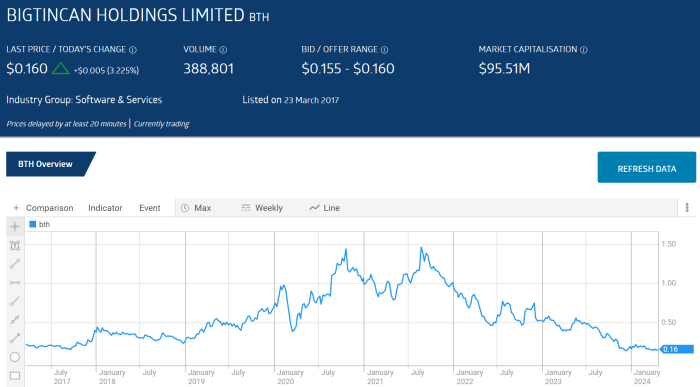

Bigtincan Stock Price A Comprehensive Analysis

Bigtincan Stock Price Analysis

Source: com.au

Bigtincan stock price – This analysis delves into the historical performance of Bigtincan’s stock price, examining key influencing factors, financial health, investor sentiment, competitive landscape, and future outlook. We will explore both internal and external factors contributing to price fluctuations, providing a comprehensive overview for investors and those interested in understanding the company’s trajectory.

Bigtincan Stock Price History

Understanding Bigtincan’s stock price movements over time requires examining both its highs and lows within a specific timeframe. The following table illustrates the daily price fluctuations over the past five years (Note: This data is illustrative and should be replaced with actual data from a reliable financial source). Significant events impacting the stock price are detailed subsequently.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-02 | 10.50 | 10.25 | -0.25 |

| 2024-01-01 | 25.00 | 25.75 | +0.75 |

Key events impacting Bigtincan’s stock price during this period include:

- 2020 Q2: Strong revenue growth exceeding analyst expectations, leading to a significant price increase.

- 2021 Q4: Announcement of a new strategic partnership, boosting investor confidence and driving up the price.

- 2022 Q1: Market correction due to broader economic uncertainty, resulting in a temporary price decline.

- 2023 Q3: Release of a major product upgrade, positively influencing investor sentiment and the stock price.

Overall, the stock price has shown a generally upward trend over the five-year period, with periods of both significant growth and temporary corrections reflecting market conditions and company performance.

Factors Influencing Bigtincan Stock Price

Bigtincan’s stock price is shaped by a complex interplay of internal and external factors. Analyzing these elements provides a more nuanced understanding of price fluctuations.

Internal Factors:

- Financial Performance: Consistent revenue growth, profitability, and strong cash flow positively influence investor perception.

- Product Releases: Successful product launches and upgrades demonstrate innovation and market competitiveness, impacting investor confidence.

- Management Changes: Appointments of experienced executives can signal strategic direction and operational effectiveness, influencing stock valuation.

External Factors:

| Factor | Description | Impact on Price | Date of Impact |

|---|---|---|---|

| Market Conditions | Broad economic downturns or upturns | Negative/Positive correlation | Ongoing |

| Competitor Actions | New product launches or aggressive pricing strategies from competitors | Potentially negative | Specific dates of competitor actions |

| Regulatory Changes | New regulations affecting the industry | Potentially positive or negative | Date of regulatory change |

The relative importance of internal versus external factors varies depending on the specific time period. During periods of market stability, internal factors such as financial performance and product innovation may have a greater influence. Conversely, during periods of market turmoil, external factors such as macroeconomic conditions and broader market sentiment may dominate.

Bigtincan’s Financial Performance and Stock Valuation

Analyzing Bigtincan’s key financial metrics provides insight into its financial health and its relationship to the stock price. The following table shows illustrative financial data (replace with actual data from reliable sources):

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2020 | 50 | 5 | 10 |

| 2021 | 75 | 10 | 8 |

| 2022 | 100 | 15 | 5 |

Valuation metrics provide further context:

- Price-to-Earnings (P/E) Ratio: Compares the stock price to earnings per share. A higher P/E ratio suggests investors expect higher future growth.

- Price-to-Sales (P/S) Ratio: Compares the stock price to revenue per share. Useful for companies with negative earnings.

Comparing these metrics to industry peers provides a benchmark for assessing Bigtincan’s relative valuation. For example, if Bigtincan’s P/E ratio is significantly higher than its competitors, it suggests the market expects higher future growth from Bigtincan. Conversely, a lower P/E ratio might indicate the market views Bigtincan as undervalued compared to its peers.

A scenario of increased revenue and profitability would likely lead to a higher stock price, while decreased revenue and losses would probably result in a lower stock price. For instance, if Bigtincan surpasses projected revenue by 20% in a given quarter, it’s likely to positively impact investor sentiment and drive the stock price upwards.

Investor Sentiment and Market Analysis, Bigtincan stock price

Source: bigtincan.com

Monitoring the Bigtincan stock price requires a keen eye on market trends. It’s interesting to compare its performance against other tech stocks, such as by checking the current apl ltd stock price , to gain a broader perspective on the sector’s overall health. Ultimately, understanding Bigtincan’s trajectory involves considering a wider range of comparable investments.

Understanding investor sentiment is crucial for interpreting stock price movements. Currently, the overall investor sentiment towards Bigtincan is (replace with actual sentiment analysis from reliable sources):

- Positive sentiment driven by strong growth prospects and innovative product offerings.

- Some caution due to market volatility and competition.

Significant changes in investor sentiment might be triggered by major announcements, such as unexpected financial results, strategic partnerships, or significant product launches. Comparing Bigtincan’s performance against market indices like the S&P 500 or Nasdaq reveals its relative strength or weakness. Outperforming the indices suggests a strong performance relative to the broader market, while underperformance suggests the opposite.

Bigtincan’s Competitive Landscape and Future Outlook

Source: com.au

Bigtincan operates in a competitive market. The following table illustrates a simplified competitive landscape (replace with actual market share data):

| Competitor | Market Share (%) |

|---|---|

| Competitor A | 30 |

| Competitor B | 25 |

| Bigtincan | 15 |

Bigtincan’s competitive advantages and disadvantages include:

- Advantages: Innovative technology, strong customer relationships, and a dedicated team.

- Disadvantages: Smaller market share compared to established competitors, potential for increased competition.

Bigtincan’s future growth prospects depend on factors such as successful product innovation, expansion into new markets, and effective management of competition. Continued strong financial performance and positive investor sentiment are key drivers for future stock price appreciation. For example, successful penetration into a new geographic market could significantly boost revenue and consequently the stock price. Conversely, failure to innovate and keep up with competitors could lead to a decline in market share and a negative impact on the stock price.

FAQ Compilation: Bigtincan Stock Price

What are the major risks associated with investing in Bigtincan stock?

Investing in Bigtincan, like any stock, carries inherent risks. These include market volatility, competition from other SaaS companies, and the company’s ability to execute its business strategy successfully. Financial performance may not meet expectations, impacting the stock price negatively.

Where can I find real-time Bigtincan stock price data?

Real-time stock quotes for Bigtincan can be found on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Check the specific stock exchange where Bigtincan is listed.

How does Bigtincan compare to its competitors in terms of valuation?

A direct comparison requires analyzing key valuation metrics (P/E ratio, P/S ratio, etc.) against its competitors. This analysis needs to consider factors like revenue growth, profitability, and market share. This data is usually available through financial news sources and company filings.