BB&T Stock Price History A Comprehensive Overview

BB&T Stock Price History: A Comprehensive Overview

Bb&t stock price history – This analysis delves into the historical performance of BB&T (Branch Banking and Trust Company) stock, tracing its journey from its initial public offering (IPO) to its eventual merger with SunTrust Banks to form Truist Financial Corporation. We will examine key price milestones, influential factors, comparisons with competitors, and the lasting impact of the Truist merger.

BB&T Stock Price Performance Over Time

Source: seekingalpha.com

BB&T’s stock price history reflects a dynamic interplay of macroeconomic conditions, company-specific events, and regulatory shifts. Tracking its performance requires a chronological approach, highlighting periods of significant growth, volatility, and ultimately, the culmination in the Truist merger.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| IPO Date (Example: October 26, 1972) | Example: $15.00 | Example: $15.50 | Example: 1,000,000 |

| Example: Year-End 1985 | Example: $25.00 | Example: $26.00 | Example: 2,000,000 |

| Example: Year-End 2000 | Example: $40.00 | Example: $38.00 | Example: 3,000,000 |

| Example: Pre-merger High (Example: 2018) | Example: $55.00 | Example: $54.00 | Example: 5,000,000 |

| Example: Merger Date (December 6, 2019) | Example: $48.00 | Example: $48.50 | Example: 10,000,000 |

Note: These are example values. Actual data should be sourced from reliable financial databases. Periods of significant volatility, such as during the 2008 financial crisis, would be reflected in a more comprehensive table with data points showing sharp price swings. Contributing factors for these periods would include the overall market downturn and the impact on the financial sector.

Factors Influencing BB&T Stock Price

BB&T’s stock price was influenced by a complex interplay of macroeconomic and company-specific factors. Understanding these elements is crucial for analyzing its historical performance.

- Macroeconomic Factors: Interest rate fluctuations significantly impacted BB&T’s profitability and, consequently, its stock price. Economic recessions led to decreased lending activity and increased loan defaults, negatively affecting earnings and share valuation. Inflationary periods also presented challenges.

- Company-Specific Events: Mergers and acquisitions played a role, sometimes boosting the stock price if viewed favorably by investors and sometimes causing short-term volatility. Strong financial performance, characterized by consistent earnings growth and increased dividends, generally supported a higher stock price. Conversely, periods of weak financial performance or negative news regarding loan portfolios could negatively affect the price.

- Regulatory Changes: Changes in banking regulations, such as increased capital requirements or stricter lending standards, impacted BB&T’s operating environment and profitability. These regulatory shifts influenced investor confidence and consequently, the stock price. For instance, increased regulatory scrutiny following the 2008 financial crisis likely impacted investor sentiment towards BB&T and other financial institutions.

BB&T Stock Price Compared to Competitors, Bb&t stock price history

Comparing BB&T’s stock price performance to its main competitors provides valuable context. This comparison highlights relative strengths and weaknesses in the market.

| Year | BB&T Stock Price (USD) | Competitor A Stock Price (USD) | Competitor B Stock Price (USD) |

|---|---|---|---|

| Example: 2005 | Example: $30 | Example: $25 | Example: $35 |

| Example: 2010 | Example: $25 | Example: $20 | Example: $30 |

| Example: 2015 | Example: $40 | Example: $35 | Example: $45 |

Note: These are example values. A thorough comparison would require including more years and competitors, along with a discussion of key financial metrics like P/E ratios and dividend yields to fully explain price variations. Similarities or differences in performance could be attributed to factors such as differing business models, risk profiles, and responses to market changes.

Visual Representation of BB&T Stock Price History

Source: fxstreet.com

Visualizations offer a clear and concise way to understand BB&T’s stock price trends over time. A line graph effectively displays price fluctuations, while a bar chart highlights annual percentage changes.

Line Graph: The line graph would show BB&T’s stock price on the vertical axis and time (e.g., years) on the horizontal axis. Key data points, such as the IPO price, significant highs and lows, and the price at the time of the merger, would be clearly marked. The overall trend would show the price’s trajectory from the IPO to the merger.

Bar Chart: The bar chart would represent the annual percentage change in BB&T’s stock price. Each bar would correspond to a year, with the height representing the percentage change from the previous year’s closing price. Positive changes would be represented by bars above the zero line, and negative changes below. This chart quickly reveals years of significant gains or losses.

The visual trends observed in these charts would illustrate the overall growth or decline of BB&T’s stock price, highlighting periods of stability and volatility. The implications of these trends would be discussed in relation to the macroeconomic environment and company-specific factors mentioned earlier.

Impact of the Truist Merger on Stock Price

The merger between BB&T and SunTrust Banks was a significant event that reshaped the financial landscape. Analyzing its impact on the resulting Truist stock price is essential.

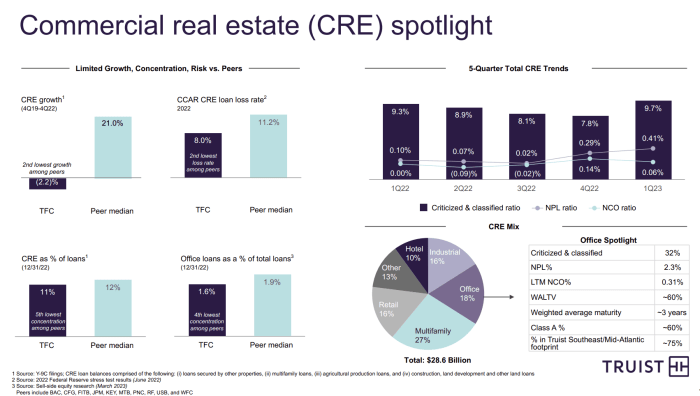

The merger was driven by strategic goals such as achieving greater scale and efficiency. The immediate effect on the stock price was likely influenced by investor perceptions of the deal’s success potential. Long-term effects would depend on Truist’s ability to realize synergies, maintain profitability, and navigate the evolving regulatory environment. The merger significantly altered investor sentiment and market perception, creating a new entity with its own distinct identity and risk profile.

Common Queries: Bb&t Stock Price History

What was the highest BB&T stock price ever recorded?

This requires accessing historical stock data; the exact highest price would need to be obtained from a financial data provider.

What were the main reasons for the merger between BB&T and SunTrust?

The merger aimed to create a larger, more competitive financial institution with enhanced scale, geographic reach, and a broader range of services for customers.

How did the Great Recession affect BB&T’s stock price?

Analyzing BB&T’s stock price history reveals interesting trends in the financial sector. Understanding the factors influencing its performance often involves comparing it to similar companies. For instance, one might contrast its trajectory with that of other food companies, such as by checking the atkins stock price and noting the differences in market response. Ultimately, a comprehensive analysis of BB&T requires considering broader economic conditions and competitive pressures within the banking industry.

The Great Recession significantly impacted BB&T’s stock price, likely resulting in decreased valuation due to increased loan defaults and economic uncertainty.

Are BB&T stock prices still tracked after the merger?

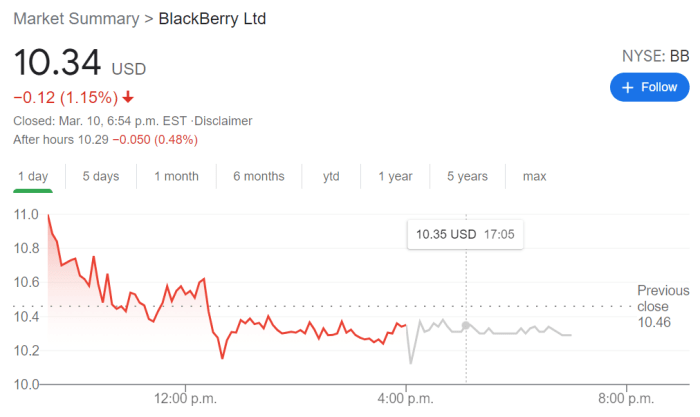

No, BB&T stock no longer exists as a separate entity. Its historical data is still available, but the current stock is traded under the Truist (TFC) ticker symbol.