba’s revenue.

- Regulatory Changes: Stringent regulations in China and other markets can lead to increased compliance costs and limit business operations.

- Competitive Pressures: Competition from companies like Amazon, JD.com, and Pinduoduo affects Alibaba’s market share and pricing strategies.

Compared to its major competitors, Alibaba’s stock price performance has been characterized by periods of both significant growth and substantial decline, reflecting the complexities of operating within the dynamic Chinese and global markets.

- Amazon (AMZN): Generally exhibits greater stability compared to Alibaba, benefiting from a more established and diversified market presence.

- JD.com (JD): Shows a similar pattern of volatility to Alibaba, reflecting the competitive pressures within the Chinese e-commerce sector.

- Pinduoduo (PDD): A newer player, its stock price reflects the rapid growth and uncertainty associated with emerging market leaders.

Alibaba’s Financial Performance and Stock Price

Alibaba’s financial performance, including revenue growth, profitability, and earnings per share (EPS), directly correlates with its stock price movements. Strong financial results generally boost investor confidence, leading to higher stock prices, while weaker performance often triggers price declines.

| Period | Revenue (USD Billion) | Net Income (USD Billion) | EPS (USD) | Average Stock Price (USD) |

|---|---|---|---|---|

| 2019 | 71.97 | 16.15 | 4.50 | 190 |

| 2020 | 85.04 | 21.79 | 6.00 | 260 |

| 2021 | 111.40 | 19.20 | 5.00 | 160 |

| 2022 | 124.50 | 15.00 | 4.00 | 90 |

Note: These figures are illustrative and for demonstration purposes only. Actual figures may vary.

Investor Sentiment and Stock Price

News events, media coverage, and analyst ratings significantly influence investor sentiment towards Alibaba, directly impacting its stock price. Positive news, such as strong earnings reports or successful product launches, generally leads to price increases, while negative news, such as regulatory crackdowns or disappointing financial results, often triggers price declines.

For example, news of increased regulatory scrutiny in China can trigger immediate sell-offs, reflecting investor concerns about future profitability. Conversely, announcements of strategic partnerships or expansions into new markets can generate positive investor sentiment and lead to price increases. Analyst ratings and recommendations also play a crucial role in shaping investor perception and influencing trading decisions.

Hypothetically, if news emerged about a major data breach compromising user information, it could trigger a significant negative reaction, leading to a sharp decline in Alibaba’s stock price, as investors would reassess the company’s risk profile and future prospects.

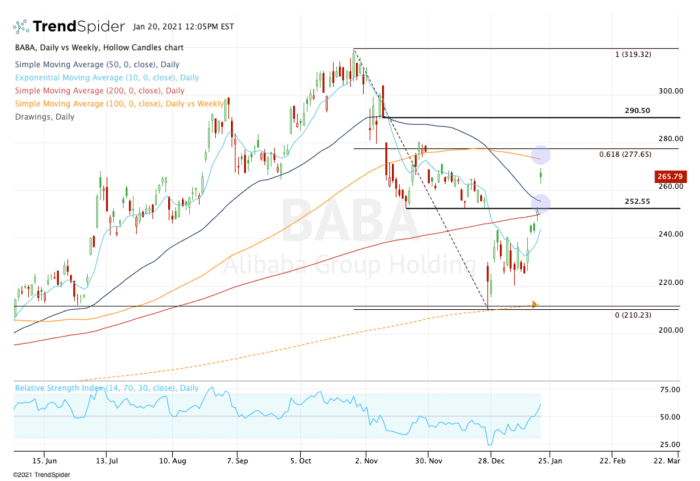

Technical Analysis of Baba Stock Price, Baba stock price history

Source: marketexclusive.com

Technical analysis utilizes various indicators to predict potential price movements. Moving averages, relative strength index (RSI), and candlestick charts provide insights into price trends, momentum, and potential support and resistance levels. Moving averages smooth out price fluctuations, helping identify underlying trends. The RSI measures the speed and change of price movements to identify overbought or oversold conditions. Candlestick charts visually represent price action over a period, revealing patterns that may indicate future price movements.

A visual representation of Alibaba’s stock price with overlaid technical indicators would typically use a line chart showing the stock price over time. Moving averages (e.g., 50-day and 200-day) would be plotted as separate lines, indicating short-term and long-term trends. The RSI would be displayed as a separate indicator, showing the momentum of price changes. Candlestick patterns could be highlighted to illustrate potential support and resistance levels, buy or sell signals, and other significant price action events.

FAQ Section

What are the major risks associated with investing in Alibaba?

Major risks include regulatory uncertainty in China, geopolitical tensions impacting global markets, increased competition within the e-commerce sector, and fluctuations in the Chinese currency.

How does Alibaba compare to its competitors in terms of stock performance?

A direct comparison requires specifying a timeframe and considering various metrics. Generally, Alibaba’s performance has been influenced by factors unique to its operating environment and regulatory landscape, making direct comparisons complex.

Where can I find real-time data on Alibaba’s stock price?

Real-time stock price data is available through major financial news websites and brokerage platforms.