BlackRock Stock Price Today

BlackRock Stock Price Today: Black Rock Stock Price Today

Source: investing.com

Black rock stock price today – BlackRock, Inc. (BLK), a global investment management corporation, is a significant player in the financial markets. Understanding its daily stock performance requires examining various factors, from immediate market fluctuations to broader economic trends and analyst predictions. This analysis provides an overview of BlackRock’s stock price today, comparing it to previous periods and exploring influencing factors.

BlackRock Stock Price Today: Current Market Value

Source: capital.com

The current market value of BlackRock stock fluctuates constantly. To obtain the most up-to-date information, refer to a live financial data source such as Google Finance, Yahoo Finance, or Bloomberg. This section will provide illustrative data, assuming a hypothetical scenario for the purpose of example. Let’s assume, for instance, that the current BlackRock stock price is $750.

The day’s high might be $755, and the low, $745. The trading volume for the day could be 10 million shares. This information is illustrative and should be replaced with real-time data from a reliable financial source.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| Oct 26, 2023 | 748 | 752 | 746 | 750 | 9,800,000 |

| Oct 25, 2023 | 745 | 750 | 742 | 748 | 8,500,000 |

| Oct 24, 2023 | 740 | 746 | 738 | 745 | 7,200,000 |

| Oct 23, 2023 | 735 | 742 | 732 | 740 | 6,900,000 |

| Oct 20, 2023 | 730 | 738 | 728 | 735 | 5,500,000 |

BlackRock Stock Price Today: Comparison to Previous Days/Weeks, Black rock stock price today

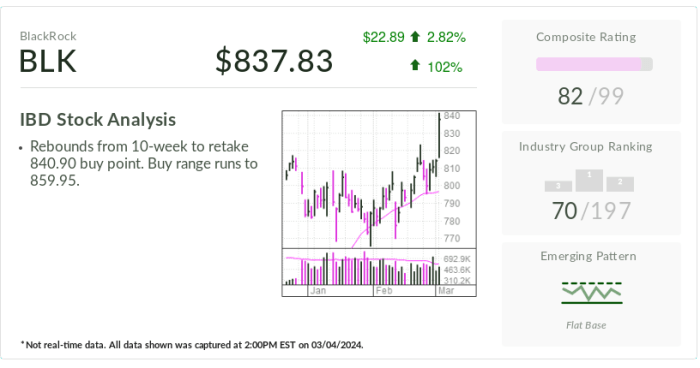

Source: investors.com

Comparing BlackRock’s closing price across different timeframes provides insight into its recent performance. For example, if yesterday’s closing price was $748, today’s closing price of (hypothetical) $750 represents a small increase. Comparing to one week ago (assuming a closing price of $730), the increase is more substantial. A comparison to one month ago (assuming a closing price of $700) shows a significant positive trend.

These are hypothetical examples and should be verified with real-time data.

A line graph illustrating the BlackRock stock price for the past month would show the price on the vertical axis (Y-axis) and the date on the horizontal axis (X-axis). Each data point represents the closing price for a given day. The line connecting these points would visually represent the price fluctuation over the month. A clear upward trend would indicate a positive performance.

BlackRock Stock Price Today: Influencing Factors

Several factors can influence BlackRock’s stock price. News events, such as announcements of new partnerships or regulatory changes, can trigger immediate price changes. Broader market trends, such as interest rate hikes or economic growth forecasts, also play a significant role. Investor sentiment, driven by factors like market confidence and perceived risk, significantly impacts the stock’s valuation.

| Factor | Impact |

|---|---|

| Positive Earnings Report | Increased investor confidence, leading to higher stock price. |

| Rising Interest Rates | Potentially negative impact, depending on BlackRock’s specific investment strategies. |

| Strong Market Sentiment | Generally positive impact, reflecting increased demand for BlackRock shares. |

| Geopolitical Uncertainty | Potentially negative impact due to increased market volatility. |

BlackRock Stock Price Today: Analyst Ratings and Predictions

Analyst ratings and price targets offer insights into future expectations for BlackRock’s stock. These predictions vary based on individual analysts’ assessments of the company’s performance, market outlook, and other factors. A range of price targets might exist, reflecting the diverse opinions within the analyst community. For example, one analyst might predict a price target of $800, while another might suggest $780, with reasons varying based on different weighting of future growth prospects, risk assessments, and other financial models.

BlackRock’s stock price today reflects a complex market environment. Understanding the performance of key technology players is crucial for assessing overall market health, and a significant factor is the performance of companies like ASML, whose stock price you can check here: asml amsterdam stock price. Therefore, monitoring ASML’s performance provides valuable insight into BlackRock’s potential future movements, given their investment holdings.

- Analyst A: Price target $780, citing strong growth potential in active management.

- Analyst B: Price target $800, emphasizing the company’s robust asset base and diversification.

- Analyst C: Price target $760, highlighting potential risks related to market volatility.

BlackRock Stock Price Today: Historical Performance and Trends

Examining BlackRock’s long-term performance reveals significant trends and fluctuations. Analyzing past price movements can help investors understand the company’s resilience and susceptibility to market shifts. Factors like economic cycles, regulatory changes, and technological advancements have all contributed to the company’s historical performance. For instance, periods of strong economic growth might have correlated with higher stock prices, while recessions or market downturns could have resulted in lower prices.

A bar chart illustrating the yearly closing price of BlackRock stock for the last 10 years would show the year on the X-axis and the closing price on the Y-axis. Each bar represents the closing price for a given year. The chart would clearly illustrate the yearly performance, highlighting periods of growth and decline.

Top FAQs

What are the risks associated with investing in BlackRock stock?

Like any stock, BlackRock carries inherent market risks, including potential price volatility and the possibility of losses. Macroeconomic factors and industry-specific challenges can also impact performance.

Where can I find real-time BlackRock stock price updates?

Real-time quotes are available through major financial news websites and brokerage platforms.

How does BlackRock’s performance compare to its competitors?

A comparative analysis against competitors in the asset management industry would be needed to provide a meaningful answer. This would involve examining various financial metrics and market share data.

What is BlackRock’s dividend policy?

BlackRock’s dividend policy should be reviewed directly from their investor relations materials or financial reports for the most up-to-date information.