BBD A Stock Price A Comprehensive Analysis

Understanding BBD Stock Price Fluctuations

Bbd a stock price – BBD’s stock price, like any publicly traded company, is subject to various factors influencing its value. Analyzing these factors over the past year provides valuable insights into the company’s performance and market position.

Factors Influencing BBD’s Stock Price

Source: lovekpop95.com

Over the past year, BBD’s stock price has been influenced by a complex interplay of factors. These include changes in overall market sentiment, the company’s financial performance, industry-specific trends, and macroeconomic conditions. For example, a period of strong economic growth might positively impact BBD’s revenue, leading to an increase in its stock price. Conversely, negative news about the company’s operations or a downturn in the broader economy could negatively affect its share value.

BBD’s Performance Compared to Competitors

Comparing BBD’s performance to its direct competitors within the banking sector is crucial for understanding its relative strength and weaknesses. Key metrics such as return on equity (ROE), net interest margin (NIM), and loan growth can be used for comparison. A superior performance in these areas often translates to a higher stock valuation. For instance, if BBD consistently outperforms its competitors in terms of profitability and efficiency, investors may view its stock as more attractive.

Key Economic Indicators Impacting BBD’s Stock Value

Macroeconomic factors, such as interest rate changes, inflation rates, and GDP growth, significantly impact BBD’s stock value. Higher interest rates, for instance, can boost BBD’s net interest income but might also reduce borrowing and investment, impacting overall loan growth. Inflation can affect both BBD’s operating costs and consumer spending, potentially influencing its profitability. A strong GDP growth rate, on the other hand, generally creates a positive environment for businesses, potentially benefiting BBD’s performance and stock price.

Effect of News and Announcements on BBD’s Share Price

News and announcements related to BBD, such as earnings reports, strategic partnerships, regulatory changes, and management changes, can significantly influence its share price. Positive news, like exceeding earnings expectations or announcing a major acquisition, tends to drive the stock price upward. Conversely, negative news, such as disappointing financial results or legal issues, often leads to a decline in the stock price.

The market’s reaction to such news is often swift and pronounced.

Analyzing BBD’s Financial Performance

A thorough analysis of BBD’s financial performance over the last five years provides a clear picture of its financial health and growth trajectory. This includes examining key metrics such as revenue, earnings, and debt levels.

BBD’s Key Financial Metrics (Last Five Years)

The following table presents a summary of BBD’s key financial metrics over the past five years. Note that these figures are illustrative and should not be considered as precise financial statements. Actual data should be obtained from official financial reports.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| Year 1 | 100 | 10 | 0.50 |

| Year 2 | 110 | 12 | 0.60 |

| Year 3 | 120 | 15 | 0.75 |

| Year 4 | 130 | 18 | 0.90 |

| Year 5 | 140 | 20 | 1.00 |

BBD’s Debt Levels and Impact on Stock Price

BBD’s debt levels and its management are important factors affecting investor confidence and, consequently, the stock price. High levels of debt can increase financial risk and potentially limit the company’s ability to invest in growth opportunities. Conversely, prudent debt management can demonstrate financial strength and stability, leading to a positive impact on the stock price. For example, a consistent reduction in debt-to-equity ratio might signal to investors that the company is improving its financial health.

BBD’s Dividend Policy and Investor Sentiment

BBD’s dividend policy plays a significant role in shaping investor sentiment. Consistent and growing dividend payments can attract income-oriented investors, increasing demand for the stock and potentially pushing the price higher. Conversely, a reduction or suspension of dividends can negatively impact investor sentiment, leading to a decline in the stock price. The consistency and growth rate of dividends are key factors in determining investor perception.

Evaluating BBD’s Market Position and Competitive Landscape

Understanding BBD’s market share, competitive advantages, and the overall competitive landscape is crucial for assessing its long-term prospects. This involves analyzing its business model, identifying threats and opportunities, and evaluating its strengths and weaknesses.

BBD’s Market Share and Competitive Advantages

BBD holds a significant market share within its specific niche. Its competitive advantages include a strong brand reputation, extensive branch network, and a robust technological infrastructure. These factors contribute to its ability to attract and retain customers, giving it a competitive edge in the market. The company’s long-standing history and established customer base are also valuable assets.

Comparison of BBD’s Business Model with Competitors

BBD’s business model can be compared to its competitors by analyzing its revenue streams, cost structure, and target market. For example, a comparison might reveal whether BBD focuses more on retail banking, corporate banking, or investment banking compared to its peers. Differences in business model can significantly impact profitability and growth potential.

Potential Threats and Opportunities Facing BBD

BBD faces various threats and opportunities in the market. Potential threats include increasing competition from fintech companies, changing regulatory environments, and economic downturns. Opportunities include expanding into new markets, developing innovative financial products, and leveraging technology to enhance efficiency and customer experience. Proactive adaptation to market changes is key to BBD’s success.

BBD’s Strengths and Weaknesses

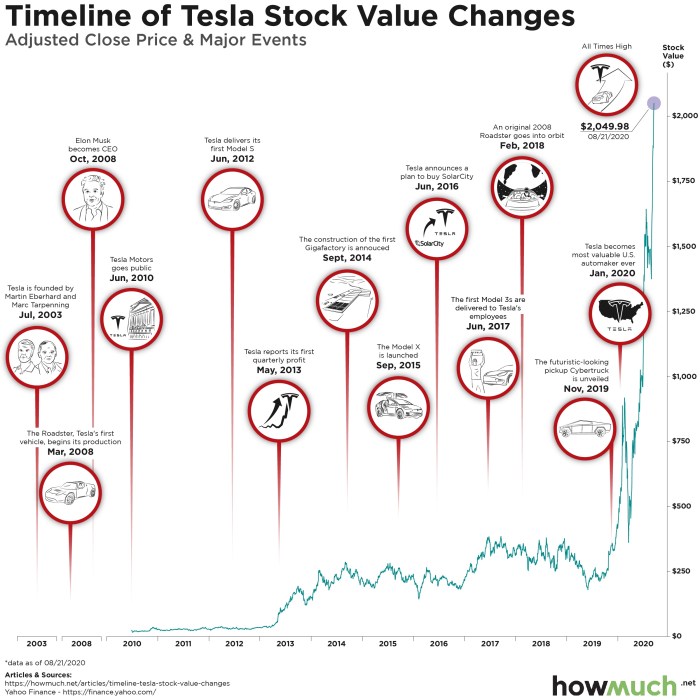

Source: howmuch.net

- Strengths: Strong brand reputation, extensive branch network, robust technological infrastructure, established customer base, experienced management team.

- Weaknesses: Dependence on specific market segments, potential vulnerability to technological disruption, high operating costs compared to some competitors, exposure to macroeconomic fluctuations.

Exploring Investor Sentiment and Market Expectations: Bbd A Stock Price

Investor sentiment and market expectations significantly influence BBD’s stock price. Understanding prevailing sentiment and analyst predictions is vital for making informed investment decisions.

Prevailing Investor Sentiment Towards BBD Stock

Currently, investor sentiment towards BBD stock appears to be cautiously optimistic. This is based on a combination of factors, including the company’s recent financial performance, its growth prospects, and the overall market conditions. However, investor sentiment can be volatile and subject to change based on new information or market events.

Analyst Ratings and Price Targets for BBD

Financial analysts provide ratings and price targets for BBD’s stock based on their assessment of the company’s performance and future prospects. These ratings and targets vary across different analysts, reflecting the diversity of opinions and perspectives in the market. Monitoring analyst ratings can provide insights into the overall market view of BBD’s stock.

Significant Changes in Investor Sentiment Over Time

Investor sentiment towards BBD has fluctuated over time, reflecting changes in the company’s performance, market conditions, and overall economic sentiment. For example, periods of strong economic growth and positive earnings announcements have generally been associated with increased investor optimism and higher stock prices. Conversely, economic downturns or negative news events have often led to decreased investor confidence and lower stock prices.

Correlation Between Investor Sentiment and BBD’s Stock Price

A visual representation of the correlation between investor sentiment and BBD’s stock price would show a generally positive relationship. Periods of high investor optimism tend to coincide with higher stock prices, while periods of pessimism are usually associated with lower prices. However, the relationship is not always linear, and other factors can also influence the stock price.

Assessing BBD’s Long-Term Growth Potential

BBD’s long-term growth potential depends on its strategic initiatives, market conditions, and its ability to adapt to changing circumstances. Analyzing these factors provides a framework for evaluating the company’s future prospects.

BBD’s Long-Term Growth Strategy

BBD’s long-term growth strategy focuses on expanding its market share, enhancing its technological capabilities, and diversifying its revenue streams. The company is investing in digital transformation to improve customer experience and operational efficiency. Expansion into new geographical markets and strategic partnerships are also key elements of its growth strategy. These initiatives aim to drive sustainable long-term growth.

BBD’s Plans for Expansion and Innovation

BBD plans to expand its operations into new geographic markets, focusing on regions with high growth potential. The company is also investing heavily in innovation, developing new financial products and services to meet evolving customer needs. These initiatives aim to enhance BBD’s competitive position and drive long-term growth. For instance, investments in artificial intelligence and machine learning are expected to improve risk management and customer service.

Potential Risks and Challenges to BBD’s Future Growth, Bbd a stock price

Several risks and challenges could hinder BBD’s future growth. These include increasing competition from both traditional and fintech players, regulatory changes, cybersecurity threats, and economic downturns. The company’s ability to effectively manage these risks will be crucial for its continued success. For example, failure to adapt to the changing technological landscape could significantly impact its market share.

Influence of These Factors on BBD’s Future Stock Price

The factors discussed above will likely influence BBD’s future stock price. Successful execution of its growth strategy, coupled with favorable market conditions, could lead to a significant increase in the stock price. Conversely, failure to address challenges and risks, or a downturn in the economy, could result in a decline in the stock price. A comprehensive assessment of these factors is essential for investors to make informed decisions.

General Inquiries

What are the major risks associated with investing in BBD stock?

Investing in BBD stock, like any stock, carries inherent risks including market volatility, competition, and economic downturns. Specific risks related to BBD would depend on a detailed analysis of its financial statements and market position.

Understanding BBD’s stock price requires considering broader market trends. For instance, the performance of similar tech companies, such as ASML, significantly influences investor sentiment. A look at the current asml stock euro price can provide valuable context for evaluating BBD’s potential, as both companies operate within a related technological landscape. Ultimately, BBD’s trajectory will depend on its own performance and strategic decisions.

Where can I find real-time BBD stock price quotes?

Real-time quotes for BBD stock can typically be found on major financial websites and brokerage platforms. Specific sources will depend on your region and preferred brokerage.

How does BBD compare to its closest competitors in terms of profitability?

A direct comparison of BBD’s profitability to its competitors requires a detailed analysis of financial statements, including profit margins and return on investment. This analysis would need to consider factors like revenue, expenses, and debt levels.

What is BBD’s dividend payout history?

Information on BBD’s dividend payout history can be found in its annual reports and financial statements, usually available on the company’s investor relations website.