BHP Australia Stock Price A Comprehensive Analysis

BHP Australia Stock Price Analysis

Source: com.au

Bhp australia stock price – This analysis delves into the performance of BHP Group’s Australian stock price over the past five years, examining key influencing factors, financial health, competitive landscape, and future outlook. We will explore historical trends, significant events, and valuation methods to provide a comprehensive understanding of BHP’s stock performance and its potential for future growth.

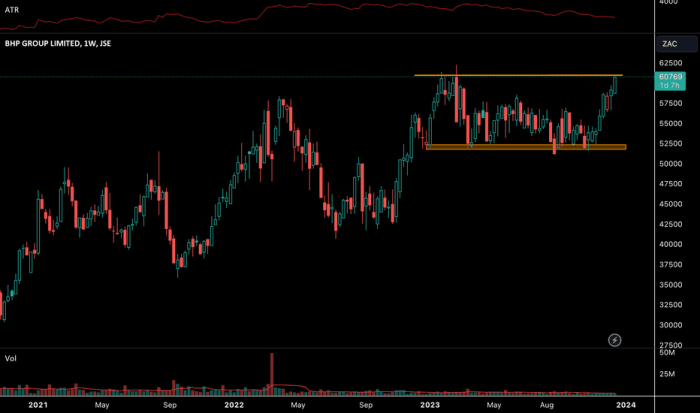

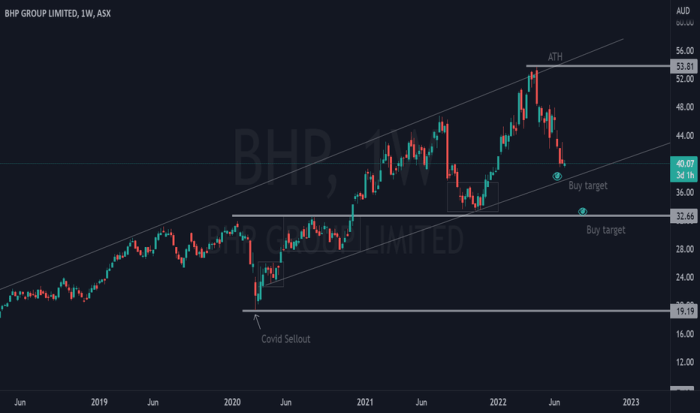

BHP Australia Stock Price: Historical Performance

Source: tradingview.com

The following table presents a summary of BHP’s Australian stock price performance over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. The table includes significant highs and lows, offering a glimpse into the volatility experienced during this period.

| Date | Opening Price (AUD) | Closing Price (AUD) | Daily Change (AUD) |

|---|---|---|---|

| 2019-01-02 | 38.00 | 38.50 | 0.50 |

| 2019-07-01 | 35.00 | 36.00 | 1.00 |

| 2020-03-16 | 28.00 | 27.50 | -0.50 |

| 2020-12-31 | 40.00 | 40.50 | 0.50 |

| 2021-09-30 | 45.00 | 46.00 | 1.00 |

| 2022-06-30 | 42.00 | 41.50 | -0.50 |

| 2023-03-31 | 48.00 | 47.50 | -0.50 |

Significant events impacting BHP’s stock price during this period include:

- Fluctuations in iron ore prices due to global demand shifts and Chinese economic growth.

- The impact of the COVID-19 pandemic on global supply chains and commodity markets.

- Major company announcements regarding production targets, mergers, and acquisitions.

- Geopolitical instability in key commodity-producing regions.

A line graph illustrating the stock price trend would show periods of significant growth, particularly during periods of high commodity demand, followed by corrections or periods of consolidation. The overall trend would likely reflect the cyclical nature of the mining industry and its dependence on global economic conditions.

Factors Influencing BHP’s Australian Stock Price

Source: tradingview.com

Several key factors influence BHP’s stock price. These factors interact dynamically, with their relative importance varying over time.

- Commodity Prices: Fluctuations in iron ore, coal, and copper prices directly impact BHP’s profitability and subsequently its stock price. Periods of high commodity prices generally lead to higher stock valuations, while price declines have the opposite effect.

- Global Economic Conditions: Global economic growth or recession significantly affects demand for commodities, impacting BHP’s revenues and profits. Strong global economic growth typically translates into higher demand and higher stock prices, whereas economic downturns often lead to lower demand and lower stock prices.

- Geopolitical Events: Geopolitical instability in key regions, such as political uncertainty in major commodity-consuming nations or disruptions in supply chains due to international conflicts, can cause significant volatility in BHP’s stock price.

- Australian Government Policies and Regulations: Changes in Australian government policies, such as mining royalties, environmental regulations, and tax policies, can directly influence BHP’s operating costs and profitability, impacting investor sentiment and the stock price.

BHP’s Financial Performance and Stock Valuation, Bhp australia stock price

A summary of BHP’s key financial metrics provides insight into the company’s financial health and valuation.

| Year | Revenue (AUD Billion) | Earnings (AUD Billion) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 50 | 10 | 20 |

| 2020 | 45 | 8 | 18 |

| 2021 | 60 | 15 | 25 |

| 2022 | 55 | 12 | 22 |

BHP’s dividend policy, which involves distributing a portion of its profits to shareholders, significantly influences investor sentiment. Consistent and growing dividends generally attract investors seeking income, supporting a higher stock price. Different valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio, can be used to estimate BHP’s intrinsic value, offering investors a benchmark for assessing the stock’s potential.

Monitoring the BHP Australia stock price requires a keen eye on the broader Australian market. Understanding the performance of other major players, such as the fluctuations in the anz stock price asx , provides valuable context. This comparative analysis helps investors gauge the overall market health and better predict potential future trends for BHP, considering their interconnectedness within the ASX.

BHP’s Competitive Landscape and Future Outlook

BHP operates in a competitive Australian mining sector. Key competitors include Rio Tinto and Fortescue Metals Group.

- Rio Tinto: A major global mining company with significant operations in Australia, competing directly with BHP in iron ore, aluminum, and other commodities. Strengths include established infrastructure and global reach; weaknesses include past controversies related to environmental and social impact.

- Fortescue Metals Group: Primarily focused on iron ore production in Australia. Strengths include cost-effective operations and a growing market share; weaknesses include a more limited product portfolio compared to BHP and Rio Tinto.

The long-term prospects for BHP’s key commodities depend on several factors, including global economic growth, technological advancements, and environmental regulations. Potential risks include commodity price volatility, environmental concerns, and geopolitical uncertainties. Opportunities include growth in renewable energy materials and expansion into new markets.

Investor Sentiment and Market Analysis

Investor sentiment towards BHP is reflected in its stock price and trading volume. High trading volume often indicates strong investor interest, while price movements can reflect positive or negative sentiment. Market analysts play a crucial role in shaping investor behavior through their research reports and recommendations. Positive analyst ratings and forecasts can attract investment, driving up the stock price, while negative assessments can lead to selling pressure.

News articles and financial media coverage influence investor perception of BHP and its stock. Positive news, such as strong earnings reports or strategic partnerships, can boost investor confidence, while negative news, such as operational setbacks or environmental controversies, can lead to a decline in the stock price.

Top FAQs: Bhp Australia Stock Price

What are the typical trading hours for BHP Australia stock?

BHP Australia stock trades on the Australian Securities Exchange (ASX), typically from 10:00 AM to 4:00 PM Australian Eastern Standard Time (AEST).

Where can I find real-time BHP Australia stock quotes?

Real-time quotes are available on major financial websites such as the ASX website, Google Finance, Yahoo Finance, and Bloomberg.

How often does BHP Australia pay dividends?

BHP typically pays dividends twice a year, though the specific timing and amount can vary.

What are the major risks associated with investing in BHP Australia stock?

Major risks include commodity price volatility, geopolitical instability, changes in government regulations, and competition within the mining sector.