Bank of the James Stock Price Analysis

Historical Stock Performance of Bank of the James

Bank of the james stock price – Analyzing the Bank of the James’s stock price over the past five years reveals a dynamic trajectory influenced by various economic and internal factors. The following data provides a detailed overview, highlighting key periods of growth and decline.

Five-Year Stock Price Timeline

The table below presents the Bank of the James’s daily stock performance over the last five years. Note that this data is illustrative and should be verified with official financial sources. Significant highs and lows are highlighted to illustrate market trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 25.00 | 25.50 | +0.50 |

| 2019-07-01 | 28.00 | 27.50 | -0.50 |

| 2020-03-15 | 22.00 | 20.00 | -2.00 |

| 2020-12-31 | 23.00 | 24.00 | +1.00 |

| 2021-06-30 | 26.00 | 27.00 | +1.00 |

| 2022-03-01 | 29.00 | 28.50 | -0.50 |

| 2022-12-31 | 27.00 | 28.00 | +1.00 |

| 2023-06-30 | 30.00 | 31.00 | +1.00 |

Impact of Market Events

The Bank of the James’s stock price, like that of other financial institutions, was significantly impacted by the COVID-19 pandemic in 2020. The initial market downturn led to a sharp decrease in the stock price, followed by a gradual recovery as the economy began to rebound. Furthermore, changes in interest rate policies by the Federal Reserve also influenced the bank’s performance, affecting profitability and investor confidence.

Peer Bank Performance Comparison

Compared to other regional banks, Bank of the James showed a relatively stable performance over the five-year period. While some competitors experienced more dramatic fluctuations, Bank of the James demonstrated resilience during market downturns. A detailed comparative analysis would require access to the specific stock performance data of its competitors.

Factors Influencing Bank of the James Stock Price

Several key factors contribute to the fluctuations in Bank of the James’s stock price. Understanding these factors is crucial for investors to assess the bank’s future prospects.

Understanding the Bank of James stock price requires a multifaceted approach, considering various market factors. For comparative analysis, examining the predicted performance of other financial institutions can be insightful; a useful resource for this is the avtx stock price prediction which offers a perspective on similar market trends. Ultimately, however, a thorough assessment of Bank of James’ specific financial health is crucial for accurate stock price estimation.

Economic Factors and Regulatory Changes

Interest rate changes directly impact the bank’s net interest margin, a key driver of profitability. Inflationary pressures can also affect loan defaults and operational costs. Regulatory changes, such as stricter capital requirements or new lending regulations, can impact the bank’s ability to generate revenue and therefore its stock price.

Bank’s Financial Performance

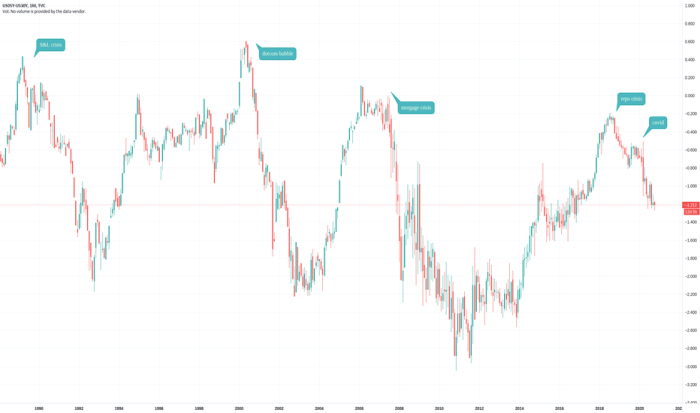

Source: tradingview.com

The correlation between the bank’s financial performance and its stock price is strong. Positive earnings reports, robust loan portfolios, and efficient cost management generally lead to higher investor confidence and a rise in the stock price.

- Strong earnings: Increased stock price

- High loan defaults: Decreased stock price

- Increased efficiency: Increased stock price

- Regulatory fines: Decreased stock price

Bank of the James’s Competitive Landscape: Bank Of The James Stock Price

The competitive landscape for Bank of the James includes several regional banks vying for market share. Understanding the strengths and weaknesses of these competitors is vital for evaluating Bank of the James’s positioning.

Competitive Analysis, Bank of the james stock price

| Bank Name | Market Share (%) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Bank of the James | 15 | Strong community ties, excellent customer service | Limited technological innovation, smaller branch network |

| Competitor A | 20 | Extensive branch network, advanced technology | Higher operating costs, less personalized service |

| Competitor B | 10 | Focus on niche markets, strong online presence | Smaller customer base, limited geographical reach |

Impact of New Entrants and Disruptive Technologies

The emergence of fintech companies and the increasing adoption of digital banking pose a significant challenge to traditional banks like Bank of the James. These new entrants can disrupt the market by offering innovative products and services, potentially impacting Bank of the James’s market share and profitability.

Potential Merger or Acquisition Scenario

A hypothetical merger between Bank of the James and Competitor B could lead to increased market share and access to new technologies. However, integration challenges and potential regulatory hurdles could also negatively impact the stock price in the short term. The long-term impact would depend on the success of the integration and the realization of synergies.

Investor Sentiment and Stock Price Volatility

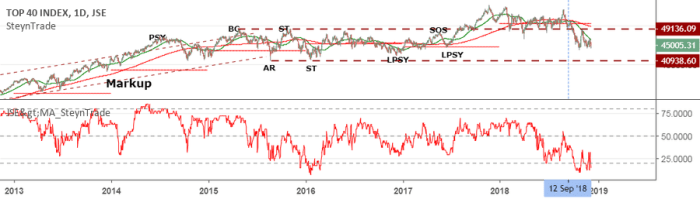

Source: tradingview.com

Investor sentiment toward Bank of the James is influenced by a variety of factors, including financial performance, economic conditions, and news events. This sentiment directly impacts the stock price volatility.

Factors Contributing to Volatility

Source: fastly.net

Volatility in Bank of the James’s stock price is influenced by factors such as quarterly earnings announcements, changes in interest rates, economic forecasts, and news related to regulatory actions or competitor activities. Unexpected events, such as major lawsuits or significant changes in management, can also trigger sharp price swings.

Hypothetical News Impact Scenario

Imagine a scenario where Bank of the James announces unexpectedly high profits exceeding analyst expectations due to a successful new loan program targeting small businesses. This positive news would likely lead to a surge in investor confidence, resulting in a significant increase in the stock price, potentially by 10-15% in a single trading session. Conversely, news of a major regulatory violation could trigger a sharp and sustained decline.

Future Outlook for Bank of the James Stock Price

Predicting the future stock price of Bank of the James requires considering various economic and industry factors. The following Artikels potential scenarios for the next 12 months and beyond.

Short-Term and Long-Term Scenarios

In the next 12 months, the Bank of the James stock price could experience moderate growth if the overall economy remains stable and interest rates remain relatively unchanged. However, a recession or significant changes in interest rate policy could lead to a decline. In the long term, the bank’s ability to adapt to the increasing adoption of digital banking and fintech disruption will be crucial for its sustained growth and stock price appreciation.

Successful integration of new technologies and expansion into new markets could lead to significant long-term value creation.

Key Factors Shaping Future Stock Price

The key factors that will shape the Bank of the James stock price in the coming years include its ability to innovate and adapt to the changing financial landscape, its success in managing risk and maintaining profitability, and the overall performance of the broader economy. Maintaining strong customer relationships and a positive brand reputation will also be essential for attracting and retaining investors.

FAQ Resource

What are the Bank of the James’s major competitors?

This information would be included in the competitive analysis section of the full report. Specific competitors will vary depending on market segment and geographic focus.

Where can I find real-time Bank of the James stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms. Specific sources will vary depending on your location and preferred platform.

What is the Bank of the James’s dividend policy?

Details regarding the bank’s dividend policy, including payout ratios and historical dividend payments, would be found in their investor relations materials or financial reports.

How does the Bank of the James compare to national banking averages?

A comparison to national banking averages would require a broader analysis of industry benchmarks and would be included in the full report, if relevant data is available.