Berkshire Hathaway Stock A Share Price Analysis

Berkshire Hathaway Stock A Share Price Analysis

Berkshire hathaway stock a share price – Berkshire Hathaway, the conglomerate led by Warren Buffett, has a long and storied history, reflected in the performance of its Class A shares. Understanding the factors driving its share price requires a multifaceted analysis encompassing historical performance, investment portfolio composition, financial health, market sentiment, competitive landscape, and future prospects. This analysis will delve into each of these aspects to provide a comprehensive overview of Berkshire Hathaway’s stock price.

Berkshire Hathaway Stock Price History, Berkshire hathaway stock a share price

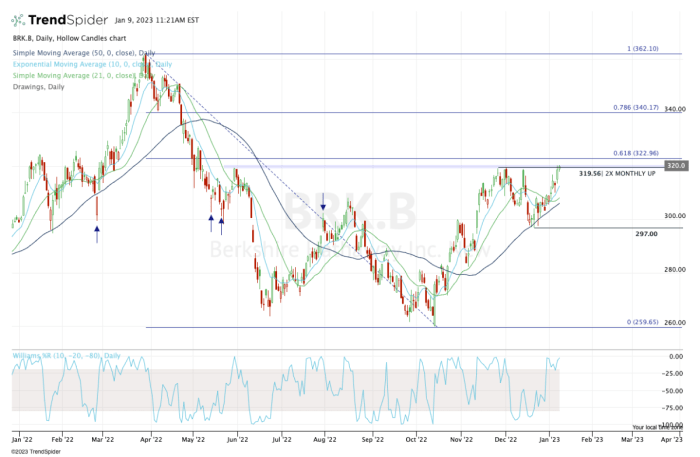

Analyzing Berkshire Hathaway’s stock price over the past two decades reveals a pattern of significant growth punctuated by periods of volatility. A line graph depicting this would show a generally upward trend, but with notable dips corresponding to major economic downturns like the 2008 financial crisis and the COVID-19 pandemic. The recovery from these dips, however, has been consistently strong, highlighting the resilience of the company’s underlying businesses and investment strategy.

Specific price fluctuations can be correlated to events such as major acquisitions (e.g., Burlington Northern Santa Fe Railroad), changes in market conditions, and shifts in investor sentiment regarding the company’s future prospects.

A comparative table against the S&P 500 over the past five years would showcase Berkshire Hathaway’s outperformance in terms of average annual returns, although it might also reveal higher volatility compared to the broader market index. This highlights the inherent risk associated with investing in a concentrated portfolio of businesses, but also the potential for greater rewards. Factors such as macroeconomic conditions, industry-specific trends (like insurance market cycles), and the success or failure of Berkshire’s significant investments all influence the share price.

For instance, a downturn in the insurance sector would likely impact Berkshire’s share price, while strong performance in its holdings in companies like Apple would likely positively influence it.

Berkshire Hathaway’s Investment Portfolio Influence

Berkshire Hathaway’s investment portfolio is a significant driver of its share price. The portfolio is incredibly diverse, spanning across various sectors and asset classes, with significant holdings in publicly traded companies like Apple, Bank of America, and Coca-Cola. The value of these holdings directly impacts Berkshire’s overall net asset value, which in turn influences investor perception and share price.

A detailed breakdown of the portfolio’s composition would illustrate the concentration in certain sectors and the impact of individual holdings’ performance on the overall stock price. A strong positive correlation would likely be observed between the performance of major investments and the overall stock price performance. For example, a significant increase in Apple’s stock price would generally lead to a rise in Berkshire Hathaway’s share price.

Changes in the value of Berkshire’s portfolio holdings significantly affect investor sentiment. Positive news about a major holding, such as a strong earnings report, typically leads to increased investor confidence and a rise in Berkshire’s share price. Conversely, negative news or poor performance by a major holding can cause a decline in investor sentiment and a drop in the share price.

This underscores the importance of monitoring the performance of Berkshire’s key investments.

Financial Performance and Share Price

Source: capital.com

Berkshire Hathaway’s financial performance, as measured by key metrics such as earnings per share (EPS), book value per share, and revenue growth, has a strong correlation with its share price. A table outlining these metrics over several years would demonstrate this relationship. Consistent profitability and robust revenue growth generally translate to a higher share price, reflecting investor confidence in the company’s long-term prospects.

Conversely, periods of lower profitability or slower growth can negatively impact investor sentiment and the share price.

Berkshire Hathaway’s lack of a dividend policy is a significant factor influencing its share price. While some investors prefer dividend-paying stocks for consistent income, others view Berkshire’s reinvestment of earnings as a more effective way to generate long-term value. This strategy, while potentially limiting short-term gains for some investors, contributes to the company’s long-term growth and overall share price appreciation.

Market Sentiment and Share Price

Source: thestreet.com

Market sentiment towards Berkshire Hathaway is shaped by various factors, including the overall economic climate, investor confidence in the company’s management, and the performance of its major investments. News events, both company-specific (e.g., major acquisitions, changes in management) and macroeconomic (e.g., interest rate hikes, recessions), significantly influence investor perception and subsequently the share price. Positive news generally leads to increased demand and a higher share price, while negative news can trigger selling pressure and a price decline.

Analyst ratings and recommendations play a crucial role in shaping market sentiment. Positive ratings from reputable analysts often boost investor confidence and attract new buyers, leading to a rise in the share price. Conversely, negative ratings or downgrades can negatively impact investor sentiment and cause the share price to fall. The consensus view among analysts is often a key factor in determining market sentiment and influencing share price movements.

Comparison with Competitors

Comparing Berkshire Hathaway’s share price performance with its main competitors in the insurance and investment sectors provides valuable insights into its relative strength and market positioning. A table comparing key financial and performance metrics (e.g., return on equity, market capitalization, price-to-book ratio) for Berkshire Hathaway and its competitors would highlight differences in their performance. Factors such as investment strategies, risk profiles, and management styles contribute to the variations in share price performance among these companies.

For example, a competitor with a more aggressive investment strategy might experience higher volatility, while a company with a focus on stable, dividend-paying stocks might show less dramatic price swings.

Future Outlook and Valuation

Predicting Berkshire Hathaway’s future share price is inherently challenging, but analyzing potential influencing factors provides a basis for informed speculation. Factors such as the overall economic environment, the performance of its underlying businesses, and the success of its investment strategy will all play significant roles. Various valuation methods, including discounted cash flow analysis, price-to-book ratio, and comparable company analysis, can be employed to estimate Berkshire Hathaway’s intrinsic value and assess whether its current share price is undervalued or overvalued.

A table summarizing the results of different valuation approaches and their resulting estimated share prices would provide a range of potential outcomes.

General Inquiries

What are the risks associated with investing in Berkshire Hathaway stock?

Like any investment, Berkshire Hathaway stock carries inherent risks. These include market risk (overall market downturns), company-specific risks (unexpected losses in Berkshire’s holdings), and the lack of a dividend. Investors should carefully assess their risk tolerance before investing.

How often does Berkshire Hathaway’s share price fluctuate?

Berkshire Hathaway’s share price, while generally considered less volatile than many other stocks, does fluctuate daily, influenced by market conditions and news affecting the company or its holdings. The degree of fluctuation can vary significantly depending on broader market trends.

Where can I find real-time Berkshire Hathaway stock quotes?

Berkshire Hathaway’s share price is often a benchmark for long-term investment strategies. However, understanding the broader market is crucial, and examining the performance of other companies provides valuable context. For instance, checking the current value of amwell stock price today offers insight into the healthcare technology sector, which can indirectly influence Berkshire’s holdings and overall investment strategy.

Ultimately, Berkshire Hathaway’s stock price remains a compelling indicator of market sentiment and long-term economic trends.

Real-time quotes for Berkshire Hathaway (BRK.A and BRK.B) are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.