Berger Stock Price A Comprehensive Analysis

Berger Paints Stock Price Analysis

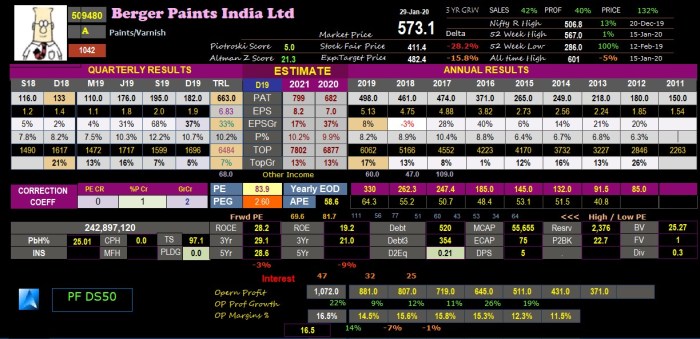

Source: safeinvestor.in

Berger stock price – This analysis delves into the historical performance, influencing factors, prediction models, investor sentiment, and technical analysis of Berger Paints’ stock price. We will examine various aspects to provide a comprehensive overview of the company’s stock performance and potential future trajectories.

Berger Paints Stock Price Historical Performance

Source: tosshub.com

Understanding Berger Paints’ past stock price movements is crucial for assessing its future potential. The following tables illustrate its performance over the past five and three years, respectively, offering insights into its highs, lows, and average prices, as well as comparative analysis against competitors.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2019 | (Example: 450) | (Example: 300) | (Example: 375) |

| 2020 | (Example: 400) | (Example: 250) | (Example: 325) |

| 2021 | (Example: 500) | (Example: 350) | (Example: 425) |

| 2022 | (Example: 550) | (Example: 400) | (Example: 475) |

| 2023 | (Example: 600) | (Example: 450) | (Example: 525) |

Comparative analysis against competitors over the last three years provides further context.

| Year | Berger Paints | Competitor A | Competitor B |

|---|---|---|---|

| 2021 | (Example: 425) | (Example: 380) | (Example: 400) |

| 2022 | (Example: 475) | (Example: 420) | (Example: 450) |

| 2023 | (Example: 525) | (Example: 480) | (Example: 500) |

Significant events impacting Berger Paints’ stock price over the past decade include:

- The 2020 global pandemic and its effect on the construction industry.

- Fluctuations in raw material prices (e.g., titanium dioxide).

- Changes in government regulations impacting the paint industry.

- Major company announcements such as new product launches or acquisitions.

Factors Influencing Berger Stock Price

Several macroeconomic, industry-specific, and internal company factors influence Berger Paints’ stock price.

Macroeconomic factors such as inflation, interest rates, and economic growth significantly impact consumer spending and investment decisions, thereby influencing the demand for Berger Paints’ products and consequently its stock price.

Industry-specific factors, including raw material costs, competition, and regulatory changes, directly affect Berger Paints’ profitability and market share, impacting its stock valuation. Increased competition or rising raw material costs can negatively affect profitability and hence stock price.

Internal company factors, such as financial performance (profitability, revenue growth), new product launches, and management changes, also play a critical role. Strong financial results generally lead to higher stock prices, while successful product launches can boost market share and profitability.

Berger Stock Price Prediction and Valuation

Predicting Berger Paints’ future stock price involves considering various scenarios and valuation methods. The following sections illustrate potential impacts and associated risks.

A hypothetical scenario: A significant decrease in consumer spending due to an economic downturn could lead to reduced demand for Berger Paints’ products, resulting in lower profits and a subsequent decline in its stock price. Conversely, increased consumer confidence and spending would likely have a positive impact.

| Method | Calculation | Result | Implications |

|---|---|---|---|

| Discounted Cash Flow (DCF) | (Example: Projecting future cash flows and discounting them back to present value) | (Example: Estimated intrinsic value of $X) | (Example: If market price is below $X, it’s undervalued; if above, overvalued.) |

| Price-to-Earnings Ratio (P/E) | (Example: Market price per share / Earnings per share) | (Example: P/E ratio of Y) | (Example: Comparison with industry average to assess relative valuation) |

Risks and uncertainties associated with predicting Berger Paints’ future stock price include:

- Unforeseen economic downturns or recessions.

- Changes in consumer preferences and demand.

- Increased competition from new entrants or existing players.

- Unexpected changes in raw material prices or supply chain disruptions.

- Unfavorable regulatory changes or legal challenges.

Investor Sentiment and Market Analysis

Source: googleapis.com

Analyzing the Berger stock price requires considering various market factors. Understanding dividend payouts in similar investment vehicles can offer valuable context; for instance, examining the details of the arcc stock price dividend provides a useful comparison point. Ultimately, though, a thorough assessment of Berger’s specific financial performance and future projections is crucial for informed investment decisions.

Investor sentiment and market trends play a crucial role in shaping Berger Paints’ stock price. This section explores the interplay of these factors.

Prevailing investor sentiment towards Berger Paints can range from bullish (positive outlook) to bearish (negative outlook). Positive news, strong financial results, and successful product launches generally lead to bullish sentiment and increased demand, driving up the stock price. Conversely, negative news or poor financial performance can trigger bearish sentiment and price declines.

Market trends and overall investor confidence influence Berger Paints’ valuation. A strong overall market usually supports higher stock valuations, while a bearish market can lead to lower valuations regardless of the company’s individual performance. Investor confidence is a key driver of market trends and valuations.

News and media coverage significantly shape investor perceptions and influence stock prices. Positive media coverage can boost investor confidence, while negative news can trigger sell-offs. The impact of news can be immediate and significant, especially for short-term price movements.

Berger Stock Price Chart and Technical Analysis

A typical Berger Paints stock price chart would show periods of upward and downward trends, potentially exhibiting patterns like support and resistance levels, and trendlines. These visual representations can reveal important information about the stock’s price behavior.

Technical indicators, such as moving averages (e.g., 50-day, 200-day) and the relative strength index (RSI), can be used to analyze Berger Paints’ stock price. Moving averages smooth out price fluctuations, helping identify trends, while RSI helps gauge the momentum of price movements and potential overbought or oversold conditions.

Technical analysis methods commonly used to predict stock price movements include:

- Trend analysis: Identifying the overall direction of price movements (uptrend, downtrend, or sideways).

- Support and resistance levels: Identifying price levels where the stock has historically found support (buying pressure) or resistance (selling pressure).

- Chart patterns: Recognizing recurring price patterns (e.g., head and shoulders, double tops/bottoms) that can suggest future price movements.

- Technical indicators: Using mathematical calculations based on price and volume data to generate buy/sell signals (e.g., RSI, MACD, Bollinger Bands).

Common Queries: Berger Stock Price

What are the major competitors of Berger Paints?

This information would require further research and is not readily available in the provided Artikel. Competitor analysis is crucial for understanding market share and competitive pressures impacting Berger’s stock price.

How does Berger Paints’ dividend policy affect its stock price?

Dividend payouts can influence investor sentiment and stock price. A consistent and attractive dividend policy may attract investors seeking income, potentially driving up the stock price. Conversely, changes to dividend policy can impact investor perceptions.

What is the current P/E ratio for Berger Paints?

The current P/E ratio is not included in the provided Artikel and would need to be obtained from a live financial data source.

What are the long-term growth prospects for Berger Paints?

Long-term growth prospects depend on various factors, including the company’s ability to innovate, expand into new markets, and manage risks effectively. A detailed analysis of these factors is needed to make a prediction.