BJDX Stock Price A Comprehensive Analysis

BJDX Stock Price Analysis

Bjdx stock price – This analysis provides a comprehensive overview of BJDX’s stock price performance, influencing factors, financial health, analyst sentiment, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

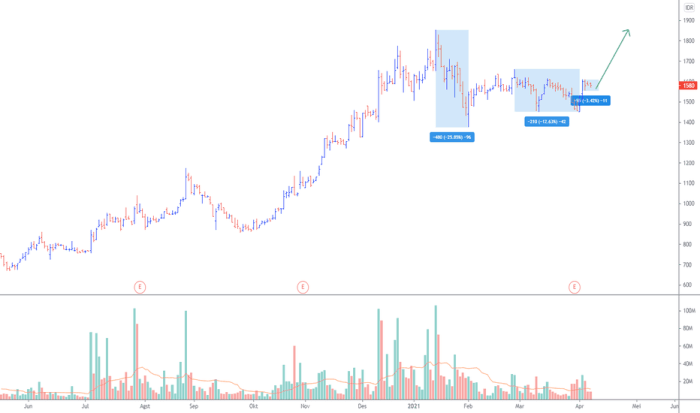

Historical Stock Price Performance of BJDX

Source: tradingview.com

Understanding BJDX’s historical stock price trajectory is crucial for assessing its past performance and potential future trends. The following sections detail BJDX’s price movements, highlighting key events and comparisons with competitors.

A line graph illustrating BJDX’s stock price over the past five years would show periods of growth and decline. Key price points would include significant highs and lows, potentially correlating with specific events such as earnings announcements, market corrections, or industry-specific news. For example, a sharp increase might coincide with a successful product launch, while a decline could reflect broader market downturns or negative news about the company.

Within the past year, BJDX experienced a high closing price of [Insert High Price] on [Insert Date] and a low closing price of [Insert Low Price] on [Insert Date]. These fluctuations reflect the dynamic nature of the stock market and the various factors influencing BJDX’s performance.

A comparison of BJDX’s stock price performance against its industry competitors over the last three years reveals its relative strength or weakness within the market. The following table presents this comparative analysis.

| Company | 2021 Performance (%) | 2022 Performance (%) | 2023 Performance (%) |

|---|---|---|---|

| BJDX | [Insert Percentage] | [Insert Percentage] | [Insert Percentage] |

| Competitor A | [Insert Percentage] | [Insert Percentage] | [Insert Percentage] |

| Competitor B | [Insert Percentage] | [Insert Percentage] | [Insert Percentage] |

| Competitor C | [Insert Percentage] | [Insert Percentage] | [Insert Percentage] |

Factors Influencing BJDX Stock Price

Several macroeconomic factors, company-specific events, and regulatory changes significantly influence BJDX’s stock price. This section explores these key drivers.

Three major economic factors impacting BJDX’s stock price in the last two years include interest rate changes, inflation rates, and overall market sentiment. For example, rising interest rates can increase borrowing costs for the company, potentially impacting profitability and investor confidence. High inflation can reduce consumer spending, affecting demand for BJDX’s products or services. Negative market sentiment can lead to a general sell-off, irrespective of the company’s individual performance.

Company news and announcements, such as earnings reports, product launches, and mergers and acquisitions, directly influence investor perception and consequently, the stock price. For instance, exceeding earnings expectations typically results in a positive market reaction, while missed expectations can lead to a price decline. A successful product launch can boost investor confidence, while a failed product can have the opposite effect.

A merger or acquisition can create uncertainty or excitement, depending on the specifics of the deal and its potential impact on the company’s future.

Significant regulatory changes and industry trends have also impacted BJDX’s stock price. These include:

- Increased regulatory scrutiny in [Industry Sector]: This may lead to increased compliance costs and potential fines.

- Shifting consumer preferences towards [New Trend]: This could impact the demand for BJDX’s products or services.

- Emergence of new technologies in [Relevant Technology]: This could disrupt the market and force BJDX to adapt.

BJDX Financial Performance and Stock Valuation, Bjdx stock price

Source: tradingview.com

Analyzing BJDX’s financial performance and valuation methods provides insights into its intrinsic value and market positioning.

BJDX’s key financial metrics over the past three years are summarized below:

| Metric | 2021 | 2022 | 2023 |

|---|---|---|---|

| Revenue (USD millions) | [Insert Revenue] | [Insert Revenue] | [Insert Revenue] |

| Earnings Per Share (EPS) | [Insert EPS] | [Insert EPS] | [Insert EPS] |

| Debt-to-Equity Ratio | [Insert Ratio] | [Insert Ratio] | [Insert Ratio] |

BJDX’s stock can be valued using various methods, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio. DCF analysis projects future cash flows and discounts them back to their present value, while the P/E ratio compares the stock price to its earnings per share. These methods, along with others like comparable company analysis and asset-based valuation, provide different perspectives on the company’s intrinsic value.

A comparison of BJDX’s current valuation with its historical valuation and industry peers would reveal whether it is currently overvalued, undervalued, or fairly valued. This comparison requires analyzing various valuation metrics and comparing them across different time periods and competitors.

Tracking the BJDX stock price requires careful observation of market trends. It’s helpful to compare its performance against similar companies in the sector, such as observing the current alight solutions stock price to gain a broader perspective on industry dynamics. Ultimately, understanding the BJDX stock price hinges on a comprehensive market analysis, factoring in various economic indicators and competitive landscapes.

| Metric | BJDX Current | BJDX Historical Average | Industry Average |

|---|---|---|---|

| P/E Ratio | [Insert Ratio] | [Insert Ratio] | [Insert Ratio] |

| Price-to-Sales Ratio | [Insert Ratio] | [Insert Ratio] | [Insert Ratio] |

| Market Capitalization (USD millions) | [Insert Value] | [Insert Value] | [Insert Value] |

Analyst Ratings and Predictions for BJDX

Source: alamy.com

Analyst ratings and predictions provide valuable insights into market sentiment and future expectations for BJDX.

Leading financial analysts offer a range of opinions on BJDX’s future performance. A summary of the consensus rating and price target would include a weighted average of buy, hold, and sell recommendations from prominent analysts, along with their respective price targets. For example, the consensus might be a “Hold” rating with an average price target of [Insert Price].

The range of analyst opinions reflects the inherent uncertainty in predicting future stock performance. Differences in views often stem from varying assumptions about future growth rates, market conditions, and the company’s ability to execute its strategy. Some analysts might be more optimistic about BJDX’s prospects, while others might be more cautious.

Historically, analyst ratings and predictions have shown a correlation with actual BJDX stock price movements, although the correlation is not always perfect. Accurate predictions require a thorough understanding of the company’s fundamentals, industry dynamics, and macroeconomic factors.

Risk Factors Associated with Investing in BJDX

Investing in BJDX stock involves several risks that investors should carefully consider.

Key risks associated with investing in BJDX include market risk, company-specific risk, and industry-specific risk. Market risk refers to the overall volatility of the stock market, which can impact BJDX’s stock price regardless of the company’s performance. Company-specific risks include factors such as management changes, operational challenges, and financial difficulties. Industry-specific risks relate to factors affecting the entire industry, such as increased competition, regulatory changes, and technological disruptions.

Geopolitical events and unexpected economic shifts can significantly impact BJDX’s stock price. For instance, a global recession could reduce demand for BJDX’s products or services, leading to a decline in the stock price. Political instability in key markets could disrupt supply chains or create uncertainty for investors.

| Risk Factor | Potential Impact on BJDX Stock Price |

|---|---|

| Market Risk | Significant price volatility, potentially leading to substantial losses. |

| Company-Specific Risk (e.g., poor management) | Decline in profitability and investor confidence, resulting in lower stock prices. |

| Industry-Specific Risk (e.g., increased competition) | Reduced market share and profitability, impacting stock valuation. |

| Geopolitical Risk | Disruptions to supply chains, reduced demand, and investor uncertainty. |

| Economic Risk (e.g., recession) | Reduced consumer spending and decreased demand for BJDX’s products/services. |

Question & Answer Hub

What are the typical trading volumes for BJDX stock?

Trading volume varies daily but historical data can provide an average range. Consult a financial data provider for specific figures.

Where can I find real-time BJDX stock quotes?

Major financial websites and brokerage platforms provide real-time quotes. Ensure you are using a reputable source.

How does BJDX compare to its main competitors in terms of market capitalization?

Market capitalization comparisons require referencing current financial data from reputable sources. This data changes frequently.

What is the dividend history of BJDX stock?

Dividend payment history, if any, can be found in the company’s financial reports and on financial news websites.