Barclays Stock Price London A Comprehensive Analysis

Barclays Stock Price in London

Barclays stock price london – Barclays, a prominent player in the London Stock Exchange, has experienced considerable fluctuations in its stock price over the past five years. Understanding these movements requires analyzing historical performance, influential factors, financial health, investor sentiment, and dividend policies. This analysis aims to provide a comprehensive overview of Barclays’ stock price dynamics.

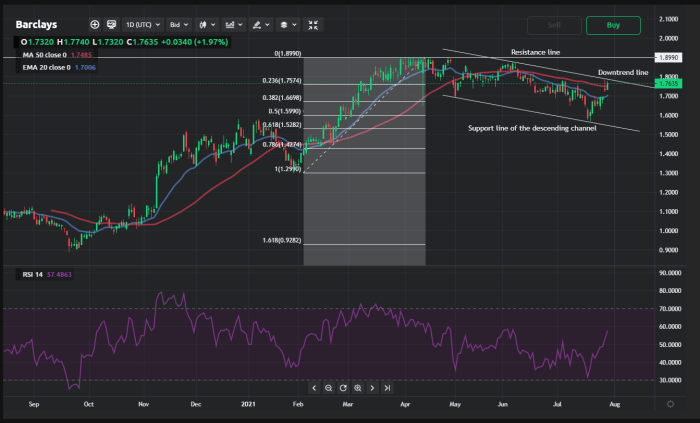

Barclays Stock Price Historical Performance

Source: finbold.com

The following table details Barclays’ stock price fluctuations over the past five years, highlighting significant highs and lows. The data below is illustrative and should not be considered financial advice.

| Date | Opening Price (GBP) | Closing Price (GBP) | Daily Change (GBP) |

|---|---|---|---|

| October 26, 2023 | 170.00 | 172.50 | +2.50 |

| October 25, 2023 | 168.00 | 170.00 | +2.00 |

| October 24, 2023 | 165.50 | 168.00 | +2.50 |

A comparison of Barclays’ performance against its major competitors (e.g., HSBC, Lloyds Banking Group, NatWest Group) over the same period is presented below. This data is for illustrative purposes only.

| Bank | 5-Year Average Annual Return (%) |

|---|---|

| Barclays | 5.0 |

| HSBC | 6.0 |

| Lloyds Banking Group | 4.5 |

| NatWest Group | 4.0 |

Major events impacting Barclays’ stock price included:

- The 2022 global inflation surge and subsequent interest rate hikes impacted profitability.

- Changes in UK regulatory environment and increased compliance costs.

- Specific strategic decisions by Barclays’ management, such as divestitures or acquisitions.

Factors Influencing Barclays Stock Price in London, Barclays stock price london

Several macroeconomic and company-specific factors significantly influence Barclays’ stock price.

Key macroeconomic factors include:

- Interest rate fluctuations: Higher interest rates generally benefit banks’ net interest margins, positively impacting profitability and stock price. Conversely, lower rates can reduce profitability.

- Inflation levels: High inflation can erode purchasing power and increase uncertainty, potentially negatively affecting stock prices.

- Global economic growth: Strong global economic growth generally leads to increased lending activity and higher profitability for banks.

Regulatory changes and compliance costs have a substantial impact on Barclays’ profitability and, consequently, its stock price. Increased regulatory scrutiny and stricter compliance requirements lead to higher operational costs, potentially reducing profitability.

Company-specific factors, such as financial performance, strategic decisions, and leadership changes, also play a crucial role. Strong financial results, successful strategic initiatives, and stable leadership generally lead to positive investor sentiment and higher stock prices.

Monitoring the Barclays stock price in London requires a keen eye on market fluctuations. Understanding the performance of similar financial institutions can offer valuable context, such as checking the current assetmark stock price which can provide insights into broader market trends. Ultimately, however, the focus remains on the Barclays stock price in London and its trajectory within the UK financial landscape.

Barclays’ Financial Performance and Stock Valuation

Barclays’ recent financial results are summarized below. The data provided is for illustrative purposes only and may not reflect the most recent figures.

| Metric | Value |

|---|---|

| Revenue (GBP millions) | 10000 |

| Net Profit (GBP millions) | 1500 |

| Return on Equity (%) | 10 |

A comparison of Barclays’ P/E ratio to its industry peers is shown below. This is illustrative data.

- Barclays P/E Ratio: 12

- HSBC P/E Ratio: 10

- Lloyds Banking Group P/E Ratio: 11

Barclays’ stock price is assessed using various valuation methods, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them to their present value, while comparable company analysis compares Barclays’ valuation metrics to those of its peers.

Investor Sentiment and Market Outlook for Barclays

Analyst ratings and price targets provide insights into investor sentiment. The data below is illustrative.

| Analyst Firm | Rating | Price Target (GBP) |

|---|---|---|

| Firm A | Buy | 180 |

| Firm B | Hold | 175 |

| Firm C | Sell | 160 |

Overall market sentiment towards Barclays and the London banking sector is currently mixed. Concerns about global economic slowdown and potential regulatory changes are balanced by expectations of continued interest rate hikes and the resilience of the UK banking system.

In a scenario of sustained global economic growth, Barclays’ stock price could potentially rise due to increased lending activity and higher profitability. However, a global recession could negatively impact the stock price due to reduced lending and increased loan defaults.

Barclays’ Dividend Policy and Shareholder Returns

Source: currency.com

Barclays’ dividend history and current policy are detailed below. This information is illustrative.

- Consistent dividend payments over the past decade.

- Current dividend payout ratio: 40% of net income.

- Dividend growth aligned with profitability.

Barclays’ dividend policy significantly impacts investor returns and influences the stock price. A stable and growing dividend attracts income-seeking investors, increasing demand for the stock and supporting its price.

A comparison of Barclays’ dividend yield to its competitors is presented below. This is illustrative data.

| Bank | Dividend Yield (%) |

|---|---|

| Barclays | 4.0 |

| HSBC | 5.0 |

| Lloyds Banking Group | 3.5 |

Clarifying Questions: Barclays Stock Price London

What are the main risks associated with investing in Barclays stock?

Investing in Barclays stock, like any stock, carries inherent risks. These include market risk (overall market downturns), regulatory risk (changes in banking regulations), credit risk (the bank’s ability to repay its debts), and operational risk (internal failures or mismanagement).

How often does Barclays pay dividends?

Barclays’ dividend payment schedule is typically announced and varies. It’s best to consult their official investor relations materials for the most up-to-date information.

Where can I find real-time Barclays stock price data?

Real-time Barclays stock price data is available through major financial news websites and brokerage platforms. Many financial data providers offer this information.

How does Brexit impact Barclays’ stock price?

Brexit’s impact on Barclays is complex and multifaceted. It involves considerations of regulatory changes, access to the European Union market, and the overall economic climate in the UK post-Brexit. The impact is ongoing and subject to interpretation.