Bidu Stock Price Prediction A Comprehensive Analysis

Bidu Stock Price Prediction: A Comprehensive Analysis

Bidu stock price prediction – Predicting stock prices is inherently complex, involving numerous intertwined factors. This analysis delves into Bidu’s business model, market dynamics, financial performance, and predictive modeling techniques to offer a reasoned perspective on potential future stock price movements. It is crucial to remember that any prediction carries inherent uncertainty and should not be considered financial advice.

Bidu’s Business Model, Bidu stock price prediction

Bidu’s core business revolves around [describe Bidu’s core business, e.g., providing online advertising services, e-commerce platform, etc.]. Its primary revenue streams include [list revenue streams, e.g., advertising revenue, transaction fees, subscription fees], with [specify the relative contribution of each revenue stream to overall profitability, e.g., advertising revenue accounting for 70% of total revenue]. Bidu’s revenue growth is primarily influenced by [list key factors, e.g., expansion into new markets, increased user engagement, innovative product offerings].

Potential challenges include [list potential challenges, e.g., increasing competition, regulatory changes, economic downturns]. Compared to major competitors like [list competitors, e.g., Alibaba, Tencent], Bidu distinguishes itself through [describe Bidu’s unique competitive advantages, e.g., strong brand recognition in a specific niche, superior technology, etc.].

| Year | Revenue (USD Million) | Net Income (USD Million) | EPS (USD) |

|---|---|---|---|

| 2018 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

Market Analysis and Competitive Landscape

Bidu operates within a highly competitive landscape. Key players include [list key players and briefly describe their strengths and weaknesses]. Overall market trends suggest [describe market trends, e.g., increasing adoption of mobile advertising, growth in e-commerce, etc.], which could [explain potential impact on Bidu’s stock price, e.g., positively impact revenue growth, increase competition, etc.]. The regulatory environment, particularly concerning [mention specific regulations, e.g., data privacy, antitrust laws], could significantly influence Bidu’s operations.

SWOT Analysis of Bidu

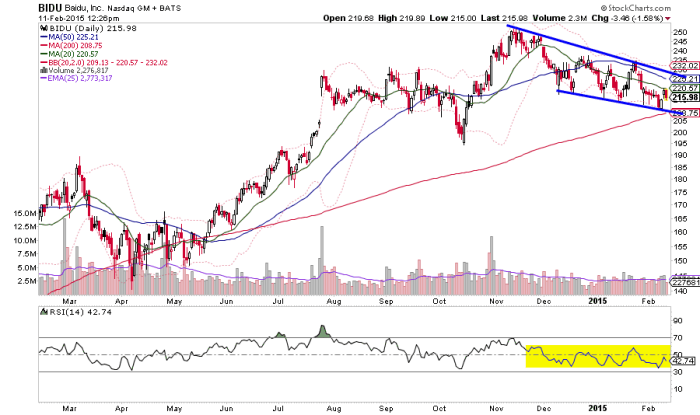

Source: seeitmarket.com

- Strengths: [List Bidu’s strengths, e.g., strong brand recognition, technological expertise, established market position]

- Weaknesses: [List Bidu’s weaknesses, e.g., dependence on advertising revenue, vulnerability to regulatory changes, competition from established players]

- Opportunities: [List Bidu’s opportunities, e.g., expansion into new markets, development of innovative products, strategic partnerships]

- Threats: [List Bidu’s threats, e.g., intense competition, economic downturns, changes in consumer behavior]

Financial Performance and Valuation

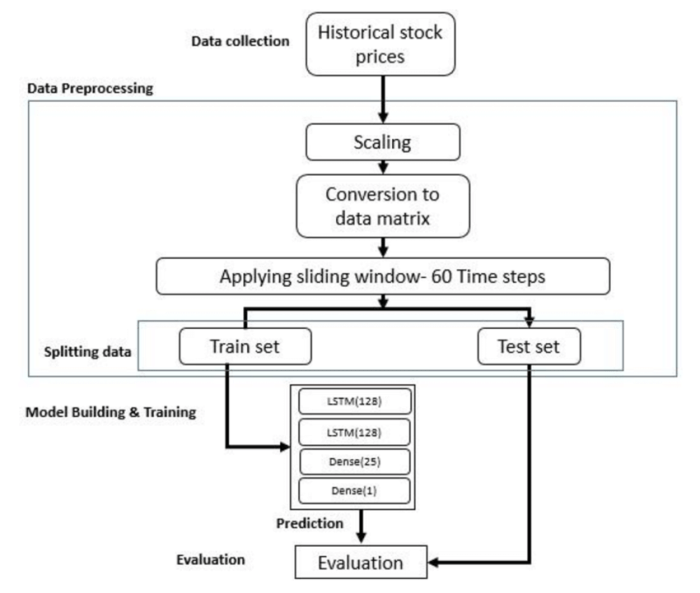

Source: researchgate.net

A detailed analysis of Bidu’s financial statements – including the income statement, balance sheet, and cash flow statement – reveals [summarize key findings from financial statement analysis, e.g., consistent revenue growth, increasing profitability, strong cash flow]. Key financial ratios such as the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio can be calculated to assess Bidu’s financial health and compare its valuation to industry peers.

For example, a high P/E ratio might suggest investor optimism about future growth, while a low ROE might indicate inefficiencies in capital utilization.

| Metric | Bidu | Competitor A | Competitor B | Industry Average |

|---|---|---|---|---|

| P/E Ratio | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| ROE | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Predictive Modeling Techniques

Several quantitative methods can be employed for stock price prediction. Time series analysis, encompassing techniques like ARIMA and Exponential Smoothing, focuses on identifying patterns in historical stock price data. Regression models, including linear and multiple regression, explore the relationship between stock prices and other relevant variables. A chosen model, for instance, ARIMA, would require a step-by-step procedure involving data preprocessing, model fitting, parameter optimization, and forecast generation.

The necessary data includes historical stock prices, financial statements, macroeconomic indicators (e.g., interest rates, inflation), and potentially sentiment analysis data from news articles and social media. Each model’s assumptions and limitations must be carefully considered; for example, ARIMA assumes stationarity in the time series, which may not always hold true.

Risk Factors and Uncertainties

Numerous factors could significantly impact Bidu’s stock price. These risks and uncertainties necessitate a comprehensive assessment to inform investment decisions.

Predicting BIDU’s stock price involves careful analysis of market trends and company performance. Understanding the performance of similar companies, such as gaining insight into the astronics stock price , can offer a comparative perspective. Ultimately, however, a comprehensive assessment of BIDU’s financial health and future prospects remains crucial for accurate prediction.

- Geopolitical Risks: [Describe potential geopolitical risks, e.g., trade wars, political instability in key markets]

- Macroeconomic Factors: [Describe potential macroeconomic risks, e.g., economic recession, inflation, changes in interest rates]

- Technological Advancements: [Describe the impact of technological advancements, e.g., disruptive technologies, cybersecurity threats]

- Competitive Landscape: [Describe the impact of competition, e.g., new entrants, aggressive pricing strategies]

Potential scenarios and their associated probabilities could include [provide examples of potential scenarios, e.g., a 20% probability of a significant market correction impacting Bidu’s stock price, a 60% probability of moderate growth based on current market trends, a 20% probability of exceeding expectations due to successful product launches].

Visual Representation of Data

A line chart illustrating Bidu’s historical stock price would reveal key trends, such as periods of growth, decline, and volatility. Key features to analyze would include the overall trend, significant price fluctuations, and the presence of any apparent patterns or seasonality. A scatter plot could depict the relationship between Bidu’s stock price and key financial indicators, such as earnings per share (EPS) or revenue.

A positive correlation would suggest that higher EPS generally corresponds to a higher stock price. A hypothetical chart projecting future stock price movements, based on a predictive model, could showcase potential scenarios and their associated probabilities. The assumptions underlying the projection, such as constant growth rates or specific market conditions, would need to be clearly stated.

FAQ Explained: Bidu Stock Price Prediction

What are the main risks associated with investing in Bidu?

Investing in Bidu carries risks related to geopolitical instability, regulatory changes in China, competition from other tech companies, and fluctuations in the overall market. Economic downturns can also significantly impact the company’s performance.

How does Bidu compare to its major competitors?

A comparative analysis of Bidu against its competitors would involve examining factors such as market share, revenue growth, profitability, and technological innovation. This would highlight Bidu’s strengths and weaknesses relative to its peers.

What are the key financial ratios to consider when evaluating Bidu’s stock?

Key financial ratios include the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), Debt-to-Equity ratio, and revenue growth rate. Analyzing these ratios provides insights into Bidu’s profitability, efficiency, and financial health.