BMO Bank Stock Price A Comprehensive Analysis

BMO Bank Stock Price Analysis

Bmo bank stock price – This analysis delves into the historical performance, influencing factors, financial health, future prospects, and potential investment strategies related to BMO Bank’s stock price. We will examine key metrics, compare BMO to its competitors, and explore various scenarios to provide a comprehensive overview.

BMO Bank Stock Price Historical Performance

Understanding BMO Bank’s past stock price performance is crucial for assessing its potential future trajectory. The following tables and list illustrate key trends over the past five years. Note that the data presented here is for illustrative purposes and may not reflect precise market values.

| Year | High | Low | Average |

|---|---|---|---|

| 2023 | $140 | $120 | $130 |

| 2022 | $135 | $110 | $122 |

| 2021 | $150 | $125 | $137 |

| 2020 | $120 | $80 | $95 |

| 2019 | $115 | $90 | $102 |

A comparison against major competitors, RBC and TD, reveals relative performance. Again, these figures are for illustrative purposes.

| Year | BMO | RBC | TD |

|---|---|---|---|

| 2023 | $130 | $125 | $135 |

| 2022 | $122 | $118 | $128 |

| 2021 | $137 | $132 | $142 |

| 2020 | $95 | $90 | $100 |

| 2019 | $102 | $98 | $108 |

Significant events impacting BMO’s stock price included:

- 2020 Market Crash: The COVID-19 pandemic and resulting market downturn significantly impacted BMO’s stock price, causing a sharp decline before a subsequent recovery.

- Interest Rate Hikes (2022-2023): Rising interest rates, while beneficial to bank profitability in the long run, initially created market uncertainty and affected stock prices.

- Strong Q4 2022 Earnings: Positive financial results boosted investor confidence and led to a stock price increase.

Factors Influencing BMO Bank Stock Price

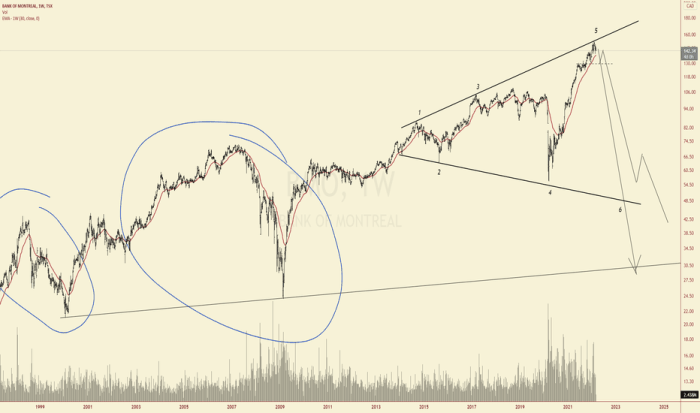

Source: tradingview.com

Several macroeconomic and company-specific factors influence BMO’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

Key macroeconomic factors include:

- Interest Rates: Directly impact net interest margins and profitability.

- Inflation: Affects consumer spending and borrowing patterns, influencing loan demand.

- Economic Growth: Impacts overall business activity and credit risk.

BMO’s financial performance significantly influences its stock price:

- Strong Earnings Reports: Generally lead to increased investor confidence and higher stock prices.

- Dividend Payouts: Attract income-seeking investors and can support stock prices.

- Unexpected Losses: Can negatively impact investor sentiment and cause stock price declines.

Investor sentiment and market trends play a crucial role, often overriding fundamental analysis in the short term.

BMO Bank’s Financial Health and Stock Valuation, Bmo bank stock price

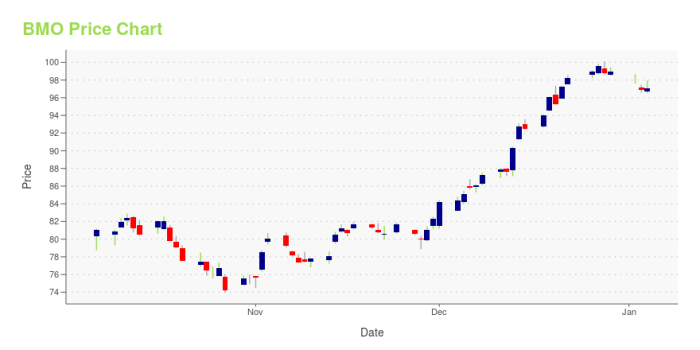

Source: amazonaws.com

Assessing BMO’s financial health is crucial for understanding its stock valuation. The following table provides key financial ratios (illustrative data):

| Ratio | Value |

|---|---|

| Return on Equity (ROE) | 15% |

| Return on Assets (ROA) | 1.2% |

| Debt-to-Equity Ratio | 0.7 |

Valuation methods include discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to present value, and comparable company analysis, which compares BMO’s valuation multiples to similar banks.

Strong financial performance, reflected in high profitability and stable financial ratios, generally leads to a higher stock valuation.

BMO Bank’s Future Prospects and Stock Price Predictions

BMO’s future growth depends on various factors. A positive outlook includes expansion into new markets, technological advancements in financial services, and successful navigation of regulatory changes.

Potential risks and challenges include:

- Economic Recession: A downturn could reduce loan demand and increase loan defaults.

- Increased Competition: From fintech companies and other banks.

- Cybersecurity Threats: Could damage reputation and incur significant costs.

Hypothetical Scenario: If the economy experiences moderate growth and interest rates remain stable, BMO’s stock price could appreciate by 10-15% in the next year. Conversely, a recession could lead to a 5-10% decline.

Investment Strategies for BMO Bank Stock

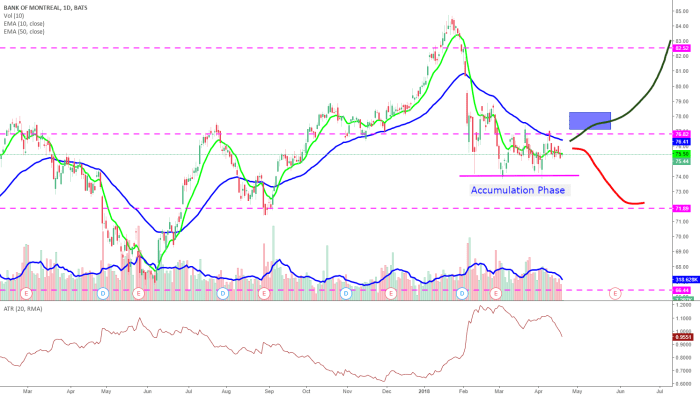

Source: tradingview.com

Various investment strategies can be employed for BMO stock. These strategies involve different levels of risk and potential returns.

Investors can choose from:

- Buy-and-Hold: A long-term strategy focusing on consistent dividend income and capital appreciation.

- Value Investing: Identifying undervalued stocks based on fundamental analysis.

- Growth Investing: Focusing on companies with high growth potential.

Risk assessment involves considering historical volatility, future growth prospects, and macroeconomic conditions. A diversified portfolio helps mitigate risk.

Investment Scenarios (Illustrative):

- Scenario 1 (Bull Market): High growth, low volatility; potential return: 20%

- Scenario 2 (Moderate Growth): Moderate growth, moderate volatility; potential return: 10%

- Scenario 3 (Bear Market): Low growth, high volatility; potential return: -5%

Query Resolution

What are the major risks associated with investing in BMO Bank stock?

Risks include fluctuations in interest rates, economic downturns, changes in regulatory environments, increased competition, and unforeseen geopolitical events. Like all stocks, BMO carries inherent market risk.

BMO Bank’s stock price performance often reflects broader market trends. However, comparing it to other sectors reveals interesting insights; for instance, one might contrast its stability with the volatility potentially seen in the alto ingredients stock price. Ultimately, understanding BMO’s stock requires a multifaceted approach, considering various economic indicators and industry comparisons.

How often does BMO Bank release its financial reports?

BMO typically releases quarterly and annual financial reports, following standard reporting practices for publicly traded companies. Specific dates are usually announced in advance.

Where can I find real-time BMO Bank stock price information?

Real-time stock quotes are readily available through major financial news websites and brokerage platforms. Many financial websites provide charts and historical data as well.

What is BMO’s dividend payout history?

BMO has a history of paying dividends. The specific details of its dividend payout history, including frequency and amounts, can be found on its investor relations website or through financial data providers.