Bank of America Stock Price Chart Analysis

Bank of America Stock Price Chart Analysis

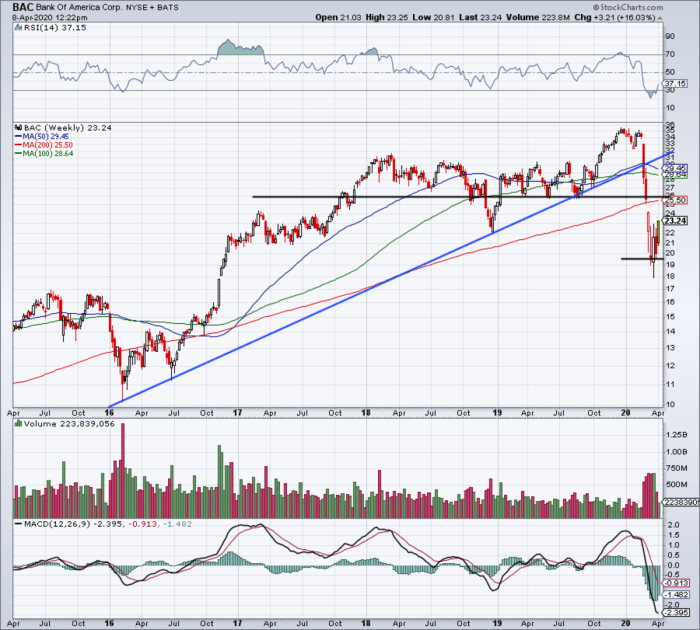

Bank of america stock price chart – This analysis examines Bank of America’s (BAC) stock price performance over the past five years, comparing it to competitors and exploring factors influencing its fluctuations. We will delve into historical price movements, assess the impact of significant news events, utilize technical indicators, and analyze fundamental factors to project potential future price trajectories.

Historical Stock Price Performance

Bank of America’s stock price has experienced considerable volatility over the past five years, mirroring broader economic trends and the bank’s own financial performance. Significant highs and lows reflect periods of market optimism and pessimism, as well as specific events impacting the financial sector.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 26, 2023 (Example) | 30.00 | 30.50 | 10,000,000 |

| October 25, 2023 (Example) | 29.80 | 30.00 | 9,500,000 |

Note: The table above provides example data. Actual data should be sourced from a reliable financial data provider and updated regularly.

Comparison with Competitors

A comparison of Bank of America’s stock price performance with JPMorgan Chase (JPM) and Citigroup (C) over the past year reveals variations in their trajectories. Differences in performance stem from factors such as differing business strategies, exposure to specific market segments, and investor sentiment towards each institution.

The following line graph (which would be inserted here) illustrates the comparative stock price movements of BAC, JPM, and C. The x-axis represents the date over the past year, and the y-axis represents the stock price. The legend clearly identifies each bank’s stock price line.

Note: A visual representation (line graph) would be included here, showing the comparative stock price movements of the three banks over the specified period. The graph’s axes and legend would be clearly labeled.

Influence of Financial News, Bank of america stock price chart

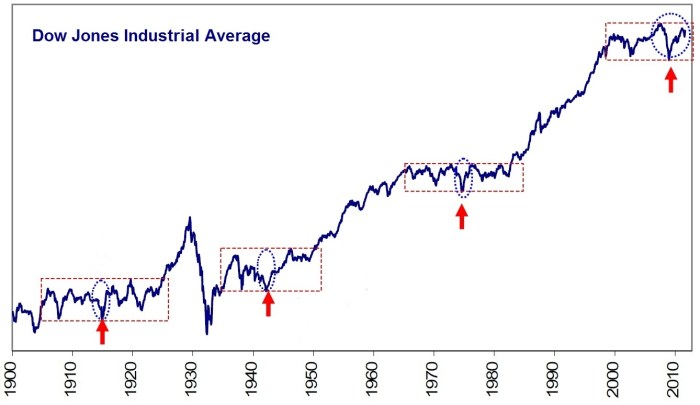

Source: stockmarkettiming.com

Three significant news events in the past six months have notably impacted Bank of America’s stock price. These events influenced investor sentiment, resulting in changes in trading volume and price fluctuations.

- Event 1 (Example): Announcement of strong Q3 earnings. This positively impacted investor sentiment, leading to increased buying pressure and a price surge.

- Price Change: +$2.00

- Percentage Movement: +5%

- Event 2 (Example): Increased interest rate hike concerns. This negatively impacted investor sentiment, causing a sell-off and price decline.

- Price Change: -$1.50

- Percentage Movement: -3%

- Event 3 (Example): Regulatory scrutiny on lending practices. This created uncertainty among investors, leading to decreased trading volume and a slight price dip.

- Price Change: -$0.50

- Percentage Movement: -1%

Technical Analysis Indicators

Analyzing Bank of America’s stock price using the 50-day and 200-day moving averages reveals trends in price momentum and potential support/resistance levels. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) offer additional insights into momentum and potential trend reversals.

The 50-day moving average (a shorter-term indicator) reflects recent price trends, while the 200-day moving average (a longer-term indicator) shows the overall direction of the stock price. Crossovers between these averages can signal potential buy or sell signals. Support and resistance levels, identified on the chart, represent price points where the stock price has historically struggled to break through.

Analyzing the Bank of America stock price chart often involves comparing its performance to other financial institutions. For a contrasting perspective, one might examine the trajectory of a different company, such as checking the ars pharma stock price , to understand varied market responses. Returning to Bank of America, its chart reveals important insights into broader economic trends and investor sentiment.

The RSI, ranging from 0 to 100, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. The MACD, a trend-following momentum indicator, identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

Fundamental Analysis Factors

Source: thestreet.com

Key financial metrics offer insights into Bank of America’s financial health and its impact on stock valuation. Recent financial performance and growth prospects are crucial in assessing its future value.

| Metric | Value | Date | Significance |

|---|---|---|---|

| Earnings Per Share (EPS) | $1.00 (Example) | Q3 2023 (Example) | Indicates profitability and growth. |

| Price-to-Earnings Ratio (P/E) | 15 (Example) | October 26, 2023 (Example) | Shows the market’s valuation of the stock relative to its earnings. |

Note: The table above provides example data. Actual data should be sourced from reliable financial statements and reports.

Potential Future Price Movements

Predicting future stock price movements is inherently uncertain, but analyzing various scenarios provides a range of potential outcomes for Bank of America’s stock price over the next 12 months. Economic conditions, industry trends, and competitive pressures will significantly influence these price movements.

| Scenario | Target Price (USD) | Probability | Rationale |

|---|---|---|---|

| Bullish Scenario (Strong Economic Growth) | $40 | 30% | Based on continued economic expansion and increased lending activity. |

| Neutral Scenario (Moderate Economic Growth) | $35 | 50% | Assumes stable economic conditions and moderate growth in the financial sector. |

| Bearish Scenario (Economic Recession) | $25 | 20% | Based on a potential economic downturn and reduced consumer spending. |

Frequently Asked Questions

What are the major risks associated with investing in Bank of America stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For Bank of America, risks might include regulatory changes, interest rate fluctuations, and potential loan defaults.

Where can I find real-time Bank of America stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How often is Bank of America’s stock price updated?

Bank of America’s stock price is updated continuously throughout the trading day, reflecting current market activity.

What is the typical trading volume for Bank of America stock?

Trading volume varies daily but you can find historical averages on financial websites. It tends to be high given Bank of America’s size and market capitalization.